By Marc Chandler (this post first appeared on Marc to Market) There is nothing quite like a falling dollar to spur take of the erosion of the greenback’s reserve status. There has been talk for several months that China is preparing in yuan-denominated oil contract (with an embedded gold option). It has not been launched yet, but some observers see it as a blow to the dollar’s role. We are...

Read More »Bond yields and helicopters

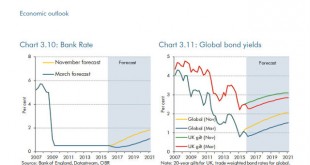

The ever-optimistic OBR has some encouraging forecasts for interest rates and global government bond yields: Well, ok, they were rather more encouraging in November than they are now. The uplift was supposed to start ANY DAY NOW, but there has been an interruption to normal service. Leaves on the line, perhaps. Or the wrong sort of snow.The trouble is, the OBR has a long record of hockey-stick forecasting. Not that it is unique in having a noticeable bias to the upside: If ever there were...

Read More »Asset allocation in a period of wealth mean reversion

In-depth analysis on Credit Writedowns Pro. Should FIFAA Be Red-Carded? Absolute Return Letter, November 2015 “When I want your opinion, I will give it to you.” Samuel Goldwyn No, I haven’t gone bonkers – the focus of the Absolute Return Letter has not all of a sudden switched to football. Nor have I lost the ability to spell correctly, although I am sure that there are one or two like-minded readers out there who would also like to see the rear side of Sepp Blatter one final time....

Read More »Jensen: How long bonds could actually outperform equities

In-depth analysis on Credit Writedowns Pro. Editor’s note: This was originally published by Absolute Return Partners in late August. So we are a little late in releasing it. Apologies. It is still good reading. The Absolute Return Letter, August/September 2015: Doodles from an eventful summer “There is something deeply troubling when the unthinkable threatens to become routine.” Bank for International Settlements Incidents of the summer 2015 This month’s Absolute Return Letter is a...

Read More »GDP transactions in secondary markets

There is a widespread view that much bank lending is unproductive, i.e. does not raise GDP – or if it does, it does so in an unsustainable way by inflating asset prices or increasing inflation, rather than by increasing production. Many proposals for bank reform therefore envisage restricting banks to “productive” lending, by which usually seems to be meant business finance and short-term consumer credit. Financial transactions on secondary markets, and the purchase of second-hand...

Read More »China’s stock markets and revisiting 2011 predictions

In-depth analysis on Credit Writedowns Pro. By Michael Pettis originally written on 31 Jul 2015 I plan to post a new entry very soon but before doing so I wanted to say a few things about the stock markets, which continue to be insane (but not unexpectedly so) and then repost a blog entry that is nearly five years old. By the time I published my latest (July 17) blog entry Beijing had managed to stop the panic with the use of what I called “brute force”, by which I meant that there was...

Read More »Are bond investors crying wolf?

In-depth analysis on Credit Writedowns Pro. You are here: Markets » Are bond investors crying wolf? The Absolute Return Letter, June 2015 By Niels Jensen To me, consensus seems to be the process of abandoning all beliefs, principles, values and policies. So it is something in which no one believes and to which no one objects.” Margaret Thatcher Investment heavyweights challenge the consensus On a regular basis I challenge the consensus. It is part of my nature, I suppose, but it comes at...

Read More » Heterodox

Heterodox