Alan Blinder published recently two columns on the WSJ (here and here) on the need to exercise fiscal restraint. In both cases he complains that the fiscal deficit is too large. Note that he is not saying that this is always the case, he emphasizes that in the second and most recent piece. The reason, as always, is that we are close to full employment. In his words:"... today we are back at full employment, or perhaps beyond it, ad economic growth kooks solid. The economy doesn't need fiscal stimulus."Blinder one must note was strongly for hiking rates in the mid to late 1990s, when he was the vice chairperson at the Fed, exactly for the same reasons (see this old piece in The American Prospect). So at least he is coherent. We cannot grow too fast, since that would cause inflation. And

Topics:

Matias Vernengo considers the following as important: austerity, fiscal policy, Natural Rate, Neoliberalism, Tax cuts, WSJ

This could be interesting, too:

Angry Bear writes A Fiscal Policy in a Global Context?

Angry Bear writes Jim, this is nothing like before. These guys are ahead of us.

Nick Falvo writes Report finds insufficient daytime options for people experiencing homelessness

Matias Vernengo writes Podcast with about the never ending crisis in Argentina

"... today we are back at full employment, or perhaps beyond it, ad economic growth kooks solid. The economy doesn't need fiscal stimulus."

Blinder one must note was strongly for hiking rates in the mid to late 1990s, when he was the vice chairperson at the Fed, exactly for the same reasons (see this old piece in The American Prospect). So at least he is coherent. We cannot grow too fast, since that would cause inflation. And we have a tendency to be at full employment (note that a few years back almost everybody said full employment, the natural rate, was about 6%, not the 4% or so we have). But if he is coherent, he has also been almost always wrong.

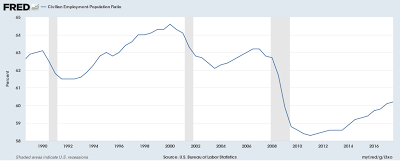

And we are not at full employment. The employment-population ratio (seen below) has finally started to recover in the last three years, but it is still well below the peak before the recession, and the participation rate (not shown but available here) has been stagnant.

Dems, and their economists (like Blinder), should be more sensible about the need to create more jobs, and particularly good jobs if they want to regain the White House and Congress. I would suggest that austerity is a terrible strategy. This is what you should expect from the Progressive-Neoliberal branch of the party, as it was aptly called by Nancy Fraser.