Paper on Paul with Tom Palley and Jamie Galbraith published by ROKE. From the abstract:"Paul Davidson was a critical figure in the preservation of John Maynard Keynes’s ideas, sticking with them when they were out of fashion. He was also key to the survival of the Post Keynesian school. Davidson endorsed Keynes’s liquidity preference theory of interest, and he emphasized fundamental uncertainty as a central feature of economic reality, essential to making sense of a monetary economy. His...

Read More »More on the possibility and risks of a recession

So both the (inverted) yield curve and the Sahm rule indicate a recession. This together with two months of slower employment creation, and the slightly higher unemployment rate, has many wondering whether the economy will crash soon. I discussed before -- a while ago, before the pandemic recession, that had nothing to do with the yield curve -- why an inverted yield curve doesn't necessarily mean a forthcoming recession. The Sahm rule, like the inverted yield curve has an impressive track...

Read More »The Gift of Sanctions

Jamie Galbraith presented, at the EPS session at the ASSA Meetings in San Antonio, the paper published by INET. As he said there: "Despite the shock and the costs, the sanctions imposed on the Russian economy were in the nature of a gift." A type of invisible hand effect, by which the unintended effect of the policy that should supposedly benefit US allies (Ukraine) has the unintended effect of helping its alleged enemies (Russia).From the abstract:This essay analyzes a few prominent Western...

Read More »What’s Left of Cambridge Economics?

A new piece by Jamie Galbraith on Project Syndicate, that reviews some recent books, but deals essentially with what happened to heterodox economics, a theme that has been treated here often (on the definition of heterodox economics go here). Jamie provides an apt definition, on the basis of what he got at Cambridge back in the 1970s. In his words:When I attended the University of Cambridge in 1974-75, I read Keynes, met Piero Sraffa, listened to Joan Robinson, and studied with Kaldor, Luigi...

Read More »Galbraith on the Texas Energy Debacle

This piece shows very clearly the limits to deregulation in the case of energy markets. Jamie's oped was published in Project Syndicate, and a slightly different version is available here at INET, in which we find out that radical free market policies ended up in what he termed 'selective socialism.' The relevant paragraph:the price mechanism failed completely. Wholesale prices rose a hundred-fold – but retail prices, under contract, did not, except for the unlucky customers of Griddy, who...

Read More »World War II, not the New Deal, is the model for COVID-19 macroeconomic policies

Central planning (Socialism?) in democratic societies There is a lot being written on the causes and cures for the economic consequences of the Coronavirus (COVID-19). The predictable distinction is among those that think that this is essentially a demand shock, mostly to services, and those that are concerned with the disruption to supply chains. And to some extent both are correct. But that is not the more relevant problem here, which is whether we need just more government or a...

Read More »James K. Galbraith’s Veblen-Commons award

Ritual and prestige among the Institutionalists Jamie got the Veblen-Commons award, something his father received back in 1976. I introduced him, and as expected discussed a bit his contributions to economics, and the understanding of institutions. His most important contributions are on the field of inequality, and the work he has done with the University of Texas Inequality Project (UTIP).There are many contributions that Jamie and UTIP have made. His use of the UNIDO payroll data,...

Read More »Galbraith on MMT and the Hyperinflation Boogeyman

From his recent piece: "Does this mean that 'deficits don’t matter'? I know of no MMT adherent who has made such a claim. MMT acknowledges that policy can be too expansionary and push past resource constraints, causing inflation and exchange-rate depreciation – which may or may not be desirable. (Hyperinflation, on the other hand, is a bogeyman, which some MMT critics deploy as a scare tactic.)"Also, this: "And MMT is not about Congress ordering the Fed to use its “balance sheet as a cash...

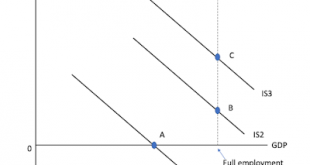

Read More »MMT and its Discontents: Again (Wonkish and Longish)

Modern Monetary Theory (MMT) has been in the news again, and for good reasons. I actually had a post with the same title back in February of 2012, hence the again in the title. But now, with the irruption of Alexandria Ocasio-Cortez in the political scene ,and with the discussion of a Green New Deal (discussed here 7 years ago) and the feasibility of higher taxes (here, also long ago, among the many on the topic) taking the center of the political debate, MMT has become trendy. The rise...

Read More »Galbraith versus Piketty on Inequality

A new paper by James k. Galbraith has been published in Development & Change. It's along the lines of his arguments in the Godley-Tobin Lecture delivered earlier this year, and to be published in the Review of Keynesian Economics (ROKE) in January. Basically, we need a macro story for inequality (which Piketty r-g framework tries, but ultimately fail to provide) and that the payroll data that Galbraith uses provides a more accurate measure of inequality than the tax records favored by...

Read More » Heterodox

Heterodox

-310x165.png)