The issue is back in the news. This time in Brazil (it was briefly an issue here when Trump did not reappoint Yellen, and then complained about Powell's interest rate where too high). At any rate, I always thought that there were good reasons for skepticism about central bank independence (CBI). As noted by Massimo Pivetti in this old piece on the Maastricht Accord and the, at that time, plan for the euro, the main reason to be doubtful is related to the interaction of monetary policy and fiscal policy. And as Quantitative Easing in the post-Global Financial Crisis has shown, central banks have become again fiscal agents of the state (never stopped being that, in all fairness).The other important reason alluded by Pivetti for doubting CBI is the effects of the interest rate on the

Topics:

Matias Vernengo considers the following as important: Brazil, Central Bank Independence, Cochrane, Fiscal Theory of the Price Level, Lara-Resende, MMT, Pivetti, Powell, Yellen

This could be interesting, too:

Matias Vernengo writes The behavior of the nominal exchange rate between the Brazilian Real and the dollar in 2024

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Matias Vernengo writes Very brief note on the Brazilian real and the fiscal package

Matias Vernengo writes 30 years of the Real Plan: Unoriginal Lessons from Latin American Stabilizations

The issue is back in the news. This time in Brazil (it was briefly an issue here when Trump did not reappoint Yellen, and then complained about Powell's interest rate where too high). At any rate, I always thought that there were good reasons for skepticism about central bank independence (CBI). As noted by Massimo Pivetti in this old piece on the Maastricht Accord and the, at that time, plan for the euro, the main reason to be doubtful is related to the interaction of monetary policy and fiscal policy. And as Quantitative Easing in the post-Global Financial Crisis has shown, central banks have become again fiscal agents of the state (never stopped being that, in all fairness).

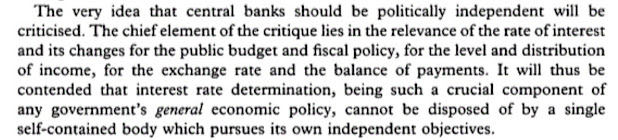

The other important reason alluded by Pivetti for doubting CBI is the effects of the interest rate on the exchange rate and balance of payments. This is a quote from Pivetti:

And one could add, through the exchange rate, the effects on inflation also matter. This can be illustrated by the discussion of the Brazilian case. Lula has been very critical of the policies of the Brazilian Central Bank (BCB), and of the higher interest rates, since the campaign last year, and some sort of a truce has been in the works, with him being less direct (or at least that has been reported).

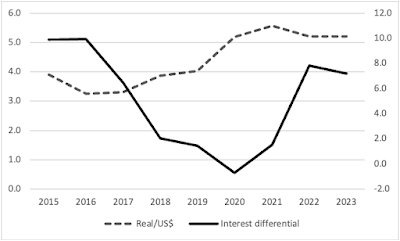

At any rate, the notion is that the higher interest rate is inimical to growth, even though Brazil did grow with relatively high interest rates in his first two mandates. The important thing to note is that Brazil had back then a relatively high and positive interest rate differential, that is a domestic nominal interest rates higher than the sum of external interest rate (the US rate) plus the risk premium (e.g. J.P. Morgan's Emerging Market Bond Index, EMBI), plus the expected nominal devaluation. In fact, as the interest rate differential (here just the difference of the BCB Selic rate, the Fed Funds plus the EMBI) was coming down, the exchange rate depreciated.

There is ample space to discuss how high the rate should be, but I'm doubtful that it can be close to zero or very low as suggested recently by André Lara Resende (that since my last post on his views, see here, has move away from Cochrane's fiscal theory of the price level, and closer to MMT; I just read his new book and that seems to be the case; on Cochrane's views on inflation see this video, also with John Taylor and Kevin Warsh).

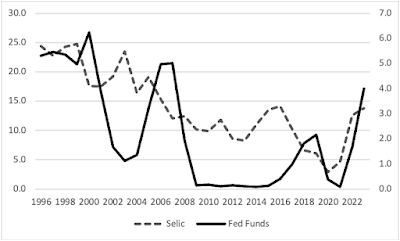

Below the BCB's Selic rate and the Fed Funds for a longer period, starting after the stabilization of the Real Plan in the 1990s.