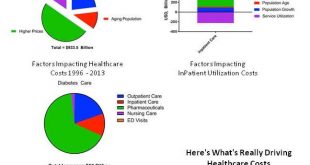

I have been doing my typical reading on healthcare in the US and ran across several articles which seemingly come together at various points in the dialogue and are written by different authors. I decided to tie them together into a much wider and telling story. An interesting point being was made by MedPage Today’s Dr. Milton Packer on his blog, “people suffer and die because Payors (Healthcare Insurance) is cost effective.” He starts his discussion on...

Read More »A Race To Suppress Academic Freedom?

A Race To Suppress Academic Freedom? The race is between the two nations competing for global dominance, the US and China. This post is triggered by an unnamed editorial in today’s Washington Post (probably authored by Fred Hiatt) criticizing China for imposing ideological limits on Chinese universities. Since the recent party congress, 40 universities have set up centers for studyiing Xi Jinping Thought. 14 universities have come under attack for...

Read More »The Leprechaun Long Run

The more people think about the Republican proposal to cut corporate taxes the worse it looks. Most people dismiss the argument that the benefits will trickle down to workers. Supporters’ argument is that reduced taxes on profits will cause increased investment which causes higher production and wages. There are strong arguments that the tax cut won’t cause firms to invest more. But aside from that, increased investment wouln’t cause (all) of the...

Read More »Proposing A Judicial Coup Via A Tax Bill

Proposing A Judicial Coup Via A Tax Bill On today’s Washington Post editorial page in a column entitled “Packing the courts like a turducken” (a deboned duck within a deboned chicken within a deboned turkey, or something like that, all for Thanksgiving, thank you), Ronald A. Klain not only reports on the actual push to pack courts with lots of young, incompetent extremists that is going on after Congress sat on judicial nominees by Obama in recent years,...

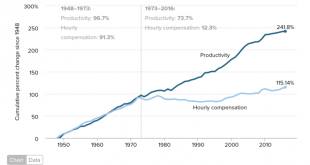

Read More »Productivity and wages

Another article from Jared Bernstein Washington Post: There’s an interesting sort of argument going on between Stansbury/Summers (SS) and Mishel/Bivens (MB). My name has been invoked as well, so I’ll weigh in. It’s a “sort-of” argument because there’s less disagreement than first appears. It all revolves around this chart, which plots to the real compensation of mid-wage workers against the growth in productivity. For years they grew together, then they...

Read More »…California’s Republican delegation boycotted a request for disaster funding for their own state.”

Lifted from comments reader Denis Drew: Donald Trump’s Response to Disaster Aid for California: Nothing Kevin DrumNov. 20, 2017http://www.motherjones.com/kevin-drum/2017/11/donald-trumps-response-to-disaster-aid-for-california-nothing/ “A few weeks ago, California requested $7.4 billion in disaster aid following the massive series of wildfires in the northern part of the state that killed 43 people and destroyed nearly 9,000 structures. Actually, let’s...

Read More »Trade deficits, offshoring jobs, Republican tax plan

Via Washington Post, Jared Bernstein writes: The Republican tax cut plan has been justly criticized for worsening both income inequality and the national debt, but the plan has another big problem: It’s likely to lead to more outsourcing of U.S. jobs and a larger trade deficit. That’s obviously a negative for factory jobs and net exports, but it’s also precisely the opposite of what Trump continues to promise to many of his working-class supporters....

Read More »More on why so many parents lose under the TCJA

Ernie Tedeschi writes: As a followup to my post earlier this morning, I’ve created a table below detailing how each policy in the TCJA affects the number of parental families in 2027 seeing a tax hike. Using refined policy parameters that have been added to the OSPC model since yesterday, I find that under the TCJA as written, 22 million families with children would see a tax hike in 2027 versus current law. This includes the indirect effects of the...

Read More »Tax Cuts Pay for themselves nonsense

by Hale Stewart (originally published at Bonddad blog) John Hinderaker Renews His “Tax Cuts Pay For Themselves With Growth” Nonsense It’s been awhile since John “Everything I wrote about economics for an entire year was wrong” Hinderaker has written about economics. The respite has been glorious. But now that Republicans in the House have passed a tax bill, ol’ John has to tell us that they will lead to glorious growth. I have one word for him:...

Read More »Many parents face higher taxes under TCJA, even if Congress makes its credits permanent

Ernie Tedeschi as linked by Paul Krugman points to an interesting author. The math is in follow up post.: Many parents face higher taxes under TCJA, even if Congress makes its credits permanent This quick post looks at the effects of the Tax Cut and Jobs Act (TCJA, the House GOP’s proposed tax plan introduced last week), but (selfishly) I focus on a specific segment of the population: families with children under 18. It turns out that parents do far...

Read More » Heterodox

Heterodox