This paper discusses the Marxist and Marxisant versions of the FH and argues that they misconceive the actual workings of modern capitalism leading to an explanatory blind alley. The spectacular ballooning of the financial system during the recent decades of weak profitability and accumulation does not constitute a new epoch, let alone a new capitalism. Instead it constitutes a well-known capitalist reaction in periods of weak profitability. This does not preclude the proliferation of new...

Read More »Michael Hudson — “Creating Wealth” through Debt: The West’s Finance-Capitalist Road

I kid to this previously, but it was in a list of links. It is important enough to give it its own post.Hudson at his best. It's a must-read. Longish, so save it for the weekend if time is an issue.Michael Hudson — On Finance, Real Estate And The Powers Of Neoliberalism“Creating Wealth” through Debt: The West’s Finance-Capitalist Road— To be delivered at the Peking University, School of Marxist Studies, May 5-6, 2018Michael Hudson | President of The Institute for the Study of Long-Term...

Read More »Michael Hudson — Monetary Imperialism

This article is adapted from the German edition of Super-Imperialism (2017).… It's a fairly long article. Here are some highlights in summary. The U.S. response has been to extend the new Cold War into the financial sector, rewriting the rules of international finance to benefit the United States and its satellites – and to deter countries from seeking to break free from America’s financial free ride. Aiming to isolate Russia and China, the Obama Administration’s confrontational diplomacy...

Read More »Zero Hedge — Ray Dalio: “This Is The Most Important Economic, Political And Social Issue Of Our Time”

The two US economies — the haves (upper 40%) and the have-nots (bottom 60%).Zero HedgeRay Dalio: "This Is The Most Important Economic, Political And Social Issue Of Our Time" Tyler Durden

Read More »Michael Hudson: Socialism, Land and Banking: 2017 Compared to 1917

Socialism a century ago seemed to be the wave of the future. There were various schools of socialism, but the common ideal was to guarantee support for basic needs, and for state ownership to free society from landlords, predatory banking and monopolies. In the West these hopes are now much further away than they seemed in 1917. Land and natural resources, basic infrastructure monopolies, health care and pensions have been increasingly privatized and financialized. Instead of Germany and...

Read More »JW Mason — New Article on Financialization

I have a new article forthcoming in Development and Change, on the political economy of financialization, coauthored with Arjun Jayadev and Enno Schroeder. A chief role of finance in a capitalist system is to allocate financial capital efficiently and effectively. Finance is supposed to impose discipline on economics. Joseph Schumpter called bankers "the ephors of capitalism." The five ephor of ancient Sparta were magistrates that held power over the monarchical aspect Spartan...

Read More »Michael Roberts — Blockchains and the crypto craze

Are blockchain and cryptocurrencies as over-hyped? Michael Roberts thinks so and explains why.Michael Roberts BlogBlockchains and the crypto crazeMichael Roberts

Read More »Ease up on shareholder payouts, pay your workers more instead

With Alberta and Ontario raising their minimum wage to $15 per hour, and BC possibly following suit soon, the usual suspects have begun their predictable howling about how this is a bad time, or it’s happening too fast, or how it will simply hurt those we are trying to help. It is true that increasing the minimum wage may result in slightly fewer jobs for teenagers, and slightly fewer hours for other workers – but the evidence shows that overall the effect is positive, especially for low...

Read More »A Short Account of The Rise of Neoliberalism

By David FieldsBetween roughly the early 1940’s and early 1970’s, the financial architecture of the world economy centered on a US engineered Keynesian accumulation agenda, as a response to the devastation wrought by the Great Depression. The capitalist institutional structure, or social structure of accumulation (Kotz, McDonough, and Reich, 1994), rested on finance being subservient to the promotion of industrial enterprise. With socially-engineered capital-labor compromises in...

Read More »Financial sector hypertrophy and financial transaction tax

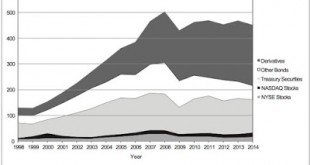

The volume of financial transactions has stabilized since the Global Financial Crisis of 2008, but remans at very high levels, as shown in the figure below. With GDP at about 18 trillions the volume of financial transactions is about 25 times the size of GDP. The potential problems associated to a hypertrophied financial sector. Yuge! The source is this paper that discusses the possibilities of a financial transactions tax (FTT), something that has been proposed by Bernie Sanders. And as...

Read More » Heterodox

Heterodox