– by New Deal democrat The Bonddad Blog The JOLTS report for February showed stabilization or slight improvement to all but one of its components, generally suggesting, well, stabilization in the overall jobs market. Starting with the monthly changes, job openings (blue in the graph below), a soft statistic that is polluted by imaginary, permanent, and trolling listings, increased 8,000 from a sharply downwardly revised January number to 8.756 million, over -100,000 lower than where we thought we were in January. Actual hires (red) rose 120,000 from a slightly upwardly revised January to 5.818 million. Voluntary quits (gold) rose 38,000 to 3.484 million from a slightly downwardly revised January. In the below graph, they are all normed to a

Topics:

NewDealdemocrat considers the following as important: Hot Topics, Jolts Report, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

The JOLTS report for February showed stabilization or slight improvement to all but one of its components, generally suggesting, well, stabilization in the overall jobs market.

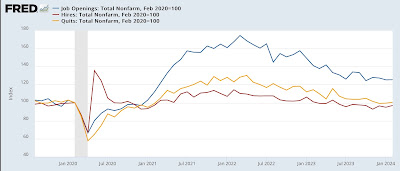

Starting with the monthly changes, job openings (blue in the graph below), a soft statistic that is polluted by imaginary, permanent, and trolling listings, increased 8,000 from a sharply downwardly revised January number to 8.756 million, over -100,000 lower than where we thought we were in January. Actual hires (red) rose 120,000 from a slightly upwardly revised January to 5.818 million. Voluntary quits (gold) rose 38,000 to 3.484 million from a slightly downwardly revised January. In the below graph, they are all normed to a level of 100 as of just before the pandemic:

All of these are slightly off their lows from the last quarter of 2023. Perhaps most significantly, while quits are 0.7% higher than they were at the beginning of 2020, actual hires are still -3.0% below the level they were at just before the pandemic hit.

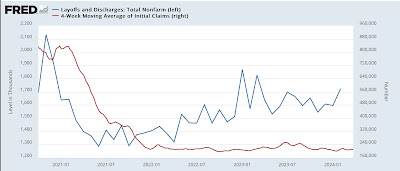

Meanwhile, for the month layoffs and discharges (blue in the graph below) rose sharply, by 128,000 to an 11 month high of 1.724 million:

This is out of sync with the recent decline in more timely, and leading, weekly initial jobless claims (red, right scale). This is likely just noise, but it certainly helps explain last month’s jump in the unemployment rate.

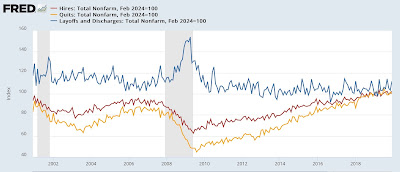

For a more historical perspective, the below graph norms the rates of hires, quits, and layoffs and discharges to 100 as of this month’s readings, and shows their record in the 20 years before the pandemic:

This shows that actual hires and quits remain at levels better than at any time in the 20 years prior to the pandemic except for 2018-19. And layoffs and discharges are lower than almost any time during that pre-pandemic period.

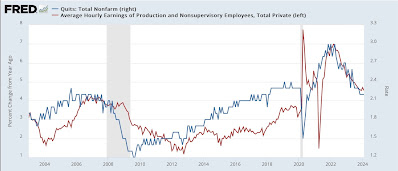

Finally, I have noted for a number of months now, since the quits rate (blue in the graph below, right scale) tends to lead average hourly earnings (red), it is worth noting that although the quits rate did not decline in February, it remans at its lowest level in 6 years, thus suggesting that the trend of deceleration is continuing:

This implies that average hourly earnings, which tied its post-pandemic low on a YoY basis in February, will likely decelerate further in coming months, if not necessarily this Friday.

December JOLTS report: while hiring has weakened, firing (and quitting) continue to show a strong labor market, Angry Bear by New Deal democrat