Share the post "Are Individual Bonds Safer than Bond Funds?"The WSJ was out with a piece discussing outflows from DoubleLine’s Total Return Bond fund this week. One of the reasons for the outflows was cited as the lack of safety in a bond fund:Among those bailing are individual investors, who helped fuel the fund’s growth but can be quicker than institutions to pull their funds when performance lags. Barney Rothstein, a retired orthodontist in Tucson, Ariz., withdrew $250,000 from the fund...

Read More »Indexing isn’t Just for Quitters

Share the post "Indexing isn’t Just for Quitters"* Sorry for the brief hiatus. Life got in the way and I had to take some time off. All is better now in case anyone cares. Here’s a good interview in Barrons with James Montier of GMO. But a few things really irked me about the interview. This is unusual for me since Montier is among the very best thinkers on Wall Street. Here’s the snippet that most intrigued me:Barron’s: Bonds are expensive, stocks are expensive. What’s an asset allocator...

Read More »The Biggest Myths in Investing

Share the post "The Biggest Myths in Investing"The following ten posts include some of the biggest myths in the investing world. I hope you find them educational and informative. If you finish this and feel ultra nerdy you might enjoy my post on the Biggest Myths in Economics.¹Myth #1 – The “Investing” MythMyth #2 – The Stock Market Is Where You Get RichMyth # 3 – You Need To Beat The MarketMyth # 4 – Indexing is AverageMyth # 5 – Bonds Lose Value if Rates RiseMyth # 6 – Gold is a Good...

Read More »The Biggest Myths in Investing, Part 9 – Risk Is Something we Can Quantify

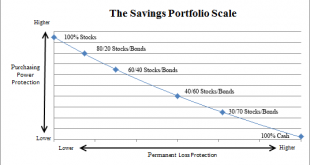

Share the post "The Biggest Myths in Investing, Part 9 – Risk Is Something we Can Quantify"This is the ninth instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. The idea of risk is a...

Read More »Repeat After me: “Bonds Don’t Necessarily Lose Value When Rates Rise”

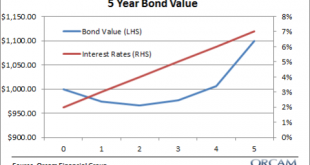

Share the post "Repeat After me: “Bonds Don’t Necessarily Lose Value When Rates Rise”"If you take a basic finance course the first thing you learn about bonds is that bond prices are inversely correlated to interest rates. So, when rates rise bonds prices fall and vice versa. This idea is so ingrained into people’s heads that it seems to have become the only thing that anyone can remember about bonds. And in today’s low interest rate environment this thinking is usually applied as...

Read More »Why The US Government Should NOT Refinance the National Debt with Longer Bonds

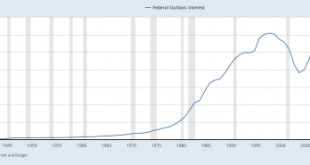

Share the post "Why The US Government Should NOT Refinance the National Debt with Longer Bonds"With a change in the US Treasury Secretary soon taking place I get to play fantasy world and imagine how I would handle the transition if I were nominated.¹ One of the common ideas these days is that we should be “refinancing” government debt and “locking in” low rates. Soon to be Treasury Secretary Steven Mnunchin recently said:“we’ll look at potentially extending the maturity of the debt because...

Read More »How Do Indexers Do Better Than Average?

Share the post "How Do Indexers Do Better Than Average?"One of the more common investing myths is the idea that indexing is necessarily “average”.¹ It makes sense at first. If you bought all of the stocks in the market then you’d generate the average return. It would be like playing fantasy football and picking all of the players in the NFL. You would lose more often than not because there is no way you’re going to beat the team that has Tom Brady, Adrian Peterson, Antonio Brown or, well,...

Read More »Indexing is the Result of Homogeneous Markets, not the Cause

Share the post "Indexing is the Result of Homogeneous Markets, not the Cause"As indexing strategies gain in popularity I am seeing a common selling point from active stock picking fund managers – the idea that more indexing creates more opportunity for active managers. This appears correct on the surface. After all, if everyone started using index funds then this would create a homogeneous set of product wrappers that cannot accurately reflect the underlying companies.¹ But this myth gets...

Read More »The Myth of Declining American Living Standards

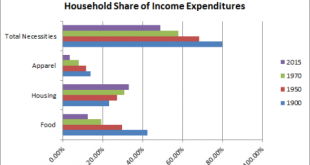

Share the post "The Myth of Declining American Living Standards" One of the running themes of this website over the last 6 years is the idea that the US economy is not doing nearly as well as it should be, however, that it’s also not doing nearly as bad as some people would have us believe. Unfortunately, whenever I publish something like the recent post on the solvency of the USA I get a lot of pushback from people arguing that American living standards are in some sort of terminal...

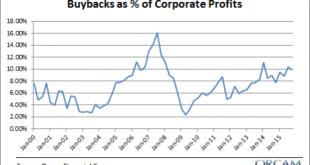

Read More »Myth Busting: Stock Buybacks aren’t Propping up the Stock Market

Share the post "Myth Busting: Stock Buybacks aren’t Propping up the Stock Market" There has been a good deal of concern about stock buybacks in recent years ranging from concerns that buybacks are a poor allocation of resources to the idea that buybacks are propping up the stock market. Today we’ll investigate the idea that stock buybacks are the primary source of elevated stock prices. A recent piece in Bloomberg stated: Buybacks are helping prop up a bull market that is entering its...

Read More » Heterodox

Heterodox