Getting more obvious it’s ‘spreading’ much like during the sub prime days, as previously discussed? European banks face major cash crunch European banks may have to pare down assets to bolster capital reserves as cheap oil is taking a toll on portfolios of energy-exposed loans. It’s slowing, whatever it is…;) Labor Market Conditions IndexHighlightsPayroll growth slowed in Friday’s employment report as did the Fed’s labor market conditions index, to plus 0.4 in January from a downward...

Read More »Japan, China, Fed comment, Capex cutbacks, South Korea

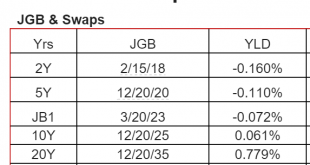

This is the yen yield curve after over 20 years of a 0 rate policy, massive QE, and now negative overnight rates. Maybe now the economy will finally respond.:( (And how good can the BOJ think the economy is?) The western educated kids/monetarists who’ve taken control don’t seem to be doing all that well, as China begins to look like the other countries they’ve taken over, like the EU, US, etc. etc. etc. What they learned is that it’s about balancing the federal budget and using monetary...

Read More »GDP, Saudi oil production, KC Fed, Chicago PMI, Shale Italy and Japan comments

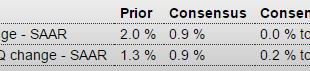

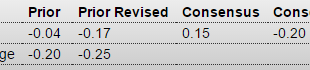

As expected, the deceleration continues, and over the next couple of years it wouldn’t surprise me if the entire year gets revised down substantially: GDPHighlightsConsumer spending is the central driver of the economy but is slowing, at least it was during the fourth quarter when GDP rose only at a 0.7 percent annualized rate. Final demand rose 1.2 percent, which is the weakest since first quarter last year but is still 5 tenths above GDP.Spending on services, adding 0.9 percentage points,...

Read More »Economic Index, Storefronts, Fed statement, Pending home sales, Durable goods orders

Also tracing the weakness back to the oil capex collapse: Econintersect’s Economic Index declined and is barely positive – and still remains at the lowest value since the end of the Great Recession. The tracked sectors of the economy which showed growth were mostly offset by the sectors in contraction. Our economic index remains in a long term decline since late 2014. The Fed got this highlighted first part right: Information received since the Federal Open Market Committee met in...

Read More »Recession warnings, Dallas Fed

Reads like we are already in recession… Recession Warnings May Not Come to Pass Jan 24 (WSJ) — Every U.S. recession since World War II has been foretold by sharp declines in industrial production, corporate profits and the stock market. Industrial production has declined in 10 of the past 12 months, and is now off nearly 2% from its peak in December 2014. Corporate profits peaked around the summer of 2014 and were off by nearly 5% as of the third quarter of last year. The Dow Jones...

Read More »Chicago Fed, existing home sales

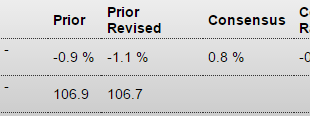

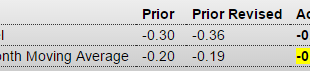

Still negative: Chicago Fed National Activity IndexHighlightsDecember was a weak month for the U.S. economy but a little less weak than November, based on the national activity index which improved to minus 0.22 from minus 0.36 (revised lower from minus 0.30). The improvement is centered in the production component as contraction in industrial production eased to minus 0.4 percent from November’s very deep minus 0.9 percent. Other components were steady with sales/orders/inventories and...

Read More »Fed comment, Retail sales, Empire State Manufacturing, Industrial production, Business inventories, Consumer sentiment

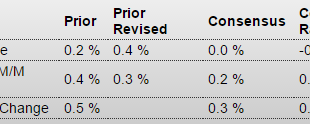

Looks like the Fed hiked during a recession. Should make for interesting Congressional testimony… Maybe the hundreds of $ millions they spend on economic research isn’t enough???;) Sales remain at recession levels: Retail SalesHighlightsRetail sales proved disappointing in December, down 0.1 percent in a headline that is not skewed by vehicles or even that much by gasoline. Ex-auto sales also fell 0.1 percent while the core ex-auto ex-gas reading came in unchanged which is well below both...

Read More »ECB, Fed, Rail traffic

Looks like they are again making hawkish noises, taking the lead of the Fed: ECB wary of further action despite uncertain future By: Balazs Koranyi and John O’DonnellJan 14 (Reuters)* Many governors sceptical of need for further action in near term* Governors urge countries to act instead with reform* Oil price and inflation expectations:Many European Central Bank policy makers are sceptical about the need for further policy action in the near term, conversations with five of them indicate,...

Read More »Spending and tax bill, Chicago Fed, CRE lending

800 billion over 10 years is something, but not enough to turn things around as it’s maybe .25% of GDP per year or so. Historically it’s taken a good 5% of GDP deficit to reverse a decline, which today means close to a 1T deficit annually. And interesting how they just jumped all over Trump for his tax plan that they claimed would add 1T to the debt over 10 years… Massive Spending and Tax Package Leaves Deficit Fears Behind Congress passed far-reaching legislation Friday to fund the...

Read More »PMI services index, KC Fed

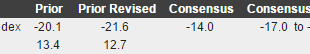

Much lower than expected from the service that tends to run much higher than the others. Fed rate hike already working! ;) PMI Services FlashHighlightsThe services PMI is slowing sharply this month, to 53.7 vs 56.1 for the final November reading and vs 56.5 for the flash reading. This is the lowest reading in a year reflecting the slowest growth in new orders since January and a fifth straight month of contraction in backlog orders. Optimism over future growth is understandably down,...

Read More » Heterodox

Heterodox