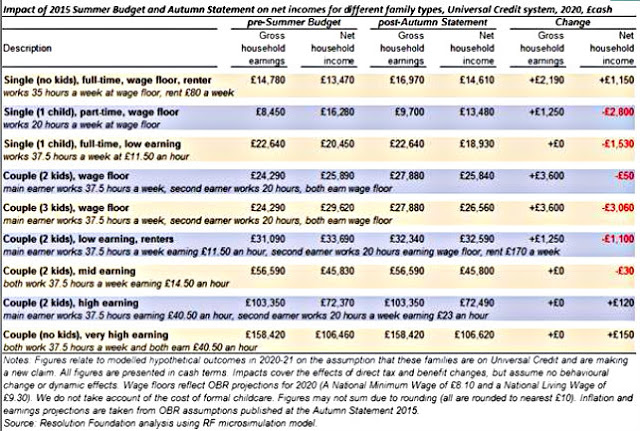

The Chancellor's Autumn Statement contained an apparent U-turn on the cuts to tax credits outlined in the July budget. Predictably, this was presented as the Chancellor "listening" to those concerned about the impact of sudden large falls in income for working families at the bottom end of the income spectrum. The Conservatives continue to position themselves as the party for "hard-working families".However, this isn't quite what it seems. The income cuts for low-income working families are not cancelled, they are merely delayed. The Chancellor has effectively hung his hoped-for reduction in tax credits expenditure on the roll-out of Universal Credit (UC). Because the UC changes announced in July have not been reversed in parallel with the tax credits climbdown, many new UC claimants will receive less than they would have received under the tax credits regime. As this chart from the Resolution Foundation shows, rollout of Universal Credit by 2020 would still mean the poorest losing a large proportion of their incomes: But the Office of Budget Responsibility, in its latest Economic and Fiscal Outlook, identifies two problems with this. Here is the first: The timetable for the rollout of UC is about as credible as the IMF's forecasts for the recovery of Greece. The latest revision shows a caseload below 6m in 2020-21. This is tiny.

Topics:

Frances Coppola considers the following as important: austerity, benefits, obr, pensions, public spending, UK, welfare

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

Nick Falvo writes Homelessness among older persons

Robert Skidelsky writes Speech in the House of Lords Conduct Committee: Code of Conduct Review – 8th of October

Nick Falvo writes Report finds insufficient daytime options for people experiencing homelessness

However, this isn't quite what it seems. The income cuts for low-income working families are not cancelled, they are merely delayed. The Chancellor has effectively hung his hoped-for reduction in tax credits expenditure on the roll-out of Universal Credit (UC). Because the UC changes announced in July have not been reversed in parallel with the tax credits climbdown, many new UC claimants will receive less than they would have received under the tax credits regime. As this chart from the Resolution Foundation shows, rollout of Universal Credit by 2020 would still mean the poorest losing a large proportion of their incomes:

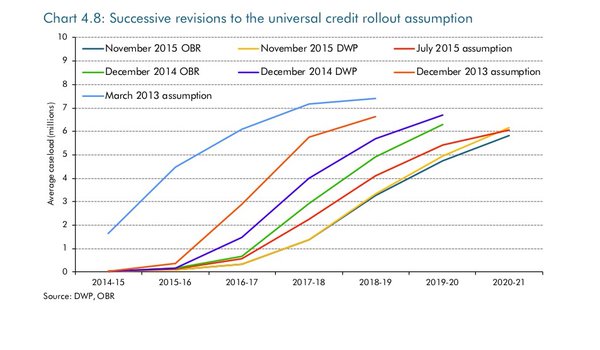

But the Office of Budget Responsibility, in its latest Economic and Fiscal Outlook, identifies two problems with this. Here is the first: The timetable for the rollout of UC is about as credible as the IMF's forecasts for the recovery of Greece. The latest revision shows a caseload below 6m in 2020-21. This is tiny.

The OBR's exasperation with the continual delays to UC rollout is evident:

And it is distinctly pessimistic about the likelihood of the current forecast proving any more accurate than previous ones:Our forecast of the marginal cost of universal credit is based on a new assumption for the pace of rollout, which we have once again deemed necessary to push back.

