One of Keynes’s central tenets — in clear contradistinction to the beliefs of mainstream economists — is that there is no strong automatic tendency for economies to move toward full employment levels in monetary economies. Money doesn’t matter in mainstream macroeconomic models. That’s true. But in the real world in which we happen to live, money does certainly matter. Money is not neutral and money matters in both the short run and the long run.... "New Keynesianism" isn't Keynesian. It...

Read More »REVIEW ESSAY–The Reformation in Economics: A Deconstruction and Reconstruction of Economic Theory by Philip Pilkington Marc Morgan

Book review.American Affairs REVIEW ESSAY–The Reformation in Economics: A Deconstruction and Reconstruction of Economic Theory by Philip Pilkington Marc Morgan | research economist at the World Inequality Lab of the Paris School of Economics.

Read More »‘Fridays for Keynesianism’ — Peter Bofinger

Excellent summary of the recognition of the classical fallacy by Keynes, what followed, and why neoclassical economics is proving so difficult to dislodge even though it has been discredited. Note: This is not the only fallacy that plays a part in neoclassical assumptions. The fallacy of composition is another, as Keynes also observed.Social Europe'Fridays for Keynesianism' Peter Bofinger | Professor of Economics at Würzburg University and a former member of the German Council of Economic...

Read More »Three Economic Ideas Threatening to Defenders of the Status Quo — Peter Cooper

1. Profit as surplus labor or as a property-based claim One idea threatening to the defenders of the status quo is the recognition that profit income reflects capitalist property relations rather than productive contribution.… 2. Capitalist economies are demand constrained The Keynesian or Kaleckian principle of effective demand may not seem quite such a hindrance to defenders of the status quo as knowledge of the nature of profit, but the motivation for its denial – at least in the...

Read More »Brian Romanchuk — Why Doesn’t The Government Impose Taxes In Chickens?

Silly question? Brian is responding to someone who asserted that in effect government does. Actually, it used to be that government confiscated property to move it to government use, but that is no longer considered "proper," unless the police do it on other pretexts. In a monetary production economy, taxes are payable in "money," that is, the government's currency. What David Andolfatto apparently means is that one's purchasing power declines as a result of taxation, which is true....

Read More »Michael Roberts — Pluralism in economics: mainstream, heterodox and Marxist

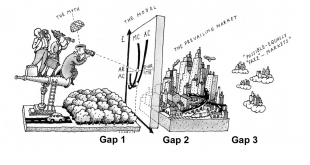

So it was great that I had been invited to present the case for the contribution of Marxist economics, along with Carolina Alves, the Joan Robinson fellow at Girton College, Cambridge. In my presentation (see my PP here The contribution of Marxian economics), I outlined the differences in theory and policy, both micro and macro between mainstream neoclassical economics, the heterodox alternatives (Keynesian, post-Keynesian, institutional and Austrian) and the Marxist. I see this as three...

Read More »The Unreal Basis of Neoclassical Economics

By Al Campbell, Ann Davis, David Fields, Paddy Quick, Jared Ragusett and Geoffrey Schneideroriginally posted hereIntroduction Ten years after the financial crisis, we still find mainstream economists engaging in overly simplistic analysis that does not accurately capture the dynamics of the real world. People studying economics need to know that the principles of mainstream economics are hopelessly unrealistic. In this short article, we demonstrate that the ten principles of...

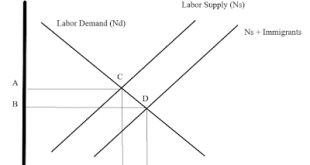

Read More »A primer on the economics of immigration: a surplus approach perspective

This is definitely not my topic of research. So you may very well ask why would I venture to wrote about it, beyond the obvious reason that it is probably one of the most debated issues these days in the US, with the government shutdown being related to the now infamous wall. I am myself twice an immigrant, I descend from immigrants (my parents returned to their country of origin, but had emigrated, and on my mother side my grandfather was also an immigrant, and the same goes on my father's...

Read More »Bill Mitchell — The ‘fiscal contraction expansion’ lie lives on – now playing in Italy – Part 1

Pathetic was the first word that came to mind when I read this article – The Italian Budget: A Case of Contractionary Fiscal Expansion? – written by Olivier Blanchard and Jeromin Zettlemeyer, from the Peter Peterson Institute for International Economics. Here is a former IMF chief economist and a former German economic bureaucrat continuing to rehearse the failed ‘fiscal contraction expansion’ lie that rose to prominence during the worst days of the GFC, when the European Commission and the...

Read More »Lars P. Syll — Kalecki and Keynes on the loanable funds fallacy

Banks are not intermediaries between savers and borrowers, and finance is not allocating existing savings to future investment. The opposite is true. Bank credit is self-funding; in credit extension, loans (assets) create deposits (liabilities). In finance as allocation of capital, investment creates saving.Lars P. Syll’s BlogKalecki and Keynes on the loanable funds fallacyLars P. Syll | Professor, Malmo University

Read More » Heterodox

Heterodox