The Eurogroup (part of which is pictured above) has produced a statement on the outcome of the latest debt talks with Greece. As ever with Eurogroup statements, it confuses more than it enlightens. So here is my attempt at translating Eurogroup-speak into plain English. __________________________________________________________________________________ The Eurogroup welcomes that a full staff-level agreement has been reached between Greece and the institutions. Phew. We got that through...

Read More »Have we done enough to prevent another financial crisis?

Notes from a talk given at Trinity Business School, Dublin, on 26th May 20164 Well, it depends what sort of crisis you mean. Have we done enough to prevent a crisis like the last one? Yes. We have scared ourselves so much about the dangers of disorderly bank failure that no way are we going to allow that to happen again – at least, not until we who lived through the crisis, and our children and grandchildren whom we tell about the crisis, are long gone and our legacy forgotten. No-one...

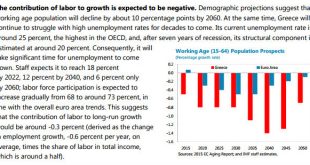

Read More »Where on earth is growth in Greece going to come from?

It's not going to come from people working more. Excerpt from the IMF's latest Debt Sustainability Analysis for Greece, just released: Oh dear. Quite apart from the negative contribution to growth, the prospect of unemployment taking 44 years to return to something approaching normality is simply appalling for Greece's population. I've looked in more detail at this here (Forbes).Well, if labour isn't going to drive growth, there's always investment, yes?Er, not really. The outlook for...

Read More »The Austerity Beatings of Greece Will Continue Until Its Morale Improves

By William K. Black April 17, 2016 Bloomington, MN The old joke, that conveys a critical truth, is the poster that says “The daily floggings will continue until morale improves around here.” The troika misses the irony in the poster, for it thinks that the answer to the eurozone nightmare problems caused by austerity is more austerity. The latest example is three IMF stories that ran contemporaneously. The IMF, again, lowered global growth forecasts. Two, the IMF is calling for...

Read More »Grexit, Brexit and financial stability

On October 30th 2015, I gave a keynote speech at Birmingham University's Finance Forum on the implications of Grexit and Brexit for financial stability. I've now written this up as a paper.I start by outlining the purpose of financial stability. Since the 2007-8 financial crisis, “financial stability” has been all the rage. We must prevent another crisis: we must solve the problems that make our financial system “unstable”. But what exactly do we mean by “financial stability”? Most people...

Read More »No apology, just an explanation

My Forbes post on the threat to democracy in the EU touched a nerve. Well, several nerves, actually. Some people regarded my invocation of the Prague Spring as insulting to the people who suffered under Soviet oppression: others objected to my comparison of the benevolent EU with the evil USSR: and a few complained that I had presented the Syriza government as "martyrs", when they are nothing of the kind. And lots of Portuguese called me out for misrepresenting how their parliamentary...

Read More »Jensen: How long bonds could actually outperform equities

In-depth analysis on Credit Writedowns Pro. Editor’s note: This was originally published by Absolute Return Partners in late August. So we are a little late in releasing it. Apologies. It is still good reading. The Absolute Return Letter, August/September 2015: Doodles from an eventful summer “There is something deeply troubling when the unthinkable threatens to become routine.” Bank for International Settlements Incidents of the summer 2015 This month’s Absolute Return Letter is a...

Read More »Public debt crisis, austerity and deflation: the case of Greece

From the new issue of the Review of Keynesian Economics (ROKE). By Marica Frangakis from the Nicos Poulantzas Institute, Athens, Greece. From the abstract:Greece is the country in which the eurozone's public debt crisis began in late 2009. The policy response of the EU elites was to provide financial assistance on condition that a strict austerity-cum-deregulation policy is applied under the watchful guidance of the European Commission, the European Central Bank and the IMF (the so-called...

Read More »In defence of the (conflicted) ECB

Everyone has been so transfixed by Yanis Varoufakis's "Plan B" revelations that his defence of the ECB's Mario Draghi passed unnoticed. Here it is, transcribed from the Lamont tape by Peter Spiegel at the FT:Mario Draghi has handled himself as well as he could, and he tried to stay out of this mire, the political mire, impressively. I have always held him in high regard. I hold him in even higher regard now, having experienced him over the last six months. Having said that, the European...

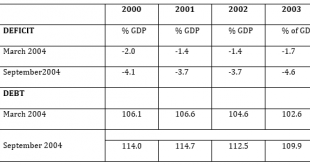

Read More »Lies, damned lies, and Greek statistics

Guest post by Sigrún DavídsdóttirThe word “trust” has been mentioned time and again in reports on the tortuous negotiations on Greece. One reason is the persistent deceit in reporting on debt and deficit statistics, including lying about an off market swap with Goldman Sachs: not a one-off deceit but a political interference through concerted action among several public institutions for more then ten years.As late as in the July 12 Euro Summit statement "safeguarding of the full legal...

Read More » Heterodox

Heterodox