by Melvin Blackman QUARTZ Last week? We were talking about market manipulation at the business level and also the state level. The industry intended to cut production so as to maintain prices if California capped prices. California was putting a new program in place to regulate pricing. An AZ state rep was going to California to ask them not to pass the bill. All are forms of market manipulation and one oil industry person did not like what I...

Read More »January 2024 consumer inflation: still a tug of war between gas and housing

January 2024 consumer inflation: still a tug of war between gas and housing – by New Deal democrat As it has been for going on two years, consumer inflation has boiled down to a contest of strength between energy (mainly gasoline), which peaked in June 2022 and roughed in June 2023, and housing, which peaked in early 2023 and has been gradually disinflating since. The headlines, as you presumably already know, are that total inflation rose...

Read More »Coincident indicators hold on, mainly due to improvement in gas prices YoY

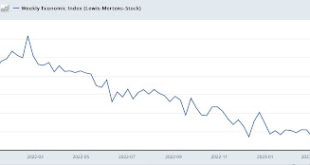

Coincident indicators hold on, mainly due to improvement in gas prices YoY – by New Deal democrat I’ve been paying particular attention lately to the coincident indicators, because the leading indicators have telegraphed a recession for about half a year – so why isn’t it here yet??? A good representation of coincident indicators remaining positive is the Weekly Economic Index of the NY Fed: It looked on track to turn negative at the...

Read More »Initial claims continue to rise along with gas prices

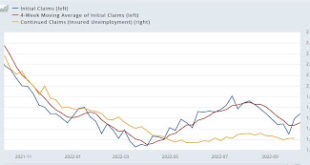

“Initial claims continue to rise along with gas prices“ – by New Deal democrat Last week I wrote that initial jobless claims may have ended their recent downtrend. This week appears to have confirmed that. Initial claims rose 9,000 to 228,000, and the 4 week average rose 5,000 to 211,500. Continuing claims, which lag somewhat, increased 3,000 to 1,368,000: With OPEC deliberately cutting back production in order to cause a shortage in...

Read More »RJS: EIA US Oil Supply and Disposition Report

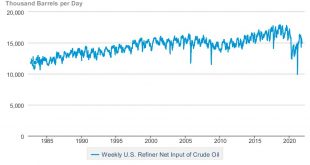

Summary: US oil supplies at a 17½ year low. SPR at a 35 year low after the SPR largest withdrawal on record. Gasoline supplies at a 6-month low. ~~~~~~~~ The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the week ending June 10th show that after a big increase in our oil imports, another big oil withdrawal from the SPR, and an increase in oil supplies not accounted...

Read More »Lowest Gasoline supplies since November 2017, Production above prepandemic levels

Focus on Fracking: gasoline supplies lowest since November 2017 despite gasoline production above prepandemic levels; Focus on Fracking, Commenter and Blogger RJS US oil data from the US Energy Information Administration for the week ending October 29th indicated that after a modest increase in our oil production and only minor changes to our oil imports, our oil exports, and our refining, we had surplus oil to add to our stored commercial crude...

Read More »Lowest Gasoline supplies since November 2017, Production above prepandemic levels

Focus on Fracking: gasoline supplies lowest since November 2017 despite gasoline production above prepandemic levels; Focus on Fracking, Commenter and Blogger RJS US oil data from the US Energy Information Administration for the week ending October 29th indicated that after a modest increase in our oil production and only minor changes to our oil imports, our oil exports, and our refining, we had surplus oil to add to our stored commercial crude...

Read More » Heterodox

Heterodox