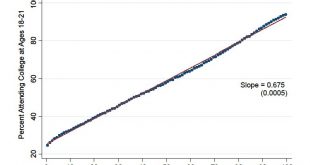

All societies need a grand narrative to justify their inequalities. In contemporary societies, the focus is on the meritocratic narrative. Modern inequality is just because it is the outcome of a process which is freely chosen in which each individual has the same opportunities. The problem is that there is a yawning gap between the official meritocratic declarations and the reality. In the United States, the chances of acceding to higher education are almost entirely determined by...

Read More »Democratising Europe begins with ECB nominations

This collective op-ed was initially published on January 22 2018 in Le Monde (in French) and in VoxEurop (in English). While our eyes are glued to the interminable vicissitudes of the German Groko, a no less important story is playing out in Brussels, but has so far met with indifference. On January 22nd and February 19th, Eurogroup finance ministers will hold private meetings that will mark the beginning of a profound renewal of the European Central Bank executive board. The first...

Read More »2018, the year of Europe

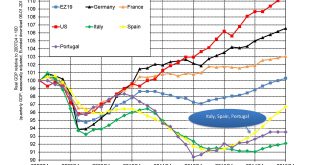

Ten years after the financial crisis, will the year 2018 see Europe making a great leap forward? Several factors contribute to this view, but the outcome is far from certain. The crisis in 2008, which triggered the sharpest global recession since the 1929 crisis, clearly originated in the increasingly obvious weaknesses of the American system: excessive deregulation, an explosion in inequalities, indebtedness of the poorest. Supported by a more equalitarian and inclusive model of...

Read More »Trump, Macron: same fight

It is customary to contrast Trump and Macron: on one hand the vulgar American businessman with his xenophobic tweets and global warming scepticism; and on the other, the well-educated, enlightened European with his concern for dialogue between different cultures and sustainable development. All this is not entirely false and rather pleasing to French ears. But if we take a closer look at the policies being implemented, one is struck by the similarities. In particular, Trump, like...

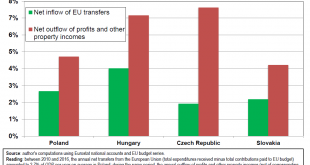

Read More »The Catalan syndrom

Is the crisis in Catalonia due to over-centralization and the intransigeance of the authorities in Madrid? Or is it instead due to generalized competition between regions and countries rivalling with each other, each pursuing their own interests, a process which has already gone much too far both in Spain and in Europe? Let’s take a step backwards. To explain the tougher pro-independence stand, reference is often made to the decision by the Spanish constitutional tribunal in 2010 to...

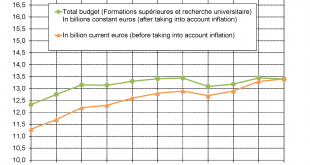

Read More »Budget 2018: French youth sacrified

To date the debate on the 2018 budget in France has concentrated on the question of tax gifts to the most wealthy. De facto, the abolition of the wealth tax and the measures in favour of top dividends and interests will cost the State budget over 5 billion euros. But it is also important to insist on the other side of the coin, in other words the losers in the 2018 budget and, in particular, on the young people sacrificed as a consequence of the fall in student expenditure per capita...

Read More »Suppression of the wealth tax: an historical error

Let it be said at once: the suppression of the wealth tax (Impôt sur la Fortune or ISF) constitutes a serious moral, economic and historical mistake. This decision reveals a profound misunderstanding of the challenges to inequality posed by globalisation. Let’s go back for a moment. During the first globalisation period between 1870 and 1914, a strong international movement gradually took shape which sought to promote a new type of redistribution and taxation. Based on a progressive...

Read More »Re-thinking the capital code

Partager cet article What should we think of the reform of the Labour Code defended by the government? The key measure, and also the one which is most highly criticized, consists in capping the compensation payments for unfair dismissal at one month’s salary per annum per year of seniority (and half a month for each year worked beyond 10 years). In other words, an employer can freely dismiss an employee who has spent over 10 years in the firm, without having to establish the...

Read More »The CICE comedy

Yet another deferral! The government of Emmanuel Macron and Edouard Philippe had already announced the postponement of the deduction of income tax at source till 2019 for totally opportunist reasons. The risk is that this elementary reform in tax modernisation, awaited in France for decades, may finally never see the light of day, even though the scheme was all ready to come into operation in January 2018. The government has now announced the postponement until 2019 of the replacement...

Read More »Reagan to the power of ten

Partager cet article Is Trump a UFO in American history or can he be seen as the continuation of long-term trends? While we have no desire to deny “Donald’s” obvious specificities, including his inimitable art of the tweet, we do have to admit that elements of continuity prevail. The tax agenda which he has just tabled in Congress is eloquent. It can be summed up in two central measures: reduction of federal income tax on corporate profits from 35% to 15% (a rate which Trump...

Read More » Heterodox

Heterodox