Guest post by Jeff Mosenkis of Innovations for Poverty Action. Two podcast recommendations: NPR has a new podcast, Rough Translation, from former East Africa correspondent Gregory Warner (web, Apple). It looks at how questions we deal with here play out differently in other cultures. The first episode looks at how Brazil ended up with race tribunals to evaluate who was Black enough to qualify for affirmative action. The second looks at fake news planted by Russia in Ukraine. The fun...

Read More »Markets as beauty contests

Markets as beauty contests [embedded content] div{float:left;margin-right:10px;} div.wpmrec2x div.u > div:nth-child(3n){margin-right:0px;} ]]> Advertisements

Read More »Solving the St. Petersburg Paradox

Solving the St. Petersburg Paradox [embedded content] Solving the St Petersburg paradox in the way Peters suggests, involves arguments about ergodicity and the all-important difference between time averages and ensemble averages. These are difficult concepts that many students of economics have problems with understanding. So let me just try to explain the meaning of these concepts by means of a couple of simple examples. Let’s say you’re offered a gamble...

Read More »Tariffs, trade and money illusion

In the past few days, I have read three pieces from Economists for Brexit - now renamed "Economists for Free Trade" - extolling the virtues of "hard" (or "clean") Brexit and calling for the UK to drop all external tariffs to zero unilaterally after Brexit. Two are written by professors of finance (Kent Matthews and Kevin Dowd). The third is from the veteran economist Patrick Minford.All three of these pieces wax lyrical about the benefits to GDP and welfare from unilaterally reducing...

Read More »Trading in Myths

Pretending that the distribution of income and wealth that results from a long set of policy decisions is somehow the natural workings of the market is not a serious position. It might be politically convenient for conservatives who want to lock inequality in place. It is a more politically compelling position to argue that we should not interfere with market outcomes than to argue for a system that is deliberately structured to make some people very rich while leaving others...

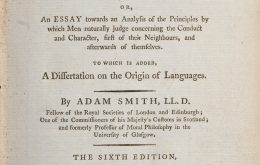

Read More »On the limits of Adam Smith’s invisible hand

On the limits of Adam Smith’s invisible hand [embedded content] It might look trivial at first sight, but what Harold Hotelling showed in his classic paper Stability in Competition (1929) was that there are cases when Adam Smith’s invisible hand doesn’t actually produce a social optimum. With the advent of neoclassical economics at the end of the 19th century, a large amount of intellectual energy was invested in trying to formalize the stringent conditions...

Read More »Adam Smith’s visible hand

Adam Smith’s visible hand How selfish soever man may be supposed, there are evidently some principles in his nature, which interest him in the fortune of others, and render their happiness necessary to him, though he derives nothing from it except the pleasure of seeing it. Of this kind is pity or compassion, the emotion which we feel for the misery of others, when we either see it, or are made to conceive it in a very lively manner. That we often derive...

Read More »Wenn ich 64 bin (personal)

Wenn ich 64 bin (personal) [embedded content] div{float:left;margin-right:10px;} div.wpmrec2x div.u > div:nth-child(3n){margin-right:0px;} ]]> Advertisements

Read More »IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action. You might have heard that just giving the poor cash, no strings attached, is all the rage in the effective aid community. Some people have suggested that if organizations want to give (more expensive) in-kind aid (food, cattle), they should first show that it’s more effective than cash. Dev Patel just recirculated a relevant paper (summary here) from Cunha, De Giorgi, and Jayachandran, who tested giving cash vs. in-kind food aid...

Read More »IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action. You might have heard that just giving the poor cash, no strings attached, is all the rage in the effective aid community. Some people have suggested that if organizations want to give (more expensive) in-kind aid (food, cattle), they should first show that it’s more effective than cash. Dev Patel just recirculated a relevant paper (summary here) from Cunha, De Giorgi, and Jayachandran, who tested giving cash vs. in-kind...

Read More » Heterodox

Heterodox