Forecasting the savings from UC has become something of a black art, largely because of the DWP's incompetence. Here's the OBR's somewhat caustic commentary on the consequences for their forecasts of the DWP's inability to provide estimates (my emphasis):....we have added our own forecast judgement of a further six-month delay to the managed migration phase of the UC rollout. As usual, we have considered evidence from DWP and the latest assessment of UC rollout by the Major Projects Authority. While this indicates greater confidence in the ‘transition phase’ rollout plan, considerable uncertainty remains over the ‘managed migration’ phase. And of course the transition phase rollout schedule has just been pushed back six months, just a year after the previous delay.....

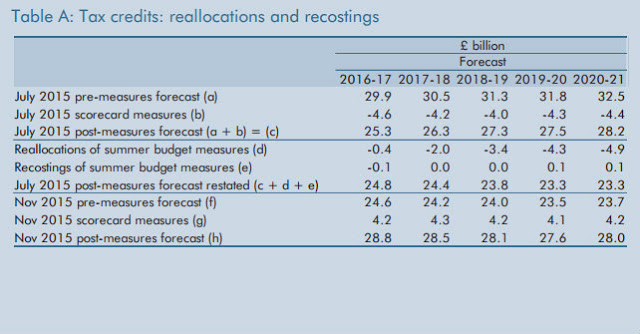

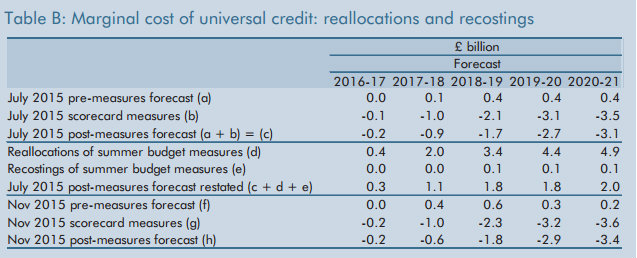

In our July forecast, we took the scorecard costings of the tax credit and UC measures (Tables A and B, line b) and added them to our pre-measures forecast (line a) to reach a post-measures forecast (line c). These costings took a bottom-up approach, whereby the effect on tax credits spending declined over time and the effect on UC increased over time as the UC caseload is assumed to rise (consistent with how the transition to UC will operate in practice). But because DWP is currently unable to produce a full bottom-up forecast of spending on UC and legacy benefits, this is not consistent with our forecast, which is based on adding the marginal cost of UC to a forecast of the legacy tax credits and benefit system.

The effect of the OBR's correction on their forecasts for the spending impact of replacing tax credits with UC is shown here:Correcting this means that the measures are now added into the forecast as though the legacy tax credit system continues indefinitely and only the marginal costs/savings are included in the UC forecast (line d). This results in a further fall in tax credit spending over the forecast period and an equal and offsetting increase to the marginal cost of UC. The net effect on spending is zero.

But irritating though the enforced methodological change must be for the OBR, the production of these tables highlights a much bigger problem for the Chancellor. Even if the latest forecast for the UC roll-out timetable by some miracle proves accurate, these tables show that the tax credits change cannot be offset by the roll-out of UC. It just isn't being rolled out quickly enough.

This is the principal reason why the Chancellor is going to exceed his self-imposed welfare cap for most (or, more likely, all) of this Parliament. But as the OBR explains, the increase in tax credits is supposed to be offset by cuts in other benefits:

What benefits would these be, then?The Government’s policy decisions raise spending in the short term but reduce it by the end of the forecast. The near-term increase reflects the decision to reverse the main July Budget cuts to tax credits, which adds £3.4 billion to spending in 2016-17 alone. A variety of cuts to other benefits save increasing amounts over time and more than offsets the changes to tax credits by 2019-20.

