Original thoughts The 30 year anniversary of the stabilization plan that controlled high inflation in Brazil, the so-called Real Plan, just passed earlier in July. I wanted to write something about it, but it got buried with other things. Here just some very short reflections. There was a huge coverage in the media and several new books and papers written about it, including by several of the actual participants of the stabilization plan. If I have to leave one impression beyond the...

Read More »On central bank independence, and Brazilian monetary policy

The issue is back in the news. This time in Brazil (it was briefly an issue here when Trump did not reappoint Yellen, and then complained about Powell's interest rate where too high). At any rate, I always thought that there were good reasons for skepticism about central bank independence (CBI). As noted by Massimo Pivetti in this old piece on the Maastricht Accord and the, at that time, plan for the euro, the main reason to be doubtful is related to the interaction of monetary policy and...

Read More »Lara-Resende and MMT in the Tropics

So André Lara-Resende, who I discussed here before, is again writing on the crisis of macroeconomics (in Portuguese and you might need to have a subscription), and now instead of embracing the Fiscal Theory of the Price Level (FTPL), has supposedly embraced Modern Money Theory (MMT). Many US MMTers cheered this as a demonstration of the reach of MMT in other countries. I would be less cheerful.Lara-Resende, let me explain to non-Brazilian readers, was a student of Lance Taylor at MIT, and...

Read More »Latin American Corner: Neo-Fisherism, New Keynesianism and monetary policy in Latin America (I)

By Naked Keynes (Guest Blogger)*Since the 2000s, like other countries in the region, Brazil adopted inflation targeting. The results are not encouraging. Brazil has, without doubt, the highest interest rate levels of Latin American economies. Brazil also has probably the widest interest rate spread in the region. In the first months of 2017, the monetary policy rate stood at 12.25%. Available data for interest rates for the year 2016 show that the deposit rate is around 12.43%, while the...

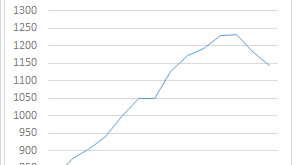

Read More »Lara-Resende, Cochrane and the Brazilian Recession

GDP has collapsed by a bit more than 7% in real terms over the last two years in Brazil (graph below show more recent data). This constitutes the worst crisis in recorded macroeconomic history, worse than the debt crisis of the early 1980s, and even the Great Depression. The reasons for this crisis are entirely self-inflicted. I discussed those issues before here (and here). The problem is not fiscal, which resulted from the crisis, nor external, since there was no real issue in financing...

Read More » Heterodox

Heterodox