I recently participated in a panel discussion in David Hulchanski’s graduate-level social housing and homelessness course at the University of Toronto. Points raised in the blog post include the fact that all English-speaking countries of the OECD have relatively low levels of public social spending, relatively low levels of taxation, and serious affordable housing challenges. The link to the full blog post is here. Nick Falvo is a Calgary-based research...

Read More »Our Neo-Feudal System Is on the Verge of Collapse — Michael Hudson

Transcript of Michael Hudson in conversation with Ellen Brown and Walt McRee. Neo-feudalism masquerading as "capitalism and democracy."The Unz ReviewOur Neo-Feudal System Is on the Verge of Collapse Michael Hudson | President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City, and Guest Professor at Peking UniversitySee alsoReminiscence of the...

Read More »The effects of financialization in Latin America: Is there space for monetary policy?

For those in Bogota next Tuesday. I'll link to the live stream, which I think will be available.

Read More »Financialization as symptom — Chris Dillow

Which is where financialization comes in. The defining event on the road to financialization in the 80s was not big bang: at the time, this was seen as merely the ending of a restrictive practice rather than the start of the creation of global investment banks. Instead, it was the credit liberalization of the early 80s, which made mortgages and consumer credit much easier to get. This did not merely increase the activity and hence profits of lenders: note the big rise in financial profits...

Read More »The Making of Homo Financius and Neoliberal Morality Oleg Komlik

In their paper Maman and Rosenhek made an insightful contribution in shedding light on how the state agencies, institutional actors and mechanisms concoct the neoliberal morality and conduct the moralization of the economic field within particular macro-institutional context. This important research direction should be amplified more in our field. One thing is certain: in (neoliberal) capitalism moral sentiments play a key role in the extraction of economic value. Maman, Daniel and Zeev...

Read More »Imperialism and profitability at Lille — Michael Roberts

G Carchedi and I are working on a paper on the economics of imperialism that covers measuring unequal exchange in trade, factor income flows on the current account; and foreign investment on the capital account. We reach similar conclusions to Ricci in that imperialism is alive and well and inequality between the imperialist economies and the rest is just as wide as it was 100 years go. Value produced in the dominated countries get appropriated and transferred to the imperialist economies...

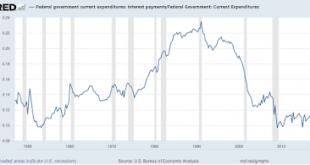

Read More »Financialization and the low burden of public debt

Financialization is a fuzzy concept. There are many definitions, and none is clear cut, at least to characterize the changes of the last 40 years or so, which is the period most authors associate with financialization. I'm not suggesting it's not a useful concept though.* In some sense, financialization refers to the last phase in the capitalist system (even if there are ways in which one might argue that capitalism was always financialized). At any rate, going to the point I wanted...

Read More »Value Creation vs Value Extraction in Today’s Economy

Book Review Mariana Mazzucato. The Value of Everything: Making and Taking in the Global Economy. Allen Lane. 2018. The playwright Oscar Wilde quipped that a cynic is a person who “knows the price of everything and the value of nothing.” As Mariana Mazzucato argues in her important and stimulating new book, “The Value of Everything,” that adage could be applied to the vast majority of mainstream, neo-classical economists. Mazzucato is the author of the previous bestseller, The Entrepreneurial...

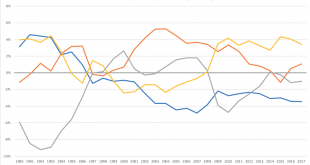

Read More »An Analysis of Financial Flows in the Canadian Economy

An essential but perhaps overlooked way of looking at the economy is a sector financial balance approach. Pioneered by the late UK economist Wynne Godley, this approach starts with National Accounts data (called Financial Flow Accounts) for four broad sectors of the economy: households, corporations, government and non-residents. Here’s how it works: in any given quarter or year each sector can be a net borrower or lender, but the sum of the four sectors’ borrowing/lending must equal to...

Read More »Financialization in Latin America

New book edited by Martín Abeles, Esteban Pérez Caldentey and Sebastían Valdecantos. From the description: The chapters in the book analyze the logic and effects of financialization in developing economies, peripheral financialization so to speak, in particular in Latin America. The first chapters look at the topic from a historical and conceptual angles, and then the latter chapters concentrate on specific manifestations like the influence of financialization on productive investment,...

Read More » Heterodox

Heterodox