From the abstract: This paper examines several mainstream explanations of the financial crisis and stagnation and the role they attribute to income inequality. Those explanations are contrasted with a structural Keynesian explanation. The role of income inequality differs substantially, giving rise to different policy recommendations. That highlights the critical importance of economic theory. Theory shapes the way we understand the world, thereby shaping how we respond to it. The...

Read More »Understanding balance of payments crises in a fiat currency system

It's weird. Whenever I say that floating exchange rates can't absorb all shocks and that balance of payments crises can happen even in fiat currency systems, I am accused of gold standard thinking. Gold standard? Me? Perish the thought. I am the world's biggest fan of fiat currencies. And of floating exchange rates, too. But that doesn't mean I regard them as a panacea.Firstly, about gold standards. Under a strict gold standard, the quantity of money circulating in the economy is...

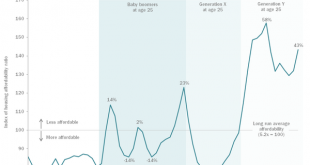

Read More »Don’t blame the boomers

From Joe Sarling's blog comes this a lovely chart showing housing affordability by cohort since 1955: As can be seen, the current generation of young people - Generation Y - faces paying a far higher proportion of their incomes in mortgages or rent than any previous cohort. This does not, of course, take into account the considerable price difference between London and everywhere else: if London were excluded, I suspect their position would not look quite so dire. Nonetheless, this chart is...

Read More »Robert Skidelsky: Lecture 1: The Anatomy of the Crisis

Another video of Robert Skidelsky, a British economic historian and the author of the best biography of John Maynard Keynes in existence. Skidelsky’s Keynesian economic ideas have also converged with Post Keynesian economics over the years.Here he gives lecture 1 of a series at the University of Warwick on economics. This lecture is an analysis of the financial crisis of 2008 and how orthodox neoclassical economics brought the world to this catastrophe.[embedded content]

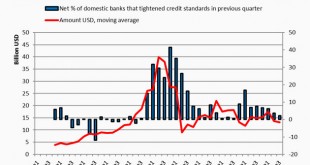

Read More »A countercyclical credit bubble?

Over at VoxEU, Philippe Bachetta and Ouarda Merrouche have a surprising take on "countercyclical" lending. They show that lending by US and European banks in US dollars to European non-financial corporates massively increased from 2007-2009, and that this helped to soften the effect of the European credit crunch on employment: Over the period 2004 to 2009, we find that foreign credit denominated in dollar to non-financial corporates is countercyclical – it increased sharply (relative to...

Read More »Bernie Sanders Decries Lack of Wall Street Prosecutions

NEP’s Bill Black appears on The Real News and says it’s important to reimplement the Glass-Steagall Act – but it’s not enough to prevent another financial crisis. You can view here with transcript or watch video below. [embedded content] [Translate]

Read More »Grexit, Brexit and financial stability

On October 30th 2015, I gave a keynote speech at Birmingham University's Finance Forum on the implications of Grexit and Brexit for financial stability. I've now written this up as a paper.I start by outlining the purpose of financial stability. Since the 2007-8 financial crisis, “financial stability” has been all the rage. We must prevent another crisis: we must solve the problems that make our financial system “unstable”. But what exactly do we mean by “financial stability”? Most people...

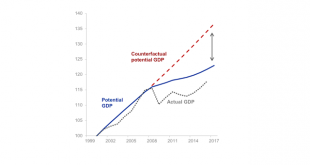

Read More »Euro area depression, charted

"The euro area economy is gradually emerging from a deep and protracted downturn. However, despite improvements over the last year, real GDP is still below the level of the first quarter of 2008. The picture is more striking still if one looks at where nominal growth would be now if pre-crisis trends had been maintained." So said Peter Praet, Member of the Executive Board of the ECB, in a recent presentation to the FAROS Institutional Investors' Forum.He's not wrong. From his presentation,...

Read More »The European Union must reform before it’s too late

At the Bank of England's Open Forum in London's Guildhall on Wednesday 11th November, an increasingly desperate-sounding Mario Draghi said this: As the majority of money is issued by private banks - bank deposits - there can only be a single currency if there is a single banking system. For money to be truly one, it has to be truly fungible, independent of its form and independent of its function. This is far from being the first time that Signor Draghi has pushed the case for common...

Read More »The Slough of Despond

I'm bored.Bored with this crisis. Bored with endless calls for bank reforms. Bored with never-ending stories of inadequate bank resolution and legal battles which benefit no-one but lawyers. Bored with ineffectual monetary policy and fiscal gridlock. Bored with seeing the same things proposed over and over again, even things we know don't work and will never happen.Today, Mike Konczal wrote a piece on why restoring Glass-Steagall wouldn't solve anything. He's right, of course. But it is now...

Read More » Heterodox

Heterodox