The FT reports that due to “modest but rising credit growth”, the Bank of England’s Financial Policy Committee (FPC) considered raising banks’ countercyclical capital buffer. According to the FT's Caroline Bingham: This measure requires lenders to build up capital in good times to draw down in more challenging times. And she goes on to say this: The prospect of yet more capital that banks must set aside would come on top of capital rules on a European and global basis that lenders must...

Read More »The insane Eurocrats

In July 2008, the European Commission decided that the UK had an "excessive deficit" under the terms of Article 104 of the Maastricht Treaty. Estimating that Government budgetary plans for 2008-9 would result in a deficit of 3.5% of GDP, the Commission said The excess over the 3 % of GDP reference value is not exceptional in the sense of Article 104(2) of the Treaty. In particular, it does not result from an unusual event outside the control of the United Kingdom authorities, nor is it the...

Read More »Did anyone notice the global financial crisis of 2007–2008?

By Paul DavidsonOn November 4, 2008, at the dedication of a new building, Queen Elizabeth of Great Britain visited the London School of Economics (LSE). While there she was given a briefing by academics at the LSE on the origins and effects of the global financial crisis and its resulting turmoil in international financial markets. The Queen is reported to have asked, “Why did nobody notice it developing?” The director of research at LSE told her, “At every stage someone was relying on...

Read More »A Finnish cautionary tale

Eurozone growth figures came out today. And they are horribly disappointing. Everyone undershot, apart from Spain which turned in a remarkable 1% quarter's growth, and Greece which somehow managed an even more incredible 0.8% (yes, I will write about this, but not in this post). France didn't grow at all, Italy all but stagnated at 0.2%, and even the mighty Germany only managed 0.4%. Despite low oil prices, falling commodity prices, weak Euro and the ECB's QE programme, Eurozone...

Read More »There are controls, and then there are controls….

Guest post by Sigrún DavídsdóttirNow that Greece has controls on outtake from banks, capital controls, many commentators are comparing Greece to Iceland. There is little to compare regarding the nature of capital controls in these two countries. The controls are different in every respect except in the name. Iceland had, what I would call, real capital controls – Greece has control on outtake from banks. With the names changed, the difference is clear.Iceland – capital controlsThe controls in...

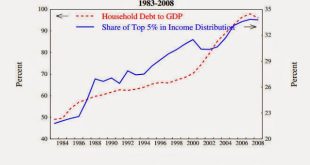

Read More »Inequality, the Financial Crisis and Stagnation

By Thomas PalleyThis paper examines several mainstream explanations of the financial crisis and stagnation and the role they attribute to income inequality. Those explanations are contrasted with a structural Keynesian explanation. The role of income inequality differs substantially, giving rise to different policy recommendations. That highlights the critical importance of economic theory. Theory shapes the way we understand the world, thereby shaping how we respond to it. The theoretical...

Read More »Property, inequality and financial crises

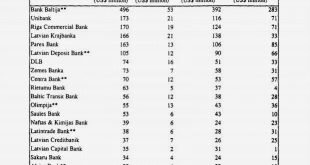

At the end of my previous post, I posed the question: why did Latvia experience the deepest recession in the world in 2008-9?The first puzzle is that Latvia's banks were in no worse shape than anyone else's and better than some. Among small countries, Iceland, Ireland and (in 2013) Cyprus all experienced bigger banking collapses relative to the size of their economies than Latvia. Larger countries did too, notably Germany and the UK, both of which suffered widespread damage across their large...

Read More »The Latvian financial crisis

This is not what you think it is. And it is not what I intended to write about, either. I was going to write about Latvia as it is now, after the deepest recession in the world in 2008-9 and an excruciatingly painful front-loaded fiscal consolidation. Has it really recovered, or is it just marking time?But in looking at Latvia now, I find myself drawn to its history. Latvia's unusual response to the kicking it got in 2008 was because of its history. It had a deep recession 1991-3 and a severe...

Read More » Heterodox

Heterodox