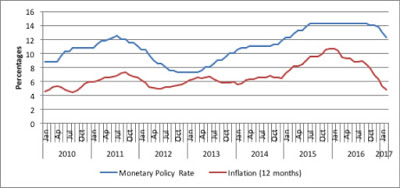

By Naked Keynes (Guest Blogger)*Since the 2000s, like other countries in the region, Brazil adopted inflation targeting. The results are not encouraging. Brazil has, without doubt, the highest interest rate levels of Latin American economies. Brazil also has probably the widest interest rate spread in the region. In the first months of 2017, the monetary policy rate stood at 12.25%. Available data for interest rates for the year 2016 show that the deposit rate is around 12.43%, while the lending rate nears, 50 %. In addition, between 2013 and 2016 the Central Bank steadily raised its monetary policy rate bringing it to the highest level in seven years. The stylized fact that is even more disturbing is that at least since the beginning 2010, the monetary policy rate is positively related to the rate of inflation (Figure 1). This stylized fact contradicts the very basis on which Brazil´s inflation target regime is founded and has sparked an important debate in monetary policy involving well known Brazilian economists including, among others, Lara Resende Eduardo Loyo, and Luiz Carlos Bresser-Pereira. At the conceptual level the debate centers around New Keynesianism and Neo-Fihserianism.

Topics:

Matias Vernengo considers the following as important: Brazil, Lara-Resende

This could be interesting, too:

Matias Vernengo writes The behavior of the nominal exchange rate between the Brazilian Real and the dollar in 2024

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Matias Vernengo writes Very brief note on the Brazilian real and the fiscal package

Matias Vernengo writes 30 years of the Real Plan: Unoriginal Lessons from Latin American Stabilizations

Since the 2000s, like other countries in the region, Brazil adopted inflation targeting. The results are not encouraging. Brazil has, without doubt, the highest interest rate levels of Latin American economies. Brazil also has probably the widest interest rate spread in the region. In the first months of 2017, the monetary policy rate stood at 12.25%. Available data for interest rates for the year 2016 show that the deposit rate is around 12.43%, while the lending rate nears, 50 %. In addition, between 2013 and 2016 the Central Bank steadily raised its monetary policy rate bringing it to the highest level in seven years.

The stylized fact that is even more disturbing is that at least since the beginning 2010, the monetary policy rate is positively related to the rate of inflation (Figure 1).

The inflation targeting framework is founded upon New Keynesian principles (rational expectations plus market rigidities) rests on three simple equations (in its reduced and essential form), aggregate demand and supply equations (IS and Phillips curve) and a Taylor rule. These are shown below.

(2) πt=f(Et(πt+i),Yg, vt), πt=inflation rate; Et=mathematical expectation formed in t.

(3) it=f(Et(πt+i), θπ πg, θY Yg, ut), where it=policy rate of interest, θπ,θY=policy parameters associated with the inflation and output gaps, and et, vt, ut are random errors, independently distributed with mean zero and constant variance.

The logic of the model is simple: an increase in the output gap brings about a rise in the rate of inflation (aggregate supply equation, (2)) which triggers an increase in the policy rate (Taylor rule, (3)) by the authorities and this reduces the output gap (aggregate demand, (1)). In turn, the reduction in the output gap narrows the inflation gap. Thus the model is stable.

However, stability (and uniqueness) require two conditions. First, it requires adding to the above three equation model, the Fisher equation ((4) rt=it-Et(πt+i)). Second it requires that the parameter on the inflation gap in the monetary policy reaction function (3) be greater than one (θπ>1). That is, when the inflation rate increases and is off target, the increase in policy rates should be greater than the rise in the inflation rate.

Only in this way can the nominal interest increase bring about a reduction in the output gap (aggregate demand equation). If θπ<1 a nominal increase in the rate of interest would not do the trick: aggregate demand responds only to variations in the real and not in the nominal rate of interest. Thus, within the logic of New Keynesianism the reason why the nominal policy rate and the inflation rate move positively together is due to the simple fact that Brazil has a “dovish” Central Bank (θπ<1).

* Naked Keynes is a generic name used for bloggers that for professional reasons must remain anonymous