So a Fed rate hike is nothing more than the federal government deciding to pay more interest on what’s called ‘the public debt’. By immediately paying more interest on balances in reserve accounts at the Fed the cost of funds to the banking system is supported at that higher level, all of which influences the interest paid on securities accounts at the Fed as well, which influences the term structure of rates. Imports up, exports down:Seems to me there’s a substantial number of people who...

Read More »Atlanta Fed, US current account, Philly Fed

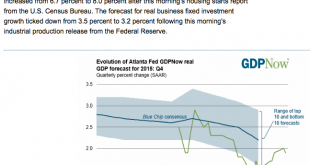

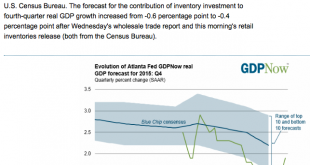

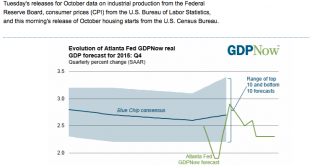

Blue chip consensus dropping quickly now, and today won’t help any:Remember a year ago when they said the oil price drop would be an unambiguous positive for the trade balance?;) Anyway, this is weak dollar stuff, vs the euro area current account surplus, which is strong euro stuff: Current AccountHighlightsThe nation’s current account deficit widened sharply in the third quarter, to $124.1 billion from a revised $111.1 billion in the second quarter. This is the widest gap of the recovery,...

Read More »Mtg prch apps, Housing starts, Industrial production, Euro trade

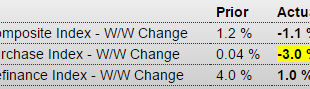

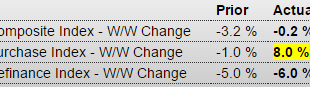

Yes, up vs last year’s dip, but remain depressed and have beenheading south since early this year: MBA Mortgage ApplicationsHighlightsApplication activity was little changed in the December 11 week, up 1 percent for refinancing and down 3.0 percent for home purchases. Year-on-year, purchase applications remain very high, up 34 percent in a gain that in part reflects a pulling forward of demand ahead of what is expected to be a rate hike at today’s FOMC. Rates were little changed in the week...

Read More »Atlanta Fed, China, S&P, bank loans

Up a notch on stats I expect will reverse in Dec, and note the street forecasts coming down:Many think the Fed is focusing on this to presume a strong underlying economy. However it’s been supported by the jump in health care premiums due to the additional people paying for insurance, a one time event, and vagaries of the deflator: Still no acceleration:

Read More »Labor market conditions index, Euro and yen charts, Fed discussion

This is the Fed’s own index and it’s on the very weak side: Labor Market Conditions IndexHighlightsFriday’s employment report, led by a 211,000 rise in non-farm payrolls, was solid but didn’t give the labor market conditions index much of a boost, coming in at only plus 0.5 vs expectations for plus 1.7. The October index, however, was revised 6 tenths higher to plus 2.2 reflecting in part the upward revision to that month’s nonfarm payroll growth which now stands at a very impressive...

Read More »Business Roundtable, Mtg apps, ADP, Productivity, 1 year charts

More evidence the capital spending contraction is not over: CEO Confidence Goes From Bad to Worse Dec 1 (Fox Business) — CEO confidence in the U.S. economy is dwindling. The Business Roundtable CEO Economic Outlook Index for the 4Q, which looks out six months, fell to the lowest level in three years For third consecutive quarter, U.S. CEOs cautious on economy Dec 1 (Reuters) — The Business Roundtable CEO Economic Outlook Index fell 6.6 points to 67.5 in the fourth quarter. The long-term...

Read More »Chicago PMI, Pending home sales, Dallas Fed

Another bad one, reversing last month’s suspect move up: Chicago PMIHighlightsVolatility is what to expect from the Chicago PMI which, at 48.7, is back in contraction in November after surging into strong expansion at 56.2 in October. Up and down and up and down is the pattern with prior readings at 48.7 in September (the same as November) and 54.4 in August.New orders are down sharply and are back in contraction while backlog orders are in a 10th month of contraction. Production soared...

Read More »Atlanta Fed, Investor poll, Fed surveys

The crowd is not always wrong, but it’s not always right, either: Fund managers polled at the start of November have significantly hiked their allocation to equities and cut cash holdings to levels not seen since July, according to research from Bank of America Merrill Lynch.Of the 200 investors managing $576 billion of assets that were quizzed by the bank for its monthly fund manager survey, four-fifths now expect the U.S. Federal Reserve to raise rates this quarter.Some 43 percent of...

Read More »Consumer Credit, Credit Check, Rail Traffic, Employment Charts

Consumer Credit HighlightsIn a record report, consumer credit data are strongly confirming the strength of the consumer. Credit outstanding surged $28.9 billion in September for the largest gain in the history of the series which goes back to 1941. Nonrevolving credit, in part reflecting vehicle financing and also student loans, rose $22.2 billion. Revolving credit, reflecting a rise in credit-card debt, jumped $6.7 billion to extend an emerging run of strength that suggests consumers are...

Read More »Job Cuts, Yellen Comment, Saudi Pricing, German Factory Orders, Maersk Job Cuts, China Trade Show

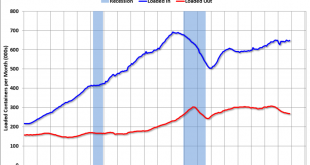

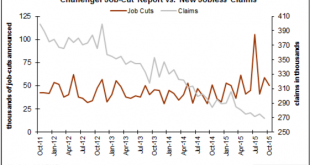

Down a bit but still trending higher since the oil price collapse: Seems she still doesn’t realize negative rates are just another tax: FED’S YELLEN: IF ECONOMY SIGNIFICANTLY DETERIORATED, NEGATIVE RATES AND OTHER TOOLS WOULD BE ON THE TABLE This implies the rest of Saudi pricing remains the same from November, when discounts to benchmarks were substantially increased. In general, discounts have been increased over the last few months: Saudi Arabia, the world’s largest oil exporter,...

Read More » Heterodox

Heterodox