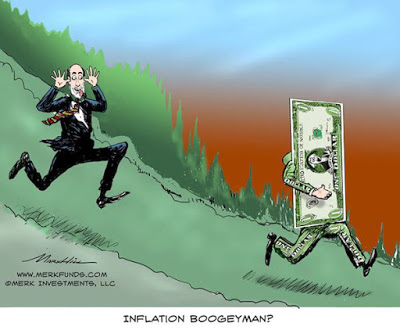

From his recent piece: "Does this mean that 'deficits don’t matter'? I know of no MMT adherent who has made such a claim. MMT acknowledges that policy can be too expansionary and push past resource constraints, causing inflation and exchange-rate depreciation – which may or may not be desirable. (Hyperinflation, on the other hand, is a bogeyman, which some MMT critics deploy as a scare tactic.)"Also, this: "And MMT is not about Congress ordering the Fed to use its “balance sheet as a cash cow.” Rather, it is about understanding how monetary operations actually work, how interest rates are set, and what economic powers the US government has. This, in turn, requires recognizing that the dual mandate is not a collection of empty words, but something that can – and should – be pursued on a

Topics:

Matias Vernengo considers the following as important: Galbraith, Hyperinflation, inflation

This could be interesting, too:

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Angry Bear writes Voters Blame Biden and Harris for Inflation

Lars Pålsson Syll writes How inequality causes financial crises

Matias Vernengo writes Inflation, real wages, and the election results

From his recent piece: "Does this mean that 'deficits don’t matter'? I know of no MMT adherent who has made such a claim. MMT acknowledges that policy can be too expansionary and push past resource constraints, causing inflation and exchange-rate depreciation – which may or may not be desirable. (Hyperinflation, on the other hand, is a bogeyman, which some MMT critics deploy as a scare tactic.)"

Also, this: "And MMT is not about Congress ordering the Fed to use its “balance sheet as a cash cow.” Rather, it is about understanding how monetary operations actually work, how interest rates are set, and what economic powers the US government has. This, in turn, requires recognizing that the dual mandate is not a collection of empty words, but something that can – and should – be pursued on a regular and sustained basis.

There are practical, straightforward, and realistic ways for policymakers to meet this mandate. Implementing them would strengthen the country, not bankrupt it. And, contrary to opponents’ fears, global investors would not flee in terror from US government bonds and the US dollar."