[unable to retrieve full-text content]NY Fed: Mortgage Originations by Credit Score, Delinquencies Increase, Foreclosures Remain Low; Calculated Risk Newsletter The NY Fed released the Q3 Quarterly Report on Household Debt and Credit this morning. Here are three charts from the report. The first graph shows mortgage originations by credit score (this includes both purchase and refinance). Look at the difference in credit […] The post NY Fed: Mortgage Originations by...

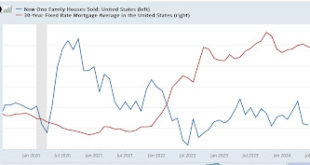

Read More »7%+ mortgages weigh on new home sales, while prices continue slight downtrend, and inventory uptrend

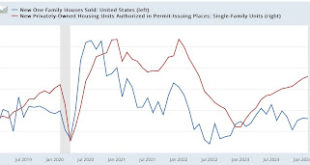

– by New Deal democrat Now that we have new as well as existing home sales, let’s take a little more extended look at the housing sector. Let me start by reiterating the big picture: mortgage rates lead sales, which in turn lead prices. Further, new home sales are the most leading of all housing metrics, but they are noisy and heavily revised. The much less noisy single family permits lag them slightly. Finally, we are looking for relative...

Read More »As mortgage rates remain rangebound, so do new home sales

– by New Deal democrat Let’s begin this post by putting why I am watching new home sales in context. The economy was kept out of recession last year, despite aggressive Fed rate hikes, in large part by commodity price deflation, much or most of which was triggered by the un-kinking of supply chains after the pandemic. That gale force economic tailwind is gone, but the Fed rate hikes remain. So, the big question for this year is whether the...

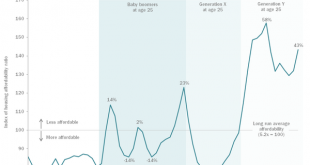

Read More »Don’t blame the boomers

From Joe Sarling's blog comes this a lovely chart showing housing affordability by cohort since 1955: As can be seen, the current generation of young people - Generation Y - faces paying a far higher proportion of their incomes in mortgages or rent than any previous cohort. This does not, of course, take into account the considerable price difference between London and everywhere else: if London were excluded, I suspect their position would not look quite so dire. Nonetheless, this chart is...

Read More » Heterodox

Heterodox