The power and poison of MMT MMT includes both problematic propositions and perfectly reasonable — even highly useful — positions. In the latter category, the idea that stands out is essentially functional finance theory. Proposed by Abba Lerner in 1943, FFT holds that, because governments borrowing in their own currency can always print money to service their debts, but still face inflation risks, they should aim to balance supply and demand at full...

Read More »Uncertainty and “trailing clouds of vagueness”

We live in a world permeated by unmeasurable uncertainty — not quantifiable stochastic risk — which often forces us to make decisions based on anything but ‘rational expectations.’ Our expectations are most often based on the confidence or ‘weight’ we put on different events and alternatives, and the ‘degrees of belief’ on which we weigh probabilities often have preciously little to do with the kind of stochastic probabilistic calculations made by the rational agents as...

Read More »Why global inequality is at an all-time high

There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning. Warren Buffett [embedded content] For the first time … researchers have gathered systematic data that allows for a comparison of wealth distributions in all countries of the world, from the bottom of the distribution to the top. The overall conclusion is that wealth hyper-concentration affects all world regions (and it has worsened during the Covid pandemic). At global...

Read More »Models and reality

One of the limitations with economics is the restricted possibility to perform experiments, forcing it to mainly rely on observational studies for knowledge of real-world economies. But still — the idea of performing laboratory experiments holds a firm grip of our wish to discover (causal) relationships between economic ‘variables.’If we only could isolate and manipulate variables in controlled environments, we would probably find ourselves in a situation where we with greater...

Read More »Economics & other crazy stuff: Happy New Year

I’m hoping next year we will make progress getting some of the crazier stuff out of the room. Here’s a little YouTube teaser from Down Under (give it a minute to get to the punchline): Who’s crazy now? All the best in 2022, Tom

Read More »Hästskitsteoremet i svensk tappning

Hästskitsteoremet i svensk tappning 1980- och 1990-talen var avregleringens årtionden. Som en följd växte ekonomin, med undantag för krisåren i början av 90-talet, snabbt. Och det ledde till att den ekonomiska ojämlikheten ökade. – Skillnaden i inkomster mellan grupper har ökat – det har varit en medveten strategi sedan 1980-talet, säger Daniel Waldenström. – I takt med att vi fick upp farten i ekonomin så skapade det förutsättningar för personer med...

Read More »Lars Jonung och Daniel Waldenström — Sveriges egna Dr Pangloss

Lars Jonung och Daniel Waldenström — Sveriges egna Dr Pangloss När Karl-Bertil Jonsson i Tage Danielssons klassiska julsaga lägger undan några rika människors julklappar och delar ut dem till fattiga brister han i respekt för den privata äganderätten, skriver Lars Jonung och Daniel Waldenström på DN Debatt idag. Enligt dessa ekonomiprofessorer är det kapitalism och marknadsliberalism som är den ’okände välgöraren’ som gynnat oss alla med “god ekonomisk...

Read More »Dangerous physics envy in economics

Dangerous physics envy in economics Unlike in physics, there are no universal and immutable laws of economics. You can’t will gravity out of existence. But as the recurrence of speculative bubbles shows, you can unleash ‘animal spirits’ so that human behaviour and prices themselves defy economic gravity. Change the social context – in economic parlance, change the incentive structure – and people will alter their behaviour to adapt to the new framework …...

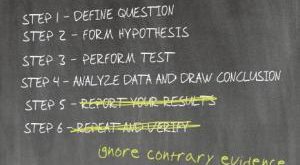

Read More »Economics journals — publishing lazy non-scientific work

Economics journals — publishing lazy non-scientific work In a new paper, Andrew Chang, an economist at the Federal Reserve and Phillip Li, an economist with the Office of the Comptroller of the Currency, describe their attempt to replicate 67 papers from 13 well-regarded economics journals … Their results? Just under half, 29 out of the remaining 59, of the papers could be qualitatively replicated (that is to say, their general findings held up, even if the...

Read More »On the limited applicability of statistical physics to economics

On the limited applicability of statistical physics to economics Statistical mechanics reasoning may be applicable in the economic and social sciences, but only if adequate consideration is paid to the specific contexts and conditions of its application. This requires attention to “non-mechanical” processes of interaction, inflected by power, culture, institutions etc., and therefore of specific histories which gives rise to these factors … Outside of very...

Read More » Heterodox

Heterodox