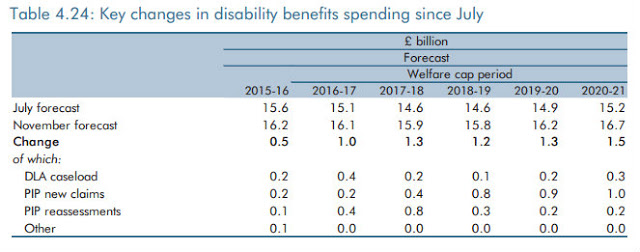

Well, some of the savings are supposed to come from the migration of Disabled Living Allowance (DLA) to Personal Independence Payments (PIP). But the OBR has just revised its forecasts for disability benefits spending upwards:

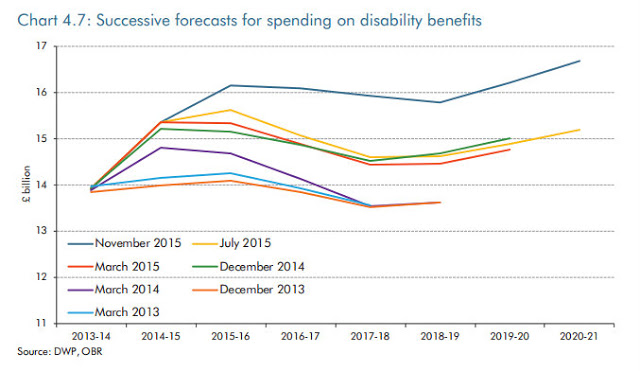

Indeed, forecasts of disability benefit spending have been continually revised upwards:The OBR expresses concern about the forecasts for disability benefit savings:

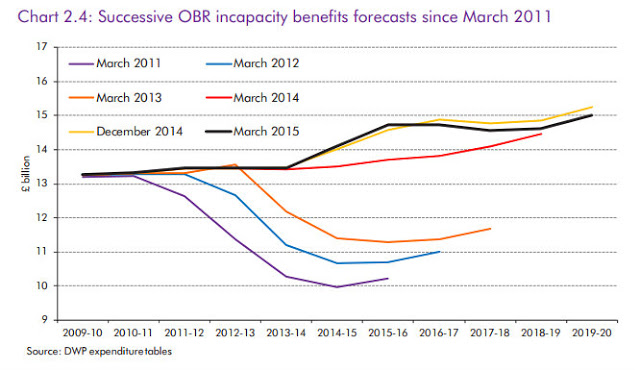

They have reason. This chart is from the OBR's Welfare Trends report of June 2015:It is a concern to us that the revisions to our spending forecasts on DLA and PIP echo the pattern of revisions to our forecasts of spending on incapacity benefit and ESA during the reform of the incapacity benefits system.

Not only did the reform of ESA/incapacity benefit fail to deliver the expected savings, the cost of the new scheme is actually quite a bit higher. It turned out that there were nowhere near as many "incapacity benefit scroungers" as was reported in the Daily Mail. This does not bode well for DSA migration.

And it doesn't bode well for the Chancellor's welfare cap. Here's the OBR on the reasons why it has revised welfare spending forecasts upwards:

So, more disabled, more ill, more children and a slower roll-out of UC. The welfare cap appears to be toast. But how then will total welfare payments be reduced by 2020? Once more, the OBR has the answer:.....we have revised up our pre-measures forecast for spending subject to the welfare cap by increasing amounts from 2016-17 to 2020-21. The biggest change has been to disability benefits, including higher numbers of new claims to disability living allowance (DLA) and personal independence payment (PIP) and a slower pace of reassessments as cases are migrated from DLA to PIP. We have also revised up spending on incapacity benefits, assuming that 38 per cent of claims will be in the more expensive support group of employment and support allowance (ESA) in steady state (up from 30 per cent in our July forecast). New ONS population projections assume higher numbers of children, pushing up spending on tax credits and child benefit.

Brilliant. The new apprenticeship levy will keep a lid on earnings, thus reducing the triple lock on pensions as well as raising additional tax that might pay for those welfare spending overruns. And if all else fails, kill the old.changes to spending outside the welfare cap have been small, with downward revisions to state pensions (from higher mortality at older ages in the new population projections and slightly lower triple-lock uprating reflecting our latest earnings growth forecast) offsetting upward revisions to jobseeker’s allowance (reflecting the higher outturns this year knocking through to the forecast);