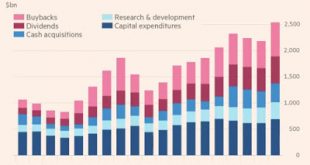

So it seems that a good chunk of the GOP/Trump tax cuts will go to buybacks, and to fuel the bubble in the stock market, according to Robin Wigglesworth in the FT (subscription required). Bad news for those that think that higher earnings lead to higher investment (meaning gross formation of capital). My impression is that if you want tax cuts to be stimulative, you should target consumption, in particular for lower income groups, which tend to spend a higher proportion of their income.

Read More »What About the New Tax Law?

New Event from the Susquehanna Progressives. Drop by if you're around the area. Info below. "As activists we need to understand the history of US tax policies, how they have changed since the 50's and why, the affect on our social fabric and what the new tax bill will mean for the health of our nation (Presentation followed by Q&A)."Presenter: Matías Vernengo, Professor of Economics, Bucknell UniversityThursday, February 22 | 7:00 - 8:30 PM Community Zone, Market Street in...

Read More »Alan Blinder on Fiscal Adjustment

Alan Blinder published recently two columns on the WSJ (here and here) on the need to exercise fiscal restraint. In both cases he complains that the fiscal deficit is too large. Note that he is not saying that this is always the case, he emphasizes that in the second and most recent piece. The reason, as always, is that we are close to full employment. In his words:"... today we are back at full employment, or perhaps beyond it, ad economic growth kooks solid. The economy doesn't need...

Read More »What Tax Plan? Sharmini Peries interviews Michael Hudson

TRNN's Sharmini Peries interviews Michael Hudson. Video and transcript.Michael HudsonWhat Tax Plan?Michael Hudson | President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City, and Guest Professor at Peking University

Read More »What’s the matter with Kansas?

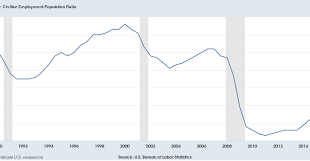

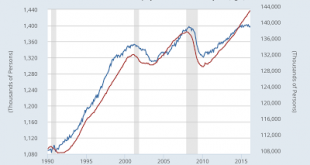

In 2010 Tea Party favorite Sam Brownback was elected governor and he had Republican majorities in both houses of its legislature. The GOP program was put in place. What happened, you ask? The result of the GOP tax cuts is significantly lower employment growth than in the national economy. By the way, lower income tax and higher sales taxes, a very regressive tax policy, has led to a persistent overestimation of revenue, and tax shortfalls that led to spending cuts, which in part...

Read More » Heterodox

Heterodox