Summary:

A paper in the new issue of ROKE by Óscar Dejuan and co-author. From the abstract: This paper develops a predator–prey model to explain cycles in credit-led economies. The predator is the part of the financial sector that issues credit money for non-output transactions. It increases the indebtedness ratio and inflates bubbles that eventually have a negative impact on the real rate of growth (the prey). From this basis, we build a couple of models that may lead to self-contained or explosive cycles. Even in the first case, there is a risk of a financial collapse when certain variables move far away from their long-term equilibrium positions. In order to tame the cycle and avoid extreme positions, governments should ban the expansion of credit money for the purchase of assets and

Topics:

Matias Vernengo considers the following as important: Dejuan, Financial cycles, Predator-Prey model

This could be interesting, too:

A paper in the new issue of ROKE by Óscar Dejuan and co-author. From the abstract: This paper develops a predator–prey model to explain cycles in credit-led economies. The predator is the part of the financial sector that issues credit money for non-output transactions. It increases the indebtedness ratio and inflates bubbles that eventually have a negative impact on the real rate of growth (the prey). From this basis, we build a couple of models that may lead to self-contained or explosive cycles. Even in the first case, there is a risk of a financial collapse when certain variables move far away from their long-term equilibrium positions. In order to tame the cycle and avoid extreme positions, governments should ban the expansion of credit money for the purchase of assets and

Topics:

Matias Vernengo considers the following as important: Dejuan, Financial cycles, Predator-Prey model

This could be interesting, too:

Matias Vernengo writes Savings Glut, Secular Stagnation, Demographic Reversal, and Inequality: Beyond Conventional Explanations of Lower Interest Rates

Matias Vernengo writes Capital Flows to the Periphery: Still ‘push’, but with significantly lower risk spreads

Mike Norman writes Does Capitalism Have a PR Problem? — Erika Fry

Matias Vernengo writes Latin America’s growth

A paper in the new issue of ROKE by Óscar Dejuan and co-author. From the abstract:

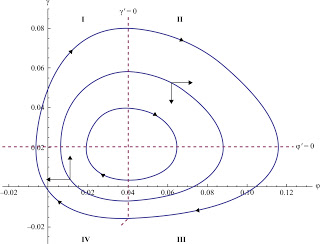

This paper develops a predator–prey model to explain cycles in credit-led economies. The predator is the part of the financial sector that issues credit money for non-output transactions. It increases the indebtedness ratio and inflates bubbles that eventually have a negative impact on the real rate of growth (the prey). From this basis, we build a couple of models that may lead to self-contained or explosive cycles. Even in the first case, there is a risk of a financial collapse when certain variables move far away from their long-term equilibrium positions. In order to tame the cycle and avoid extreme positions, governments should ban the expansion of credit money for the purchase of assets and introduce permanent checks to risky credit.You can read the whole paper here.