New Working Paper published by the Political Economy Research Institute (PERI). From the abstract:Interest rates have declined over the last 40 years, a period of increasing inequality. The steady decline in interest rates has been interpreted by and large as resulting from a decline of the natural rate of interest. This paper surveys the main explanations associated with the notion of a decline in the natural rate of interest, including the savings glut and the secular stagnation...

Read More »Capital Flows to the Periphery: Still ‘push’, but with significantly lower risk spreads

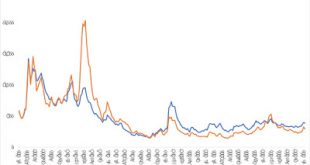

Gabriel Aidar and Julia Braga (Guest Bloggers) We have, in our new paper, gone back to the old pull-push debate on determinants of capital inflows to emerging markets, to look at the behavior of country risk premium spreads. Our Principal Component Analysis of the country-risk spread series of ten emerging economies from 1999 to 2019 revealed that 86% of the total volatility of the original series can be represented by only two components, suggesting the prevalence of common factors in...

Read More »Does Capitalism Have a PR Problem? — Erika Fry

Still clueless. Caught in the bubble and out of touch. “For every one positive article about capitalism, there are 11 negative ones,” said Nathan Rosenberg, founding partner of Insigniam, a management consulting firm. “CEOs should seize their job. Capitalism has created more elevation of [the] human condition than any religion or government ever has. We don’t tell our story. We don’t talk about the benefits. We have to get out and tell our story.”... FortuneDoes Capitalism Have a PR...

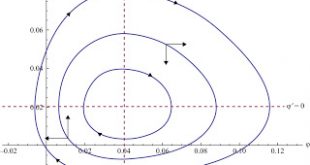

Read More »A predator–prey model to explain cycles in credit-led economies

A paper in the new issue of ROKE by Óscar Dejuan and co-author. From the abstract: This paper develops a predator–prey model to explain cycles in credit-led economies. The predator is the part of the financial sector that issues credit money for non-output transactions. It increases the indebtedness ratio and inflates bubbles that eventually have a negative impact on the real rate of growth (the prey). From this basis, we build a couple of models that may lead to self-contained or...

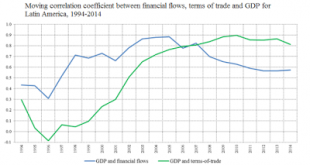

Read More »Latin America’s growth

From the presentation with Esteban Pérez. The graph shows that growth in the region is increasingly tied to terms of trade changes and financial flows. This was something we discussed a few years ago here.

Read More » Heterodox

Heterodox