October jobs report: great utilization, decent growth, poor wages HEADLINES: +261,000 jobs added U3 unemployment rate down -0.1% from 4.2% to 4.1% U6 underemployment rate down -0.3 from 8.2% to7.9% Here are the headlines on wages and the chronic heightened underemployment: Wages and participation rates Not in Labor Force, but Want a Job Now: down -443,000 from 5.628 million to 5.135 million Part time for economic reasons: down -369,000...

Read More »The Long Run and International Economics

(/Dan here…lifted from Robert’s Stochastic Thoughts) The Long Run and International Economics I am still thinking about Krugman and the Gravelle GeardownDo click the link if you are interested in understanding what I am typing about. Very briefly the question is: what effect would cutting the tax on profits have on the _US capital stock ? The particular issue is what difference does it make that most of US production is production of non traded goods and...

Read More »The Virginia Governor’s Race

The Virginia Governor’s Race I rarely talk directly about specific political races, but I live in Virginia where in less than a week there will be the most closely watched election in the nation for governor. It is very close, and the Republican, Ed Gillespie, might well win, even though his Dem opponent, Ralph Northam, leads by narrow margins in most polls. Sound familiar? Sure, but why am I going on about this? It is because even the pro-Dem...

Read More »A Comment on Krugman on Gravelle

yes that intuition is difficult. I have an attempt. So 1% of GDP is tradable. Also consumption and total production fixed. Mars cuts tax from t to 0. So to invest more Mars runs a current account deficit — all cyberservice provided by earlhlings & martian cyberworkers go build capital. Note all the extra capital belongs to earthlings (I assumed martian savings are fixed). Paul Krugman finds intuition for the calculations of Jennifer Gravelle...

Read More »A NAWRU proposal

A NAWRU proposal Marco Fioramanti and I have strongly criticized the European Commission DG EcFin Output Gap working Group estimates of output gaps. I have also written a lot here at angrybearblog This topic is very important, because the output gaps are used to calculate cyclically corrected budget balances which are regulated by the Stability and Growth Pact. The calculations determine dictates for fiscal policy of Euro bloc member states. Having...

Read More »Gimme shelter: the real cost of renting vs. homeownership

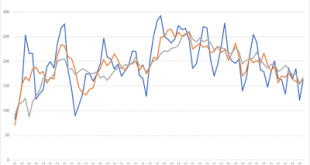

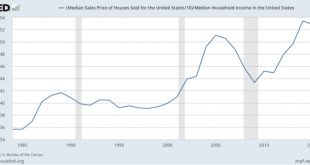

Gimme shelter: the real cost of renting vs. homeownership What is the real cost of shelter? Over the last decade there has been lots of discussion of housing prices in isolation. Sometimes that discussion includes an inflation adjustment — which is problematic, since housing constitutes nearly 40% of the entire consumer price index, so in essence housing is being deflated largely by the cost of housing itself! From time to time there has also been a...

Read More »Similar to “Alexander – Murray,” CMS Proposal Gives States Authority to Redefine ACA Minimum Benefits

I have been getting quite a few alerts on proposed changes happening behind the scenes with the ACA. I also found a couple of new places with some intelligent writers who have explained things in greater depth than what I knew. The CMS is proposing a rule allowing states greater authority in defining the ACA. This comes in addition to Trump’s EO. The new rule would give states greater flexibility in: – Defining the ACA’s minimum essential benefits to...

Read More »Everything Is Going Great, So Let’s Change It

Everything Is Going Great, So Let’s Change It Well, the actual headline on the front page of the Washington Post below the fold today reads, “Economy shows strong growth, could provide GOP momentum.” The strong growth is the 3.0% annual growth rate of GDP in the third quarter (supported by a strong stock market), with the momentum not being the obvious point that this might lead to general popular electoral support in the future for the GOP, but more...

Read More »Top Marginal Tax Rates and Economic Growth

Top marginal taxation and economic growth by Santo Milasi and Robert Waldmann has (finally) been publishedhere in Applied Economics ABSTRACT The article explores the relationship between top marginal tax rates on personal income and economic growth. Using a data set of consistently measured top marginal tax rates for a panel of 18 OECD countries over the period 1965–2009, this article finds evidence in favour of a quadratic top tax–growth relationship....

Read More »House Passes Senate Tax Reform Budget Resolution and Creates 2018 Budget

Everyone is reporting a 2018 Budget has been passed. Tucked away inside the 2018 Budget is a Tax Reform Resolution which allows the House to write the bill. The House has passed the Senate Tax Reform Budget Resolution creating a $1.5 trillion deficit with a 216-212 vote. What this means in the Senate is a majority vote is only necessary to pass the Tax Reform bill which Trump has been campaigning and tweeting silly comments. Unless the House and Senate...

Read More » Heterodox

Heterodox