Stephanie's new book is available for preorder. It should be a game-changer.The blurb reads, "Deficits can be used for good or evil." "Evil?" Probably few people know that German economic development post Weimar and rearmament in preparation for WWII was engineered under Adolph Hitler by Hjalmar Schacht, head of the Reichsbank (German central bank). Hitler is often associated with the Weimar Republic that destroyed the Deutsche mark (DM). Nothing could be further from the truth. Under...

Read More »Hard Truths for the Inflation Truthers

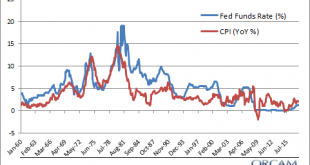

The main goal of this website over the years has been to search for an operationally sound and empirically supported perspective of how the monetary system works. I’ve debunked tons of myths in the process of this search, but the inflation truthers have been hard to convince for some reason. Strangely, there are still people out there who believe that the BLS lies about inflation stats and that all the data is manipulated. But I have some hard truths for the inflation truthers. Hard truth...

Read More »Is This The Worst Thing The WSJ Has Ever Published?

Well, I thought that 2018 had to be peak stupidity for humanity, but we are not off to a good start in 2019. I opened the Wall Street Journal this morning to find this article which has a falsehood in every single paragraph. 10 for 10. Let’s review this impressive mess. First, the title, “The Fed’s Obama-Era Hangover” is just catchy politics. The Fed is an independent entity and President Obama had nothing to do with the policies enacted by the Fed, but the entire article disparages...

Read More »Debunking Passive Investing Myths on Bloomberg TV

(The fabulous Scarlet Fu and Eric Balchunas, hosts of ETF IQ)Here’s my appearance from yesterday on ETF IQ on Bloomberg TV in case you missed it. We touched on: 1) Why is the myth of passive investing important to understand? Short answer, but the longer-than-tv answer: passive has become a misnomer as anyone can construct an index fund in an active strategy and then claim to be “passively” tracking that index via an ETF. It’s easy to fall into the trap that passive is good and active is...

Read More »5 Questions and Answers on “Passive” Investing, Part Deux

Here’s part two of the Q&A on passive investing. If you haven’t read part 1 it will be helpful to do that first since I laid out the necessary definitions and foundation for a clear discussion. I answered Marks’ first question about passive investing in the first post, but as it was running a little long I didn’t get to the next four. So let’s bang those out: Question 2: “What are the implications of passive investing for active investing?” Marks goes on to specifically ask: “what...

Read More »5 Questions and Answers on “Passive” Investing

If you have read my 2012 essay on “The Myth of Passive Investing” then you probably don’t need or want to read what’s below. If there’s a consistent theme on this website it’s that I am trying to establish a consistent taxonomy and set of understandings of financial concepts so that people can better navigate the monetary world we live in. Sadly, finance and economics is filled with words that are used in such a general manner that they have virtually no meaning. For instance, the word...

Read More »The Difference Between Asset Price Inflation & Consumer Price Inflation

One of the more common responses to the fact that inflation is low is the idea that the inflation is all in asset prices. So, for instance, if someone were to say that all the Fed’s post-crisis stimulus didn’t result in inflation you might look at stock prices and argue that the price increases all flowed into stocks. That’s not necessarily wrong, but I think it needs to be well understood because asset price inflation is generally good for the economy while consumer price inflation could...

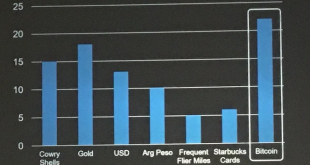

Read More »Why Bitcoin Will Never Be the Dominant Form of Money

The ultimate dream of the crypto currency enthusiasts is for money to become decentralized and essentially removed from the hands of banks and Central Banks who can “manipulate” it for their own benefit. This is a nice thought, but most of it is based on misunderstandings about what “money” is. Let me explain. I was browsing Twitter this weekend when I ran across this post that was being retweeted by a bunch of the top crypto enthusiasts: When banks stored all our money, the bankers...

Read More »2 Annoying Myths About Low Rates

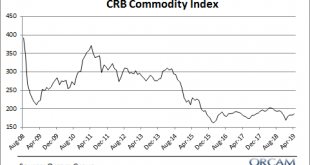

* – This is an updated post from 2015 that remains relevant. There’s usually two forms of ideological rhetoric that accompany low interest rates. The first is that the Fed has “manipulated” interest rates lower. And the second is that the Fed is “punishing savers”. These myths have scared people away from stocks and bonds and left them frozen in cash or worse, chasing commodities and gold. So let’s take a look at each of these ideas because some clarity might help put things in a more...

Read More »Are Individual Bonds Safer than Bond Funds?

Share the post "Are Individual Bonds Safer than Bond Funds?"The WSJ was out with a piece discussing outflows from DoubleLine’s Total Return Bond fund this week. One of the reasons for the outflows was cited as the lack of safety in a bond fund:Among those bailing are individual investors, who helped fuel the fund’s growth but can be quicker than institutions to pull their funds when performance lags. Barney Rothstein, a retired orthodontist in Tucson, Ariz., withdrew $250,000 from the fund...

Read More » Heterodox

Heterodox