RJS, MarketWatch 666, October’s Case–Shiller HPI; Advance Economic Indicators for November With the major month end reports already released last week, the only widely watched report released this week was the Case-Shiller Home Price Index for October from S&P Case-Shiller, which doesn’t even report any prices of homes, but just a index generated by averaging relative sales prices of homes that sold during August, September and October against...

Read More »“Multi-year lows for total crude supply and oil & products supply”

Commenter and Blogger RJS, Perspective: I (RJS) suspect some of the inventory pullback has to do with tax strategies, but we’ve had all this sitting near multiyear lows going in, so they’re worth noting. I checked googled, & I don’t see anyone else reporting these lows, even at sites like oilprice.com. They’re probably on deadlines to get their articles done, and don’t have time to check the spreadsheets. Strategic Petroleum: Reserve at...

Read More »Natural Gas Up, SPR same, Oil Supply Down, Gasoline Supplies Up

Commenter Blogger RJS Summary: Natural gas supplies above average for first time since April. Strategic Petroleum Reserve at a 19-year low. Total oil & products supplies near a 7-year low. Total oil supply falls by most in 25 weeks. Gasoline supplies jump most in 20 months. Distillate’s demand falls by most in 5 years. DUC wells in four basins are lowest on record. DUC backlog at 5.5 months is below pre-pandemic norm. DUC well report for...

Read More »November Durable Goods: New Orders up 2.5%

November Durable Goods: New Orders up 2.5%, Shipments Up 0.7%, Inventories Up 0.6%, MarketWatch 666, RJS The Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders for November (pdf) from the Census Bureau reported that the value of the widely watched new orders for manufactured durable goods increased by $6.5 billion or 2.5 percent to $268.3 billion in November, the 6th increase in seven months, after October’s new...

Read More »Record High in Producer Price Index and Other Market Indicators

Record 9.6% Annual Increase in November Producer Price Index; Record 6.9% YoY Increase in Core Prices; Record 7.1% YoY Increase for Final Demand Services, Record 14.9% Increase for Final Demand Goods, and a 46+ year Record for Prices of Intermediate Goods, RJS, MarketWatch 666 The seasonally adjusted Producer Price Index (PPI) for final demand rose 0.8% in November, as prices for finished wholesale goods rose 1.2% while margins of final services...

Read More »PPI, Core Prices, Demand Services and Goods Increase

November’s retail sales, industrial production, producer prices, & new home construction; October’s business inventories, Summary: Record 9.6% Annual Increase in November Producer Price Index; Record 6.9% YoY Increase in Core Prices; Record 7.1% YoY Increase for Final Demand Services, Record YoY 14.9% Increase for Final Demand Goods, and a 46+ year Record for Prices of Intermediate Goods The seasonally adjusted Producer Price Index (PPI)...

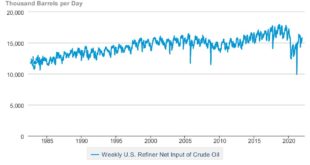

Read More »Oil Supplies at 83 Month Low, Demand at Record High

Total supplies at an 83 month low; total demand at a record high; distillates demand at 18+ year high; global shortage at 1,210,000 bpd, Focus On Fracking, RJS Strategic Petroleum Reserve approaching a 19 year low; oil + products supplies drop to an 83 month low; total oil product demand sets a record high, led by distillates demand at 18+ year high; global oil shortage at 1,210,000 barrels per day in November as OPEC output falls 563,000 barrels...

Read More »Oil Rebounds and SPR at another 18 – 1/2 year Low

Oil rebounds on Omicron optimism; SPR at another 18 1/2 year low as sales to Asian refiners begin, Focus of Fracking, RJS Not really much news this week; gasoline & distillate inventories continue to rebound from the lows, no big moves on prices or much else; the headline is almost contrived . . . the “sales to Asian refiners” came from an oil blogger who said we sold SPR oil to China and India. That information hasn’t been released...

Read More »CPI Up 0.8% in Nov. on Higher Prices for Food, Fuel, Shelter, Vehicles, and Airfare; Inflation at a 39 Year High

Blogger and Commenter RJS, MarketWatch 666, November’s consumer prices, October’s trade deficit, wholesale sales, and JOLTS The consumer price index rose 0.8% in November, as higher prices for food, energy, new and used vehicles, airline fares, and toys were only slightly offset by lower prices for information technology devices, hospital services and for vehicle insurance….the Consumer Price Index Summary from the Bureau of Labor Statistics...

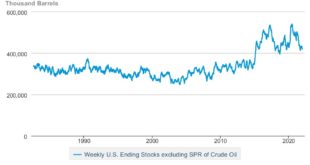

Read More »SPR at an 18-1/2 Year Low, Gasoline Supplies Up

Blogger RJS, Focus on Fracking, Strategic Petroleum Reserve is at an 18 1/2 Year Low; Gasoline Supplies Rose by Most in 22 Weeks on a 22 Week Low in Demand The Latest US Oil Supply and Disposition Data from the EIA Weekly U.S. Ending Stocks excluding SPR of Crude Oil (Thousand Barrels) (eia.gov) US oil data from the US Energy Information Administration for the week ending November 26th showed that after a switch of “unaccounted for crude...

Read More » Heterodox

Heterodox