There is a huge amount of hysteria about government debt and deficits, not just in the UK but throughout much of the world. As I write, Brazil has been downgraded by Standard & Poors because of concerns about rising government debt and weakening commitment to primary fiscal surpluses in a context of political uncertainty and deepening recession. It is the latest in a long line of downgrades and investor flight over the last few years. The global economy is a very stormy place.The UK,...

Read More »The real purpose of central banks

One of the things that has emerged from the PQE debate is a suggestion that it is time to consider ending the Bank of England's inflation-targeting mandate. Unfortunately this got mixed up with calls for ending the operational independence of the Bank of England (Richard Murphy), or abolishing central banks (Bill Mitchell, stated in response to a question at Reframing the Progressive Agenda).What we might call the "twin peaks" approach to macroeconomic policy-setting has been adopted the...

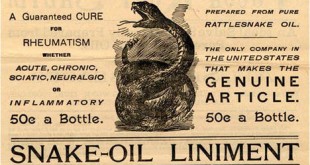

Read More »Monetary Snake Oil

Guest post by Paddy Carter. Jeremy Corbyn’s People’s QE offers the alluring prospect of spending more without borrowing more. Which is just the ticket, if you want to replace austerity with largesse, and cut the deficit to boot. Sadly, this appealing miracle cure is pure snake oil (although there is, perhaps, a version of the idea which might be helpful, if substantially less miraculous). The basic idea behind People’s QE is to finance public spending by printing money. This is actually...

Read More »Grexit: The staggering cost of central bank dependence

In-depth analysis on Credit Writedowns Pro. By Charles Wyplosz originally posted at Vox on 29 Jun 2015 This weekend’s dramatic events saw the ECB capping emergency assistance to Greece. This column argues that the ECB’s decision is the last of a long string of ECB mistakes in this crisis. Beyond triggering Greece’s Eurozone exit – thus revoking the euro’s irrevocability – it has shattered Eurozone governance and brought the politicisation of the ECB to new heights. Bound to follow are...

Read More »The Euro Glut: The Summer 2015 Update

Deutsche Bank's George Saravelos was one of the first to use the term "euro glut". He anticipated a massive capital outflow from Europe that countered the huge European current account surplus. The Euro glut also led to the end of the EUR/CHF peg. Reasons are missing investment opportunities in Europe despite the high savings rate.

Read More »Are bond investors crying wolf?

In-depth analysis on Credit Writedowns Pro. You are here: Markets » Are bond investors crying wolf? The Absolute Return Letter, June 2015 By Niels Jensen To me, consensus seems to be the process of abandoning all beliefs, principles, values and policies. So it is something in which no one believes and to which no one objects.” Margaret Thatcher Investment heavyweights challenge the consensus On a regular basis I challenge the consensus. It is part of my nature, I suppose, but it comes at...

Read More »Rising Sight Deposits at SNB Means Rising SNB Debt

Money creation and sight deposits may have two points of view: 1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions 2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions. We will present both alternatives.

Read More » Heterodox

Heterodox