I am a big fan of looking at things through the lens of the sectoral balances. For instance, I sometimes post this chart on this website which depicts the government’s balance vs the non-government. (This is a stupid chart without a lot more context) It’s a decent (though incomplete) depiction of the private sector’s balance versus the government’s position and it’s helpful to understand because, mainly, if you believe the private sector is too heavily indebted, then the government’s position might be insightful. For instance, I would argue that the late 90’s were a period of concern because there was an equity market bubble and heavily leveraged corporations combined with a government running a surplus which created recession risk. That’s not necessarily a bad thing. After all, if

Topics:

Cullen Roche considers the following as important: How Things Work, Myth Busting

This could be interesting, too:

Cullen Roche writes The Investors Podcast – Masterclass in Inflation

Cullen Roche writes How Does the Fed “Manipulate” Interest Rates?

Cullen Roche writes What is “Fractional Reserve Banking”?

Cullen Roche writes Everything Wrong with the “Money Printer Go Brrrr” Meme

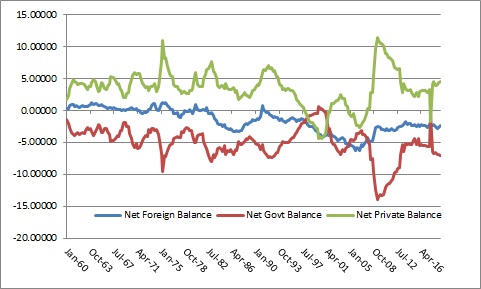

I am a big fan of looking at things through the lens of the sectoral balances. For instance, I sometimes post this chart on this website which depicts the government’s balance vs the non-government.

(This is a stupid chart without a lot more context)

It’s a decent (though incomplete) depiction of the private sector’s balance versus the government’s position and it’s helpful to understand because, mainly, if you believe the private sector is too heavily indebted, then the government’s position might be insightful. For instance, I would argue that the late 90’s were a period of concern because there was an equity market bubble and heavily leveraged corporations combined with a government running a surplus which created recession risk. That’s not necessarily a bad thing. After all, if there are economic booms then sometimes an inevitable bust is the result. But it’s a nice framework for understanding potential risks in the economy IF, and only IF, you add a lot more context to it.

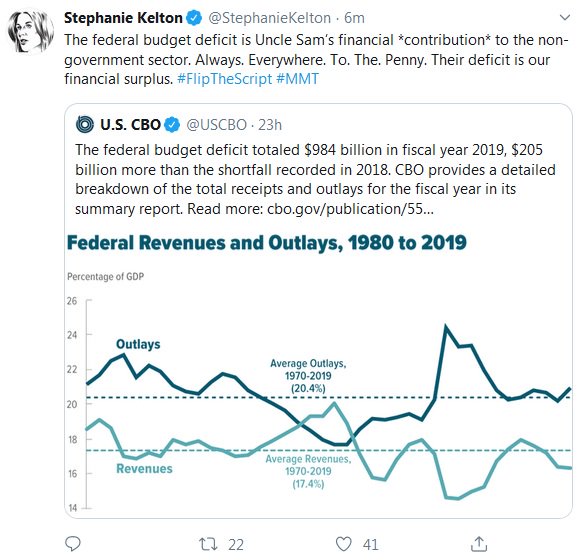

Anyhow, some people use this chart in a misleading manner. The worst abusers of this chart are the MMT people and they constantly use it to misrepresent how the monetary system works. So let’s discuss that a bit because it confuses a lot of people. For instance, here’s Stephanie Kelton posting this image on Twitter yesterday saying the government’s deficit is the non-government’s surplus:

Let’s deconstruct this a little bit because MMT’s depiction of this is mostly a fallacy of composition that tries to imply that the government must be running a deficit virtually all the time:

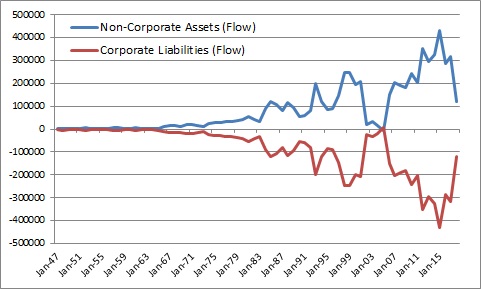

1) This is just an accounting identity. The government’s spending is someone else’s income. You could recreate a chart of this using any sectoral relationship. For instance, when I take out debt and spend the money that becomes someone else’s income. The Cullen Roche deficit is the non Cullen Roche surplus. It’s not helpful or insightful to run around saying that my deficit is everyone else’s surplus without a lot more context. After all, if we did this then we could run around posting silly charts like this one showing corporate debt and trying to imply that corporate debt is always good or always needs to be expanding. Sure, this might be partly true, but it’s not something we should lazily throw around.

(This is a stupid chart without a lot more context)

2) Who is “our”? The worst part about this chart’s depiction in MMT circles is the implication that the government is somehow an external entity. For instance, in his basic primer on MMT, Randall Wray says “Net private financial wealth equals public debt.” But Wray’s comment is true in only the most misleading context. For instance, ALL financial assets net to zero (including the government’s). The only thing we have left after netting all of this is non-financial assets. We all save, borrow and grow our wealth against other sectors. There are literally millions of individual sectors in the economy. All of these sectoral assets and liabilities net to zero so it’s misleading to strip out one sector and imply that this is the sector supplying all the savings. That’s simply not how it works at an aggregate level.

For instance, let’s say we have no government yet, no monetary system yet and a community that wants to build a bunch of homes to live in. So we write up a bunch of debt contracts that can be used as forms of money to pay for the way we’ll build a bunch of homes. Let’s pretend that I make all these debt promises to pay other people so I take out loans and pay workers to build 5 houses. When we’re all done I have a bunch of debt (and 5 homes) and the workers have saved the money I paid them. In the MMT world we are no better off despite the fact that the workers have saved money and I now have a bunch of houses. Sure, our financial assets and liabilities net to zero, but we have real non-financial assets. We are, empirically, better off despite the fact that our financial assets net to zero.

So, in the MMT world you need Comrade Wray to come in and convince us all that we need a Home Owners Association so we can then have “net financial assets”. So we form a HOA and the HOA borrows money to make silly rules and they spend some of that money to make pretty signs posting the rules and the sign maker saves some of that income. Of course, the HOA is, in essence, the liability of its home owners because they’re the ones who are on the hook to make sure that the debt the HOA has can be funded and expanded if necessary. The HOA can create “net financial assets” that add to someone’s financial wealth, but at the aggregate level the HOA’s liabilities are every home owner’s liability even if those liabilities are depicted on the HOA’s balance sheet (after all, it is the home owners who are responsible for running, managing and sustainably funding the HOA). So, at the aggregate level all of these financial assets net out and the home owners aren’t necessarily better or worse off after the HOA has been formed unless you think pretty signs with silly rules are a net benefit to society.

In the MMT world the HOA is the government and we need an ever expanding HOA to make sure that the home owners all save enough. But the problem is that the HOA is effectively a liability of the home owners just like the government is effectively a liability of the people who form it. Sure, we might be better off with the HOA. I am certainly not saying that all government is bad. Not even close. But imagine creating an entire economic school around the idea that the HOA is the center of the housing community and that we absolutely rely on the HOA at all times to advance our community’s well-being. It’s a ludicrously incomplete depiction of how the world actually works.

Anyhow, I am building an actual house that isn’t in a HOA and I am getting zero government assistance during the process so I should probably get outside and get back to work creating actual non-financial wealth.

(Check out my non-financial assets!)