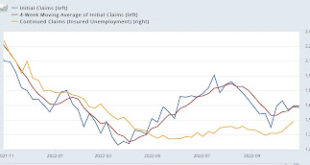

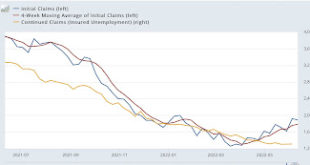

Jobless claims: steady as she goes by New Deal democrat [ Special programming note: yesterday’s Fed action, and more important the statements made afterward, merit special attention. I will put up a special post on that later today.] Initial jobless claims remained at their recent low level, down -1,000 from one week ago to 217,000. The 4 week average declined -500 to 218,750. Continuing claims, which lag slightly, rose 47,500 to a 7 month...

Read More »Despite increase in openings, the decelerating trend of reverse musical chairs remains intact

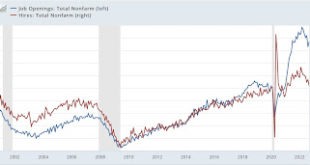

September JOLTS report: despite the increase in openings, the decelerating trend in the game of reverse musical chairs remains intact – by New Deal democrat In 2021 and earlier this year, the jobs market was typified by a game of reverse musical chairs in which there were more chairs (available jobs) than players (job seekers). As a result, employers had to increase wages in order to attract workers to their openings. But since this left other...

Read More »Manufacturing, construction, and job openings all show an economy under stress

Manufacturing, construction, and job openings all show an economy under stress – by New Deal democrat As usual, we begin another month with important manufacturing and construction data. Additionally, the JOLTS report for September was also released. The ISM manufacturing index has a very long and reliable history. Going back almost 75 years, the new orders index has always fallen below 50 within 6 months before a recession, and in three...

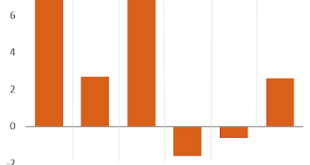

Read More »Q3 GDP: good news for now, bad news for the future

Q3 GDP: good news for now, bad news for the future – by New Deal democrat I have to keep this note brief, since I am on the road. As you presumably already know, real GDP was positive for the Third Quarter, up 2.6% at an annual rate: Subject to revisions in the next several months of course, but for the moment, this puts to rest ideas that the US economy was in a recession earlier this year, since the decline was very shallow and not...

Read More »The Treasury yield curve has now almost totally inverted

The Treasury yield curve has now almost totally inverted – by New Deal democrat One of the few leading indicators not flashing red for recession has been the short end of the Treasury yield curve, which has been relentlessly positive – until now. While the 10 year minus 2 year Treasury spread has been negative for months, the 10 year minus 3 month had remained positive. But twice in the last two weeks the 3 month Treasury has yielded more...

Read More »New Deal democrat’s weekly indicators for October 17 – 21

Weekly Indicators for October 17 – 21 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. If you thought the long leading indicators couldn’t get any worse – well, they could. As usual, clicking over and reading will bring you up to the virtual moment as to how the economy is doing right now, and how it is likely to perform over the next 12 months+. “New Deal democrat’s Weekly Indicators for October 10 – 14,” Angry Bear...

Read More »September jobs report: positive report within a framework of continued deceleration

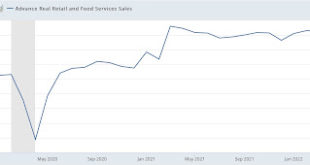

September jobs report: a very positive report within a framework of continued deceleration As I have written many, many times, consumption leads employment; and the near stagnation in real sales and spending signaled that we should expect weaker monthly employment reports, with both fewer new jobs and a higher unemployment rate. In September, the former happened; the latter did not. The three month average in employment gains since February...

Read More »Weekly Indicators for August 15 – 19 at Seeking Alpha

Weekly Indicators for August 15 – 19 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The continued decline in gas prices has been doing some nice things to other indicators as well. Meanwhile, manufacturing as measured by the regional Feds is getting worse. As usual, clicking over and reading will bring you fully up to date, and reward me just a little bit for my efforts. ...

Read More »The increasing trend in new jobless claims continues

The increasing trend in new jobless claims continues Initial jobless claims declined -3,000 to 229,000 last week, vs. the 50+ year low of 166,000 set in March. The 4 week average also rose 2,750 to 218,500, compared with the all-time low of 170,500 ten weeks ago. Continuing claims rose 3,000 to 1,312,000, or 6,000 above their 50 year low of 2 weeks ago: It’s now clear that initial claims have been in an uptrend over the past 2.5 months. If...

Read More »Negative May and YoY real retail sales add to the foreboding signals of a recession next year

Negative May and YoY real retail sales add to the foreboding signals of a recession next year Nominal retail sales for the month of May declined -0.3%, and April was revised down by -0.2% to +0.7%. This reduces April’s number, after inflation to +0.4%, followed by a “real” decline in May of -1.2% after rounding. YoY real retail sales were up 8.1%, but because inflation in the past 12 months has been 8.5%, real retail sales YoY is down -0.4%. Here...

Read More » Heterodox

Heterodox