Robert Mundell And Supply Side Economics The death of Nobel Prize winner Robert A. Mundell at age 88 has brought forth much discussion about his work and legacy. Most of this discussion, such as several columns by Paul Krugman, have commented favorably on the work for which he was officially given the prize, several papers he wrote in the late 1950s and early 1960s while he was at the IMF. These papers, drawing on the experience of his native...

Read More »The Tax Cuts and Jobs Act isn’t working and there’s no reason to think that will change — Hunter Blair

Didn't work before and didn't work this time. Hype.Economic Policy InstituteThe Tax Cuts and Jobs Act isn’t working and there’s no reason to think that will change Hunter Blair

Read More »Robert Waldmann — Optimal Taxation of Capital Income 2019 (let them Bern)

...the standard Judd 85/86 result that the optimal rate of taxation of capital income* goes to zero as time goes to infinity is what mathematicians call a boo boo (oopsie). The asserted theorem is false as explained by Ludwig Straub and Ivan Werning.… Angry BearOptimal Taxation of Capital Income 2019 (let them Bern) Robert WaldmannSee also * We just raised the federal tax rate on capital gains and dividends from 15 percent to 23.8 percent, but most economists say these tax rates should be...

Read More »Eric Schliesser — On Ibn Khaldun and Ronald Reagan (and a now obscure Belgian scholar)

Not particularly important unless you are interested in the history of economics, but it is interesting owing to the Reagan connection compared with post 9/11 Islamophobia.Digressions&ImpressionsOn Ibn Khaldun and Ronald Reagan (and a now obscure Belgian scholar)Eric Schliesser | Professor of Political Science, University of Amsterdam’s (UvA) Faculty of Social and Behavioural Sciences

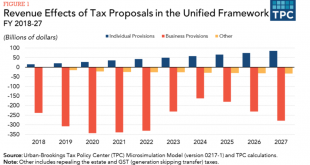

Read More »Bob Bryan — One chart shows why Trump could have big trouble getting his tax plan past some Republicans

Business InsiderOne chart shows why Trump could have big trouble getting his tax plan past some Republicans Bob Bryan

Read More »Trumponomics looks more and more like Voodoo Economics

Posting has been slow. Last weeks of classes and too many things to do. At any rate, this is the tax plan (below Trump's, above Laffer's infamous napkin plan; no big difference though). Nothing much to say. It's vague, as his campaign promises. The only certain thing is lower taxes for the wealthy. As I noted before, there is no big stimulus in his budget (the big infrastructure spending he promised), and most of the stimulus comes from tax cuts for corporations and the wealthy (which...

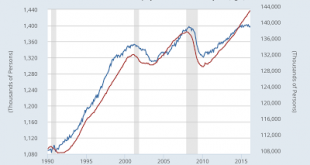

Read More »What’s the matter with Kansas?

In 2010 Tea Party favorite Sam Brownback was elected governor and he had Republican majorities in both houses of its legislature. The GOP program was put in place. What happened, you ask? The result of the GOP tax cuts is significantly lower employment growth than in the national economy. By the way, lower income tax and higher sales taxes, a very regressive tax policy, has led to a persistent overestimation of revenue, and tax shortfalls that led to spending cuts, which in part...

Read More » Heterodox

Heterodox