Guest post by Tom Streithorst. Brexit already looks a disaster. Sterling has plunged to the lowest level in thirty years, the FTSE fell more than 12% at the open, global equities lost $2 trillion in value in less than a day, and gold, the traditional safe haven in times of turmoil, has shot up. Uncertainly reigns. Firms are less likely than ever to hire or invest. It is going to get worse. Who shall we blame? David Cameron is the obvious villain. He did not need to call this referendum....

Read More »The snake oil sellers

The fallout from Britain’s historic decision to leave the European Union continues. Domestically, there are regrets, recriminations and accusations. Young people,particularly those aged 16-17 who did not have a vote, complain that the vote did not take their interests into account A petition for a second referendum reached over 3m votes in a few days, although it was subsequently found to have been hacked: the true number is uncertain. The media have spent the weekend tracking down...

Read More »Silence

I have reluctantly decided that there will be no more posts on Coppola Comment until after the referendum.Since I have declared my support for Remain, anything I write about the UK and the EU is now inevitably seen as biased, and anything I write about any other subject is - equally inevitably - seen as avoiding the issue. I cannot, for example, write a balanced analysis of the likely effects on financial services of a vote in either direction, though that is my specialism. Nor can I...

Read More »Jeremy Corbyn’s Fantasy World

In the video below, Andrew Marr asks Corbyn whether open borders has become extremely unpopular with Labour’s working class voters, which is a plain truth (here, here, here, and here). His answer?[embedded content]Corbyn’s response: no, it’s all a conspiracy by the right-wing newspapers and (apparently) there are no significant downsides to mass immigration of any kind (such as, for example, overpopulation, soaring housing and rent costs, holding down of real wages, competition for scarce...

Read More »The EU’s greatest achievement

"The EU's greatest achievement is the Euro", said Michael Portillo on the BBC's This Week programme last Thursday.No, Michael, it isn't. It is the EU's worst mistake.As Yanis Varoufakis entertainingly explains in an interesting lecture published in the Australian Journal of Political Economy, the creation of the Euro led inexorably to the buildup of unsustainable debt - both private and public - in the Eurozone periphery countries: The problem is that creating a monetary union is a...

Read More »The unaffordable George

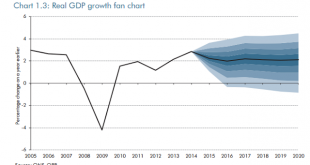

On March 16th, George Osborne unveiled his shiny new Budget. Full of populist tax giveaways to help "hard working people", it was the sort of budget that we might expect from a Chancellor riding the crest of an economic recovery. UK plc is growing well, profits are rising and the Board can afford to increase the dividend.But this is not the current economic situation. Far from an economic recovery gathering pace, the latest figures from the OBR show that UK plc is slowing. In its March 2016...

Read More »Those elusive welfare spending cuts

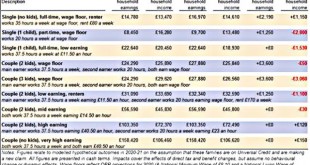

The Chancellor's Autumn Statement contained an apparent U-turn on the cuts to tax credits outlined in the July budget. Predictably, this was presented as the Chancellor "listening" to those concerned about the impact of sudden large falls in income for working families at the bottom end of the income spectrum. The Conservatives continue to position themselves as the party for "hard-working families".However, this isn't quite what it seems. The income cuts for low-income working families are...

Read More »Grexit, Brexit and financial stability

On October 30th 2015, I gave a keynote speech at Birmingham University's Finance Forum on the implications of Grexit and Brexit for financial stability. I've now written this up as a paper.I start by outlining the purpose of financial stability. Since the 2007-8 financial crisis, “financial stability” has been all the rage. We must prevent another crisis: we must solve the problems that make our financial system “unstable”. But what exactly do we mean by “financial stability”? Most people...

Read More »Investment is needed everywhere

And particularly in Europe, as this chart shows: The ratings agency Standard & Poors has called for governments everywhere to increase investment spending. It also says they need to improve the efficiency of the spending they are already doing. Private sector investment spending all over the world fell after the 2008 financial crisis. In Europe, where the crisis started earlier, it started falling in 2007. And it has not recovered. Private sector investors remain risk-averse and...

Read More »The insane Eurocrats

In July 2008, the European Commission decided that the UK had an "excessive deficit" under the terms of Article 104 of the Maastricht Treaty. Estimating that Government budgetary plans for 2008-9 would result in a deficit of 3.5% of GDP, the Commission said The excess over the 3 % of GDP reference value is not exceptional in the sense of Article 104(2) of the Treaty. In particular, it does not result from an unusual event outside the control of the United Kingdom authorities, nor is it the...

Read More » Heterodox

Heterodox