Le prix de la Banque de Suède en mémoire d’Alfred Nobel décerné lundi 12 octobre aux deux économistes américains Paul Milgrom (72 ans) et Robert Wilson (83 ans) renoue avec la tendance majoritaire des attributions du « prix Nobel d’économie » depuis sa création, en 1969 : le couronnement d’une longue carrière d’économistes, le plus souvent nord-américains, vouée à l’élaboration de modèles théoriques d’amélioration du fonctionnement des marchés dans le sens d’une plus grande...

Read More »Trade, saving and an economic disaster

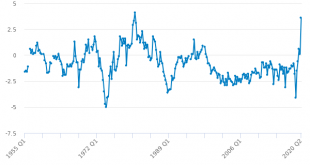

The UK is running a trade surplus. No, really, I am not joking. This is from the ONS's latest trade statistics release:The UK total trade surplus, excluding non-monetary gold and other precious metals, increased £3.8 billion to £7.7 billion in the three months to August 2020, as exports grew by £21.4 billion and imports grew by a lesser £17.5 billionIt's the first time the UK has run a trade surplus since the late 1990s: And if you were thinking this was because of the lockdown, you would...

Read More »Trade, saving and an economic disaster

The UK is running a trade surplus. No, really, I am not joking. This is from the ONS's latest trade statistics release:The UK total trade surplus, excluding non-monetary gold and other precious metals, increased £3.8 billion to £7.7 billion in the three months to August 2020, as exports grew by £21.4 billion and imports grew by a lesser £17.5 billionIt's the first time the UK has run a trade surplus since the late 1990s: And if you were thinking this was because of the lockdown, you would...

Read More »Studying economics — a total waste of time

Studying economics — a total waste of time One may perhaps, distinguish between obscure writers and obscurantist writers. The former aim at truth, but do not respect the norms for arriving at truth, such as focusing on causality, acting as the Devil’s Advocate, and generating falsifiable hypotheses. The latter do not aim at truth, and often scorn the very idea that there is such a thing as the truth … These writings have in common a somewhat uncanny...

Read More »Economics education needs a revolution

Economics education needs a revolution You ask me what all idiosyncrasy is in philosophers? … For instance their lack of the historical sense, their hatred even of the idea of Becoming, their Egyptianism. They imagine that they do honour to a thing by divorcing it from history sub specie æterni—when they make a mummy of it. Friedrich Nietzsche Nowadays there is almost no place whatsoever in economics education for courses in the history of economic...

Read More »Time on my hands

Time on my hands . [embedded content]

Read More »Wage rigidities and men in yellow hats

Wage rigidities and men in yellow hats It seems reasonable to hope that a successful explanation of wage rigidity would contribute to understanding the extent of the welfare loss associated with unemployment and what can be done to reduce it … Many theories of wage rigidity and unemployment include partial answers to these questions as part of their assumptions, so that the phenomena of real interest are described in the theories’ assumptions. For...

Read More »Modern macroeconomics — theory based on misleading illusions

Modern macroeconomics — theory based on misleading illusions Standard new Keynesian macroeconomics essentially abstracts away from most of what is important in macroeconomics. To an even greater extent, this is true of the dynamic stochastic general equilibrium (DSGE) models that are the workhorse of central bank staffs and much practically oriented academic work. Why? New Keynesian models imply that stabilization policies cannot affect the average level of...

Read More »Economics — an egregious case of theory denialism

Economics — an egregious case of theory denialism . [embedded content] Using formal mathematical modelling, mainstream economists sure can guarantee that the conclusions hold given the assumptions. However the validity we get in abstract model-worlds does not warrantly transfer to real-world economies. Validity may be good, but it isn’t — as Nancy Cartwright so eloquently argues — enough. From a realist perspective, both relevance and soundness are sine qua...

Read More »DSGE macroeconomic models

While one can understand that some of the elements in DSGE models seem to appeal to Keynesians at first sight, after closer examination, these models are in fundamental contradiction to Post-Keynesian and even traditional Keynesian thinking. The DSGE model is a model in which output is determined in the labour market as in New Classical models and in which aggregate demand plays only a very secondary role, even in the short run. In addition, given the fundamental philosophical...

Read More » Heterodox

Heterodox