The consumer may finally be faltering – by New Deal democrat At this point I think the “smart” econ take is that either any recession is very much delayed, or even not going to happen at all. While everything is possible, I’ve argued in several places that if you date a potential business cycle peak to January of this year, the data doesn’t look so rosy. To wit, below is a graph with all of the main monthly data series the NBER has said it...

Read More »The Fed still seems determined to bring about a recession

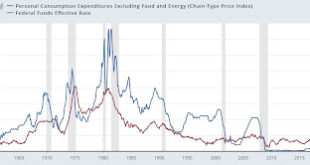

The Fed still seems determined to bring about a recession – by New Deal democrat As I wrote on Saturday, several coincident indicators have stabilized in the past several months (for example, Redbook consumer sales, which has been at roughly 5% YoY for 8 weeks; and payroll tax withholding, which was only up 1.2% YoY for the last 4 months of 2022, but is up 4.7% YoY for the first 9 weeks of this year). This has led to increased speculation that...

Read More »Credit conditions in Q4 were recessionary

Credit conditions in Q4 were recessionary – by New Deal democrat While we are still in our lull concerning monthly data, on Monday there was a significant update of one long leading indicator that is only reported Quarterly: the Senior Loan Officer Survey. This survey has an excellent history of over 30 years telling us about credit conditions. Loosening of credit, and an increase in demand for credit means expansion ahead. Credit tightening...

Read More »Index of leading indicators says recession almost certain; so what of the coincident indicators?

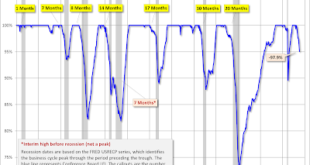

Index of leading indicators says recession almost certain; so what of the coincident indicators? – by New Deal democrat This week is one of those where almost all of the important data is crammed into one day – in this case, Thursday, when Q4 GDP, initial claims, real manufacturng and trade sales, durable goods orders, and new home sales will be reported all at once. In the meantime, you may have heard that yesterday the Index of Leading...

Read More » Heterodox

Heterodox