The Fed still seems determined to bring about a recession – by New Deal democrat As I wrote on Saturday, several coincident indicators have stabilized in the past several months (for example, Redbook consumer sales, which has been at roughly 5% YoY for 8 weeks; and payroll tax withholding, which was only up 1.2% YoY for the last 4 months of 2022, but is up 4.7% YoY for the first 9 weeks of this year). This has led to increased speculation that the US will avoid an economic downturn, and maybe even avoid a slowdown altogether. But unless the Fed changes its perspective, I find it difficult to see that happening. First of all, Fed Chairman Jerome Powell as well as other Board members have expressed concern about the continued elevated level

Topics:

NewDealdemocrat considers the following as important: Featured Stories, politics, Recession 2023, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

The Fed still seems determined to bring about a recession

– by New Deal democrat

As I wrote on Saturday, several coincident indicators have stabilized in the past several months (for example, Redbook consumer sales, which has been at roughly 5% YoY for 8 weeks; and payroll tax withholding, which was only up 1.2% YoY for the last 4 months of 2022, but is up 4.7% YoY for the first 9 weeks of this year). This has led to increased speculation that the US will avoid an economic downturn, and maybe even avoid a slowdown altogether.

But unless the Fed changes its perspective, I find it difficult to see that happening.

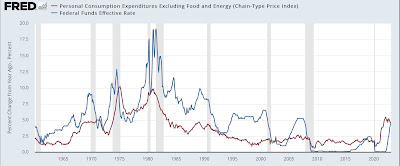

First of all, Fed Chairman Jerome Powell as well as other Board members have expressed concern about the continued elevated level of inflation in their favorite metric, the “sticky” price index for core PCE’s. Here’s the long term historical view of that in comparison with the Fed funds rate:

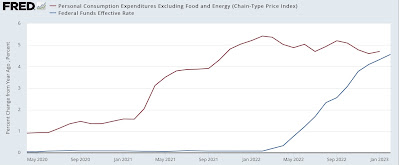

And here is the close up since the end of the pandemic recession:

For most of the past 60+ years, the Fed funds rate was higher than core PCE inflation. While that wasn’t the case for most of the last 15 years, it is certainly the case that the 5%+ difference during 2021 was the most by which PCE core inflation exceeded the Fed funds rate. Given the historical comparisons, the Fed probably feels that they should hike at least another 0.50% so that the Fed funds rate at very least is equal to the inflation rate.

And as I’ve noted a number of times before, this is the steepest rate at which the Fed has hiked interest rates since 1982:

Only in 1974, 1980, and 1981 did the Fed hike rates more rapidly. Since it takes time for the effects of Fed rate hikes to spread through the economic system (for example, as I have recently pointed out, housing under construction is less than 1% below its all time record set in October), the downward pressure put on the economy from those rate hikes is far from abating.

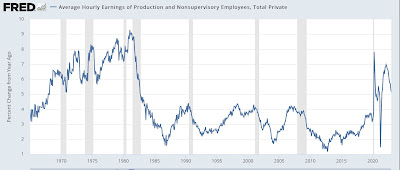

Further, some members of the Fed have been transparent that they want to see sharp deceleration in wage growth, which as of January was down from its 2021 peak of 7.0%, but still at 5.1% YoY, an extremely strong rate of gains compared with the last 40+ years:

In order to do that, they are going to have to bring the game of “reverse musical chairs” to an end. By this game I mean the cycle by which the lowest paying employers at any given time find themselves being unable to fill positions, leading to competition to escalate wages on offer, so as not to be the unlucky loser. So long as the cycle continues, there are always employer “losers,” and so ongoing pressure to continue to raise wages.

And that means bringing down the number of job openings compared with actual hires:

the latest number of which we will find out in Wednesday’s JOLTS report for January.

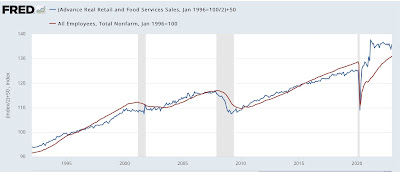

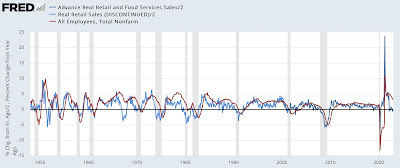

Another way of looking at the same thing is that the trend line of sales vs. employment, as to which the former has completely outperformed the latter since the rounds of pandemic stimulus:

must be brought back into equilibrium. Unless there is going to be a renewed surge in employment gains (*extremely* unlikely), that means bringing down real sales. And in the past, brining down real consumption has *always* meant recession:

Under these circumstance, I just can’t see how we can avoid a real downturn in consumption and employment.