A gender tax to address gender pay gap In dem Café Handsome Her in Melbourne, Australien, können Kaffee und Snacks für männliche Gäste mehr kosten – wenn sie wollen. Und das hat gute Gründe. Die Inhaberinnen des Cafés im angesagten Stadtteil Brunswick bitten männliche Kunden, rund 18 Prozent mehr zu zahlen, damit sie „das geschlechtsspezifische Lohngefälle reflektieren“. In Australien verdienen Männer durchschnittlich 17,7 Prozent mehr für ihre...

Read More »Krugman and Mankiw on loanable funds — so wrong, so wrong

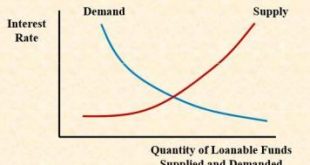

Krugman and Mankiw on loanable funds — so wrong, so wrong A couple of years ago — in a debate with James Galbraith and Willem Buiter — Paul Krugman made it perfectly clear that he was a strong believer of the ‘loanable funds’ theory. Unfortunately, this is not an exception among ‘New Keynesian’ economists. Neglecting anything resembling a real-world finance system, Greg Mankiw — in his intermediate textbook Macroeconomics — more or less equates finance to...

Read More »The loanable funds hoax

The loanable funds hoax The loanable funds theory is in many regards nothing but an approach where the ruling rate of interest in society is — pure and simple — conceived as nothing else than the price of loans or credits set by banks and determined by supply and demand — as Bertil Ohlin put it — “in the same way as the price of eggs and strawberries on a village market.” It’s a beautiful fairy tale, but the problem is that banks are not barter institutions...

Read More »DSGE models — worse than useless

DSGE models — worse than useless The main point of this book is to serve as an antidote to the intellectual poison of the erroneous’veil of ignorance’ aphorism … Accordingly [it] rejects as erroneous the standard macroeconomic model, whose assumptions have been built into DSGE models. Among other conceptual absurdities, such as the assumption that economic actors consist of identical omniscient ‘rational agents’ all of whom have perfect information about...

Read More »The bonus puzzle

If bonus or “incentive pay” schemes work so well for senior executives and bankers, why does everyone not get them? The conventional answer is that a bonus scheme or incentive plan will indeed encourage the recipients to make more money for the shareholders or clients on whose behalf they act … A classic paper on the “principal-agent problem” … by Bengt Holmstrom and Paul Milgrom pointed out that the conventional answer makes the mistake of assuming that jobs are simple and...

Read More »How rigged markets make the rich richer

How rigged markets make the rich richer Markets are never just given. Neither God nor nature hands us a worked-out set of rules determining the way property relations are defined, contracts are enforced, or macroeconomic policy is implemented. These matters are determined by policy choices. The elites have written these rules to redistribute income upward. Needless to say, they are not eager to have the rules rewritten — which means they also have no...

Read More »IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action. This week’s Freakonomics episode, titled “Everything You Always Wanted to Know About Money (But Were Afraid to Ask)” (Apple podcasts) features an all-star cast of Jack Bogle on not trying to beat the market, Annamaria Lusardi on teaching basic financial tips to NFL players, and Harold Pollack on his index card of financial heuristics. Readers of this blog are all financial whizzes but, you know, for your friends and stuff....

Read More »Professor Bill Mitchell in New Zealand Discussing MMT

This is a presentation by Professor Bill Mitchell at the University of Victoria, Wellington, New Zealand on July 28, 2017. It addresses framing of the macroeconomic policy debate and touches on the most fundamental insights of Modern Monetary Theory. Most here will be avid readers of the professor’s blog, but this talk is too good not to post. While in New Zealand, Professor Mitchell also did an interview for the public broadcaster. A link can be found in the billy blog post of July 31,...

Read More »Self-Imposed Constraints as an Obfuscating Factor

From inception of a monetary economy with a government-issued currency, it is clear that government spending must come before tax payments or purchases of government debt. The order of requirements is basically: (i) government defines its monetary unit of account; (ii) government imposes taxes and other obligations that can only finally be settled in that currency; (iii) government spends (or lends) its currency into existence; (iv) non-government can now obtain the currency and, among...

Read More »IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action. In a clever online nudging experiment, 627,000 online taxpayers in Guatemala were given one of five different kinds of honesty messages, reminders about public goods, or legal warnings in a captcha. But none of the messages had any effect on taxes paid. Some unexpected side effects of antimalarial insecticide-treated bednets (ITNs): We show that ITNs reduced all-cause child mortality, but surprisingly increased total fertility...

Read More » Heterodox

Heterodox