Read More »

Michael Roberts Blog MMT 2 – the tricks of circulation

Confused. Michael Roberts needs to read more of the MMT primary literature if he wants to critique MMT in any detail. Nevertheless, MMT starts with the conviction that it is the state (not capitalist commodity relations) that establishes the value of money. Not quite.MMT starts with the observation of Warren Mosler that under the current monetary system, a contemporary sovereign currency is a public monopoly, with the currency issuing government acting as the people's representative —...

Read More »Stephanie Kelton — The Wealthy Are Victims of Their Own Propaganda–To escape higher taxes, they must embrace deficits.

Grow the pie within public investment for public purpose rather than shrinking it through austerity or dividing the size of the pieces it differently through redistribution. Having your cake and eating it too. I would add that it is still necessary to address economic rent and its social and political effects. The reason this is so hard to do is that America is a plutocracy. The institutions are rigged. Bloomberg OpinionThe Wealthy Are Victims of Their Own Propaganda–To escape higher...

Read More »Cullen Roche — MMT–The Good, the Bad and the Ugly

Cullen has said all this previously in blog posts, and he summarizes his take in this one. His views have been addressed previously at MNE.Pragmatic CapitalismMMT – The Good, the Bad and the UglyCullen Roche

Read More »Kevin Muir — EVERYTHING YOU WANTED TO KNOW ABOUT MMT (BUT WERE AFRAID TO ASK)

If you read only one MacroTourist post all year, this is the one I want you to read. I think it’s that important.... Throwing in the towel. I agree with Ben that MMT will change the type of inflation the economy experiences. I will leave it to much smarter people than I to decide if this is a good or bad thing. In the meantime, in the coming months, quarters and years, watch for MMT to become a much larger source of change for your portfolio and trading. You might think it’s great and that...

Read More »Peter May — MMT as nonsense economics – or not

Richard Murphy has always said that MMT supporters do not properly understand tax and Jonathan Portes seems to me, on the evidence of this article, to fall into the same category. What Jonathan Portes misses is that the ‘financial constraints’ are self-imposed. It’s bad enough – in reality – being short of teachers, nurses and doctors. But having bogus self imposed financial constraints is just – well – self imposed.Finance is man made. Jonathan Portes, as a former Treasury civil servant,...

Read More »An American Budget

By J.D. ALT Let’s imagine pulling together a group of enlightened economic planners to create an American budget for, say, the years 2020-2024. What might they come up with? To begin with, how might they even go about thinking about how to create an American budget? It’s not so obvious as, for example, the way the Congressional Budget Office might go about it. The CBO would begin by tallying up how much money America’s government will have to spend in the years 2020-2024. Then they’d...

Read More »Jonathan Portes — Nonsense economics: the rise of modern monetary theory

Poorly argued. Economics professor Jonathan Portes admits that the fundamentals of MMT about operations are correct, and that MMT economists recognize that the financial constraint on fiscal deficits is inflation. Then he concludes that it is obvious that MMT cannot work since the real constraint is available resources and government spending uses resources instead of creating them. So, over time, inflation cannot be avoided other than by increasing taxes, that is, limiting the deficit by...

Read More »Ben Wray — 5 big ‘rock the boat’ ideas the indy movement could take from Alexandria Ocasio-Cortez

MMT for Scotalnd. Scotland for MMT.Common Space5 big ‘rock the boat’ ideas the indy movement could take from Alexandria Ocasio-Cortez Ben Wray

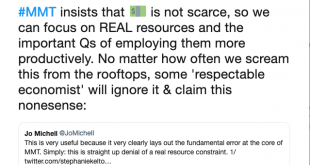

Read More »More MMT “criticism”

Confuses QE (monetary policy) with fiscal injection (fiscal policy). Can't get much more wrong than that. Moreover, confuses the monetary in a monetary production economy with production of goods. The author is ill-informed and not qualified to speak on this topic. Fail.GoldSeekModern Monetary Theory: A Cargo Cult Keith Weiner, Monetary MetalsSee also Another straw man argument that makes stuff up. Well, not so much. Furman and Summers: “Although politicians shouldn’t make the debt their...

Read More » Heterodox

Heterodox