This article was cross-posted from Labour List where it was published on the 14th January, 2021.Labour has a steep hill to climb to regain the public’s confidence that it can be trusted to manage the economy. I get that. And Labour has to recover from a catastrophic electoral defeat – a defeat that took place under the leadership of the left.So, given past failures, how does Labour rebuild confidence? The first requirement, in my view, is for Labour to listen to, and trust the public. Their...

Read More »How does Labour rebuild trust on the economy? Listen to the public

This article was cross-posted from Labour List where it was published on the 14th January, 2021. Labour has a steep hill to climb to regain the public’s confidence that it can be trusted to manage the economy. I get that. And Labour has to recover from a catastrophic electoral defeat – a defeat that took place under the leadership of the left. So, given past failures, how does Labour rebuild confidence? The first requirement, in my view, is for Labour to listen to, and trust the public....

Read More »How does Labour rebuild trust on the economy? Listen to the public

This article was cross-posted from Labour List where it was published on the 14th January, 2021.Labour has a steep hill to climb to regain the public’s confidence that it can be trusted to manage the economy. I get that. And Labour has to recover from a catastrophic electoral defeat – a defeat that took place under the leadership of the left.So, given past failures, how does Labour rebuild confidence? The first requirement, in my view, is for Labour to listen to, and trust the public. Their...

Read More »Reconciling IS-LM and endogenous money

This post was sparked by conversations with people who have opposing views of how money creation works. Some people think that classical models such as IS-LM don't work with endogenous money theory, therefore the models need to be discarded: others think that there's nothing wrong with the model and the problem is endogenous money theory. Personally I think that simple models like IS-LM can be powerful tools to explain aspects of the working of a market economy, and it behooves us therefore...

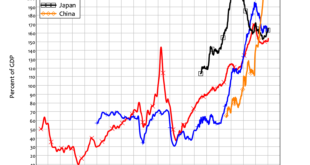

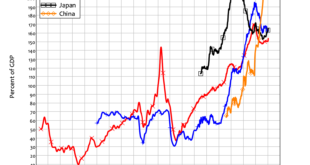

Read More »To save the climate – don’t listen to mainstream economists

Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one.Figure 1: Private debt levels over the history of capitalismLooking forward to the next ten years, and given so...

Read More »To save the climate – don’t listen to mainstream economists

Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one. Figure 1: Private debt levels over the history of capitalism Looking forward to the next ten years, and given...

Read More »To save the climate – don’t listen to mainstream economists

Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one.Figure 1: Private debt levels over the history of capitalismLooking forward to the next ten years, and given so...

Read More »The Fiscal Deficit, Modern Monetary Theory and Progressive Economic Policy

Modern Monetary Theory or MMT has crept in from the academic margins to become an influential doctrine in progressive policy circles in the United States. Both Elizabeth Warren and Bernie Sanders drew on the ideas of MMT to shape their ambitious public spending platforms. MMT has been cited as one way to fund a Green New Deal, in combination with progressive tax reform. It is safe to say that most Canadian progressives are not debating the finer points of monetary and...

Read More »The Fiscal Deficit, Modern Monetary Theory and Progressive Economic Policy

Modern Monetary Theory or MMT has crept in from the academic margins to become an influential doctrine in progressive policy circles in the United States. Both Elizabeth Warren and Bernie Sanders drew on the ideas of MMT to shape their ambitious public spending platforms. MMT has been cited as one way to fund a Green New Deal, in combination with progressive tax reform. It is safe to say that most Canadian progressives are not debating the finer points of monetary and...

Read More »The Reserve Bank’s Pandemic Predicament

by Lekha Chakraborty and Harikrishnan S As the Reserve Bank of India Governor Shri Shaktikanta Das puts it upfront, these are extraordinary times, and we need to respond with “whatever it takes” to deal with the pandemic. Over the past few days, our hope for systematically “flattening the curve” by containing the COVID-19 pandemic and moving to a quick V-shaped or U-shaped recovery is waning[i]. Evidence is increasingly pointing towards the situation worsening to a dual crisis — a...

Read More » Heterodox

Heterodox