The Conference Board argues that Chinese official data should be taken with some skepticism. Nothing new there. They have adopted a new measure, which implies "Chinese economic growth at a more realistic 3.7 percent" for the recent past. In this scenario, interestingly enough, "it’s likely that the bulk of China’s slowdown has already taken place since 2011, even if unapparent in official statistics." So the picture is probably worse than the official one (as shown below, from The Economist) So China will grow at about 4% and has already been growing at that pace for a while, if one believes the Conference Board (in the official data above one might think there is more space for a slowdown, but clearly it has gone already down too). The big questions are whether this will continue, and what would be the impact for the global economy (and the US).Arguably the slowdown is the result of the transition from an export-led development strategy to a domestic, consumption centered economy, compounded by the problems of an unregulated banking sector, the infamous shadow banks. Note, however, that most problems are associated to domestic demand, and debt in domestic currency. China still has current account surpluses and huge external reserves, even if the latter have decreased.

Topics:

Matias Vernengo considers the following as important: China, Deindustrialization, exchange rate depreciation, Global crisis

This could be interesting, too:

Dean Baker writes Donald Trump is badly nonfused # 67,218: The story of supply and demand

Matias Vernengo writes Very brief note on the Brazilian real and the fiscal package

Merijn T. Knibbe writes Peak babies has been. Young men are not expendable, anymore.

Robert Skidelsky writes In Memory of David P. Calleo – Bologna Conference

So China will grow at about 4% and has already been growing at that pace for a while, if one believes the Conference Board (in the official data above one might think there is more space for a slowdown, but clearly it has gone already down too). The big questions are whether this will continue, and what would be the impact for the global economy (and the US).

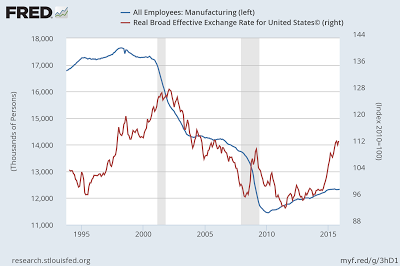

Arguably the slowdown is the result of the transition from an export-led development strategy to a domestic, consumption centered economy, compounded by the problems of an unregulated banking sector, the infamous shadow banks. Note, however, that most problems are associated to domestic demand, and debt in domestic currency. China still has current account surpluses and huge external reserves, even if the latter have decreased. So the problems of a typical developing country, which cannot grow given the external constraint, are nonexistent. Also, it is true that some firms have debts in dollars (and revenue in yuan), and the depreciation of the yuan poses problems, but again the People's Bank of China has enough dollars that rescuing and absorbing the costs of exchange rate risk should be a minor issue. This is not to say that a further slowdown is impossible, but if it continues it should be counted as a policy mistake, not a structural constraint.