New Year, same old labor market deceleration – by New Deal democrat This morning’s JOLTS report for November continued the same trend of labor market deceleration that we have seen since the blazing hot boom of 2021. Job openings declined -62,000 to 8.790 million, the lowest level since March 2021. Actual hires fell sharply, by -363,000 to 5.465 million, the lowest since the pandemic lockdown month of April 2020. Quits declined by -157,000 to 3.471 million, the lowest since February 2021. The below graph norms each to 100 as of right before the onset of the pandemic: Both hires and quits are actually *lower* than before the pandemic. While this isn’t recessionary, it points to the normalization of each metric at very least. Since

Topics:

NewDealdemocrat considers the following as important: Hot Topics, Jolts Report, November 2023, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

New Year, same old labor market deceleration

– by New Deal democrat

This morning’s JOLTS report for November continued the same trend of labor market deceleration that we have seen since the blazing hot boom of 2021.

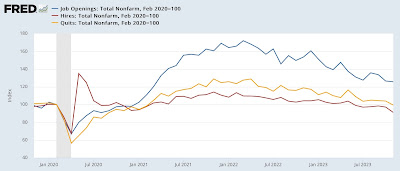

Job openings declined -62,000 to 8.790 million, the lowest level since March 2021. Actual hires fell sharply, by -363,000 to 5.465 million, the lowest since the pandemic lockdown month of April 2020. Quits declined by -157,000 to 3.471 million, the lowest since February 2021. The below graph norms each to 100 as of right before the onset of the pandemic:

Both hires and quits are actually *lower* than before the pandemic. While this isn’t recessionary, it points to the normalization of each metric at very least. Since openings are a “soft” number that can be influenced by phantom postings, I discount them somewhat, except for their value in showing the trend.

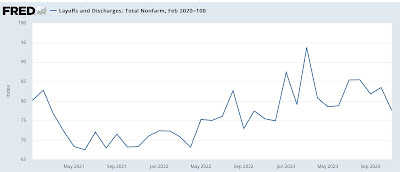

The good news in November was that layoffs also declined sharply, by -116,000 to 1.527 million. This is in accord with the decline in weekly initial jobless claims we have recently seen:

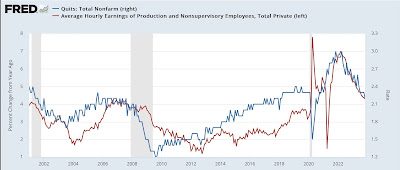

Finally, four months ago I premiered a comparison of the quits rate (blue in the graph below) and average hourly earnings (red). This is because the former has a 20+ year history of leading the latter, which I have in the past described as a “long lagging” indicator that turns well after most other metrics. Here’s the update on that comparison for this month:

As noted above, we had a big decline in quits in November. While this may in part be a seasonal adjustment issue post-pandemic, it does point to a continued softening in the YoY% gains we can expect in average hourly wages in the months ahead.

So: simply put – more deceleration, but still positive vs. recessionary.

October JOLTS report: yet one more month in the ongoing decelerating trend – Angry Bear, By New Deal democrat