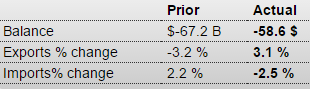

This is just for ‘goods’ but seems to be counter to all other releases reporting weak exports, but it has been zig zagging it’s way lower and August was particularly weak. And note the weakness in car imports: International trade in goodsHighlightsSeptember reversed August’s outsized goods trade gap, coming in at $58.6 billion vs $67.2 billion. Exports jumped 3.1 percent following August’s 3.2 percent decline with wide gains in consumer goods, autos, industrial supplies and capital goods....

Read More »Confidence, Richmond, PMI Services

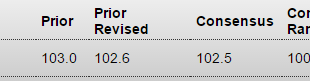

A lot less than expected based on jobs assessment, and note the drop in car buying plans: United States : Consumer ConfidenceHighlightsA decline in the assessment of the current jobs market pulled down the consumer confidence index to a lower-than-expected 97.6 in October. This is about 2.4 points below Econoday’s low-end forecast and 5.0 points below a revised September.Consumers are saying there are fewer jobs available then there were in September and more say jobs are hard to get. But...

Read More »Existing Home Sales, Chicago Fed, Leading Indicators, KC Fed

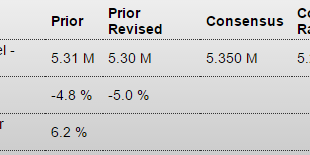

Higher than expected, not directly a contributor to GDP or a measure of output.The change in fed mtg regs that caused the blip and mtgs and subsequent reversalneeds to play out here as well: Existing Home SalesHighlightsExisting home sales bounced back very strongly in September, up 4.7 percent to nearly reverse the prior month’s revised decline of 5.0 percent, a decline that now looks like an outlier on a steadily rising slope. The month’s annual sales rate, at 5.55 million, is just beyond...

Read More »Exports, News Headlines, Atlanta Fed, German Comment

They say its the strong $ that’s hurting exports. I say it’s the drop in oil related capex after the price collapse: This is what news headlines have been looking like (not good): From Rüdiger (top German Specialist) research: German new business orders for August were broadly lower. Compared to July, which was revised downward, they fell a seasonally adjusted 2.1pc. Compared to August 2014 orders rose 3.4pc. However, there are two critical factors behind this figure....

Read More »Capex Revision, Gallup Spending Survey, PMI, ISM Non Mfg Index

A gauge of U.S. investment plans slipped more in August than initially estimated, giving a cautionary sign for the economic outlook. New orders for non-military capital goods outside of aviation fell 0.8 percent in August, the Commerce Department said on Friday. The government had previously reported that this gauge, which is a leading indicator of business investment, had fallen 0.2 percent during the month. Shipments of this category of goods also fell, declining a...

Read More »Clarida on Fed policy: or how does the Fed affect inflation

Richard Clarida gave an interview (right at the beginning of the podcast) on why the Fed should increase the rate of interest. He also said that the Fed can affect inflation, which, he correctly points out, is denied by several economists. However, the degree of confusion on this subject is significant, and modern monetary theory, and its implications for central banking behavior, is, in part, responsible for that.The conventional wisdom on what central banks can do (and one can think of...

Read More »On the Fed’s decision at the Rick Smith Show

[embedded content]

Read More »Even The Economist is against raising the interest rate

In the last issue, The Economist suggests that the Fed should not be concerned too much with inflation, and that they should not raise the interest rate for now. They say: "Weak wage growth suggests that there is still lots of slack in the labour market. Underemployment, which includes workers who are part-time but want a full-time job, and discouraged workers who might be tempted back into the labour force, stands at just over 10%, higher than before the crisis. This measure probably has...

Read More »Will the Fed hike the interest rate?

It seems increasingly probable. Stanley Fischer suggested that is possible in his speech last weekend at Jackson Hole. My bet is that unless labor markets numbers are terrible Friday, there is a good chance there will be a minor rate increase in the next meeting. That is a bit of a surprise. It's also not a very good idea, as I noted before, and Mark Weisbrot suggests here.

Read More »The Euro is Poised for a Rise, Expect $1.50 in 2 to 4 Years

We present twelve reasons that could sustain a further euro appreciation to $1.40 or even 1.50 in the upcoming two to four years. The main one is that Germans are net global creditors and Americans net debtors. This is reflected in fiscal and monetary policy and in investors' behaviour. The post was written in December 2013, but the arguments are still valid today and will continue to be valid in the future.

Read More » Heterodox

Heterodox