The rational expectations putsch The tiny little problem that there is no hard empirical evidence that verifies rational expectations models doesn’t usually bother its protagonists too much. Rational expectations überpriest Thomas Sargent has defended the epistemological status of the rational expectations hypothesis arguing that since it “focuses on outcomes and does not pretend to have behavioral content,” it has proved to be “a powerful tool for making...

Read More »Rybin Male Choir

[embedded content]

Read More »Public debt — questions and answers

Public debt — questions and answers Can a government go bankrupt? No. You cannot be indebted to yourself. Can a central bank go bankrupt? No. A central bank can in principle always ‘print’ more money. Do taxpayers have to repay government debts? No, at least not as long the debt is incurred in a country’s own currency. Do increased public debts burden future generations? No, not necessarily. It depends on what the debt is used for. Does maintaining full...

Read More »John Hassler och Klas Eklund — etablissemangsekonomer med dimljuset på

John Hassler och Klas Eklund — etablissemangsekonomer med dimljuset på Det är svårt att hitta en mer missbrukad ekonomisk klyscha än just ”strukturreformer”. För att citera en diskussion i Financial Times; ”Strukturreformer är en tom amatörekonomisk fras, ofta med vaga referenser till avregleringar och skatte- och budgetnedskärningar”. Ordet dyker ständigt upp när något lands ekonomi anses ha kört fast på en för låg tillväxtkurva … Så också när man i början...

Read More »The real public debt problem

The real public debt problem The claim that our public debt is excessive has been used as a major justification for austerity – cuts in spending. That massive debt, we are told, 1) must be repaid, 2) threatens our country with bankruptcy, and 3) is a burden on future generations. All these are wrong. Let me explain why … Britain’s national currency is managed by our central bank, the Bank of England, owned by the citizens of the United Kingdom (that is, our...

Read More »Alan Krueger (1960 – 2019)

Alan Krueger (1960 – 2019) I’ve subsequently stayed away from the minimum wage literature for a number of reasons. First, it cost me a lot of friends. People that I had known for many years, for instance, some of the ones I met at my first job at the University of Chicago, became very angry or disappointed. They thought that in publishing our work we were being traitors to the cause of economics as a whole. David Card Back in 1992, New Jersey raised the...

Read More »Public debt — a macroeconomic necessity

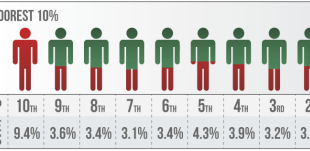

Public debt — a macroeconomic necessity The problem stems from the fact that the affluent, which include successful entrepreneurs and capital owners, save relatively more than average or poor households … For this to work out, additional demand would have to be created … The implication of this is that there’s a macroeconomic requirement to run public deficits, founded on a demand gap that arises from households and firms wanting to set aside savings in...

Read More »MMT — the Wicksell-Le Bourva connection

MMT — the Wicksell-Le Bourva connection Comparing the limited work of Wicksell, Le Bourva, and MMT, we find that they share many similarities. Obviously, the institutions and issues being discussed have changed during the decades these scholars were writing, yet all three views agree on some fundamental issues. The methodology is quite similar, with a strong focus on balance sheets opposed to theoretical models based on assumptions that are necessary for...

Read More »How to teach economics if you have a dissenting perspective

How to teach economics if you have a dissenting perspective Issue #1: How do you teach the introductory economics courses if you have a dissenting perspective? Mankiw lays out three alternatives, teaching the mainstream and suppressing your own views, teaching minority or fringe views (i.e. your own), or not teaching introductory econ at all. He says the second option is “pedagogical malpractice” … I opted for an approach neither of them consider, to...

Read More »MMT and the real issue of money and debt

MMT and the real issue of money and debt Austerity policies throw millions of people out of work … The lower level of output caused by austerity means there are fewer goods and services available to distribute. Society becomes objectively poorer in material production terms. How can that be helpful? … Some readers may object: what if there just isn’t enough money to buy people? If there’s just no money, it’s no good going ever further into debt. Wrong....

Read More » Heterodox

Heterodox