Share the post "Why Equity Outperforms Credit" In my new paper on asset allocation I go into quite a bit of detail about why certain asset classes generate the returns they do. Understanding this is useful when thinking in a macro sense and trying to gauge why financial assets perform in certain ways in both the short-term and the long-term. It’s important to understand the fundamental drivers of these returns in order to avoid falling into the trap that these assets generate returns due...

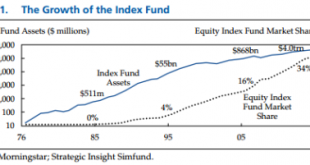

Read More »Is Indexing Just Another Wall Street Fad?

Share the post "Is Indexing Just Another Wall Street Fad?" Here’s an interesting comment from value investor Seth Klarman on the rise of indexing (this is from 1991!): Klarman is obviously biased because he’s in the business of selling a high fee asset management platform. If indexing is right then his form of highly active alpha chasing asset management is wrong. This is basically what Bill Ackman was saying when he lashed out against indexing earlier this year. Anyhow, I think Klarman...

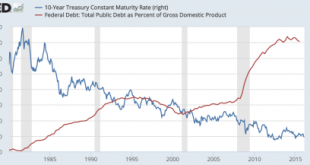

Read More »Let’s Talk About the US Government’s Interest Burden

Share the post "Let’s Talk About the US Government’s Interest Burden" Greg Ip had a piece in the Wall Street Journal yesterday discussing the debt burden in the USA and how low interest rates have “moved back” the “hands on the doomsday debt clock”. The article touches on the important topic of entitlement spending and whether it’s sustainable, but does so in a manner that misleads readers about why this might be a problem. For instance, Ip says that “higher federal borrowing puts upward...

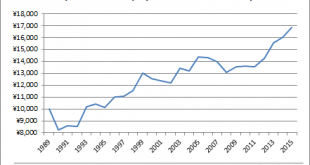

Read More »The Importance of Global Asset Allocation – Japan Edition

Share the post "The Importance of Global Asset Allocation – Japan Edition" I’m a big fan of owning a global equity market portfolio consistent with something resembling the Global Financial Asset Portfolio (though, I would also add that this portfolio isn’t necessarily ideal).¹ If you’re a US investor this has looked like a pretty silly idea in the last few years as foreign stocks have been poor performers in relative terms. Despite this short-term performance there is widespread...

Read More »Dear Hedge Funds: Index Funds Didn’t Eat Your Returns

Share the post "Dear Hedge Funds: Index Funds Didn’t Eat Your Returns" Indexing strategies have been the fastest growing segment of the asset management world in the last 15 years due to low fees, tax efficiency, diviersification and the failure of higher fee active managers to justify their higher fees. As this trend plays out we’re hearing more and more stories about how this trend is bad for investors and how we need these old high fee active managers to better manage the asset space....

Read More »5 Big Macro Myths

Share the post "5 Big Macro Myths" James Montier of GMO wrote a wonderful piece earlier this week that I am just getting around to posting. Pragcap readers will really enjoy it as it covers a lot of ground that I’ve been harping on for years now. James discusses 5 big macro myths that just won’t die including: Myth 1: Governments are like households Myth 2: Printing money to finance budget deficits is inflationary Myth 3: Budget deficits/high debt lead to high interest rates Myth 4:...

Read More »The Money Multiplier and the Myth that Just Won’t Die…

Share the post "The Money Multiplier and the Myth that Just Won’t Die…" Almost every single mainstream economic textbook teaches some version of the money multiplier theory of banking. In short, this is the view that $1 of central bank reserves allows a bank to make $10 of loans or something like that. The basic premise works from the causation that Central Banks control the money supply. Of course, as I’ve explained many times before, this is completely backwards. Banks make loans by...

Read More »Why No One Should Support the Gold Standard

Share the post "Why No One Should Support the Gold Standard" The gold standard is silly. No one should be in favor of going back to it. Here’s why: The Gold standard does not create “Sound Money” policy. One of the biggest myths about the Gold Standard is that it will create “sound money” policies that won’t allow the government to debase the currency. History shows this is totally wrong. A gold standard does not restrict the government from devaluing the currency. Over the course of...

Read More »What If Everyone Indexed?

I see this question more and more as indexing grows in popularity. People generally think that more indexing will make the markets function less efficiently . I don’t think this is true at all. Unfortunately, the question and its answers are usually shrouded in misunderstandings about how assets are priced and myths about what it means to invest “passively”. So, let’s think about this from an operational perspective. An index fund is not really an “index”. They are portfolios managed...

Read More »Tobin’s Q Is Not a Valid Market Timing Metric

Over the course of the last seven years many market pundits have relied on Tobin’s Q to argue that the stock market is overvalued and I’ve argued that the indicator is misleading (see here for a sampling of the many predictions made with this metric). And then today I noticed this piece on MarketWatch arguing that the stock market could fall 70% because Tobin’s Q says the market is overvalued. That’s very scary so let’s explore this some more. First, what is Tobin’s Q? Tobin’s Q was a...

Read More » Heterodox

Heterodox