[unable to retrieve full-text content] – by New Deal democrat The JOLTS survey parses the jobs market on a monthly basis more thoroughly than the headline employment numbers in the jobs report. It also is a slight leading indicators for both initial jobless claims and unemployment; and for forecasting wage growth as well. Like many other statistics concerning jobs, the […] The post JOLTS report for October: continuing trend of deceleration has begun to pose a problem...

Read More »JOLTS report for September shows continued deceleration in almost all metrics, now close to a cause for concern

[unable to retrieve full-text content] – by New Deal democrat The JOLTS survey parses the jobs market on a monthly basis more thoroughly than the headline employment numbers in the jobs report. For several years, my mantra for a lot of statistics has been “deceleration.” Well, in the case of the employment market, we have passed the point where deceleration […] The post JOLTS report for September shows continued deceleration in almost all metrics, now close to a...

Read More »April JOLTS report: firming in hires, quits, and a (good) decline in layoffs, while “fictitious” job openings continue their slide

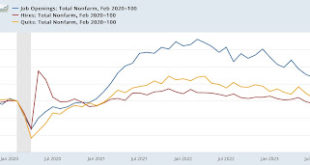

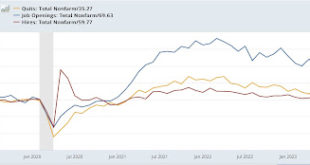

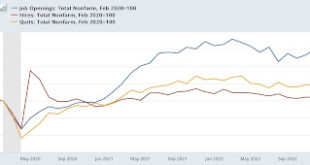

– by New Deal democrat The JOLTS report for April showed most metrics rebounding slightly from March lows, with the exception of the “soft data” job openings. The overall picture is that hiring is weak relative to the past five years, but so are layoffs, and voluntary quits are equally relatively strong, balancing them out. To wit: job openings (blue in the graph below), a soft statistic that is polluted by imaginary, permanent, and trolling...

Read More »March JOLTS report: declines in everything, fortunately including layoffs

– by New Deal democrat After almost half a year of general stabilization, or very slow deceleration, the JOLTS report for March featured multi-year lows in almost all of its components. Job openings (blue in the graph below), a soft statistic that is polluted by imaginary, permanent, and trolling listings, declined -325,000 to a three year low of 8.488 million. Actual hires (red) declined -281,000 to 5.500 million, the lowest level since the...

Read More »February JOLTS report: soft landing-ish? – except for a noisy jump in layoffs

– by New Deal democrat The Bonddad Blog The JOLTS report for February showed stabilization or slight improvement to all but one of its components, generally suggesting, well, stabilization in the overall jobs market. Starting with the monthly changes, job openings (blue in the graph below), a soft statistic that is polluted by imaginary, permanent, and trolling listings, increased 8,000 from a sharply downwardly revised January number to...

Read More »New Year, same old labor market deceleration

New Year, same old labor market deceleration – by New Deal democrat This morning’s JOLTS report for November continued the same trend of labor market deceleration that we have seen since the blazing hot boom of 2021. Job openings declined -62,000 to 8.790 million, the lowest level since March 2021. Actual hires fell sharply, by -363,000 to 5.465 million, the lowest since the pandemic lockdown month of April 2020. Quits declined by -157,000...

Read More »August JOLTS report: a pause in deceleration, but the trend remains intact

August JOLTS report: a pause in deceleration, but the trend remains intact – by New Deal democrat Last month I concluded my post on the July JOLTS report’s sharp declines by noting that “None of these statistics move in a straight line, so it would be a mistake to project this report’s relatively big moves forward. But the trend clearly remains in place.”This month’s report for August showed that was the case, as all of the major metrics...

Read More »May JOLTS report: continued decelerating trend, but still extremely positive

May JOLTS report: continued decelerating trend, but still extremely positive – by New Deal democrat Let me start out with the statement that has been my touchstone for the JOLTS report for the last year or more: for the last several years, the jobs market has been a game of “reverse musical chairs,” where there are always more chairs than participants. Those employers whose chairs weren’t filled had to increase their wage and/or...

Read More »March JOLTS report shows labor market about halfway to pre-pandemic normalization

March JOLTS report shows labor market about halfway to pre-pandemic normalization – by New Deal democrat The title of this piece is an important to clue the relative nature of this morning’s Job Openings and Labor Turnover report for March. For the last several years, the jobs market has been a game of “reverse musical chairs,” where there are always more chairs than participants. Those employers whose chairs weren’t filled had to increase...

Read More » Heterodox

Heterodox