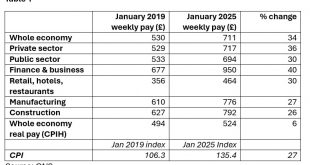

Today (Thursday), the Office for National Statistics published its monthly set of employment stats. While its Labour Force Survey has been under the cosh for some time for unreliability, the ONS’s data on average wage rates and changes retain their importance. The data – this time for January 2025 – covers average total pay, regular pay and bonus pay for the whole workforce. It also provides average wage data by broad sector.The ONS also publishes its estimate of ‘real pay’ after taking...

Read More »Speech in the House of Lords Conduct Committee: Code of Conduct Review – 8th of October

“My Lords, in taking part in this debate, I must declare an interest: recently, I was a victim of the committee chaired by the noble Baroness, Lady Manningham-Buller. Although this is not the kind of interest a Member is normally obliged to declare, I believe that my personal experience has given me a certain insight into the way the system works, which may be of public interest. I welcome the committee’s aim to shorten and clarify the code and guide wherever possible—they require...

Read More »The West must no longer tolerate Israel’s human rights breaches

My latest post at Substack examines the state of play in Gaza after six months of war. Fair to say, it is truly horrible. But more importantly, there is now overwhelming evidence that Israel has deliberately and systematically violated international humanitarian law. These violations could amount to genocide.On 28th March, the International Court of Justice decided that the situation in Gaza had significantly worsened since its original order in January imposing six "provisional measures"...

Read More »Feeling the pay pain

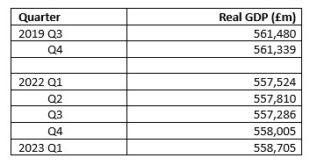

May 2023. The UK economy struggles along, shedding another 0.1% of GDP. The ‘size’ of the economy, measured as GDP, is a fraction (0.7% to be precise) greater than in May 2019, 4 long years ago. It’s still smaller than in the second half of 2019. Even worse, average real pay (i.e. after allowing for CPI inflation) is a fraction lower than it was in 2019 – in May 209, £499, in May 2023, £497. But that average masks a great deal of variety, between those whose pay has kept up with inflation...

Read More »Feeling the pay pain

May 2023. The UK economy struggles along, shedding another 0.1% of GDP. The ‘size’ of the economy, measured as GDP, is a fraction (0.7% to be precise) greater than in May 2019, 4 long years ago. It’s still smaller than in the second half of 2019. Even worse, average real pay (i.e. after allowing for CPI inflation) is a fraction lower than it was in 2019 – in May 209, £499, in May 2023, £497. But that average masks a great deal of variety, between those whose pay has kept up with inflation...

Read More »Feeling the pay pain

May 2023. The UK economy struggles along, shedding another 0.1% of GDP. The ‘size’ of the economy, measured as GDP, is a fraction (0.7% to be precise) greater than in May 2019, 4 long years ago. It’s still smaller than in the second half of 2019. Even worse, average real pay (i.e. after allowing for CPI inflation) is a fraction lower than it was in 2019 – in May 209, £499, in May 2023, £497. But that average masks a great deal of variety, between those whose pay has kept up with inflation...

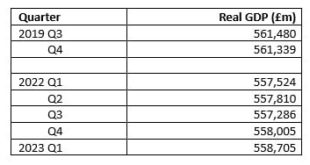

Read More »The UK economy – stalled and unhealthy

Day after day, day after day,We stuck, nor breath nor motion;As idle as a painted shipUpon a painted ocean.[The Rime of the Ancient Mariner, Samuel Taylor Coleridge]The UK economy remains stuck. Last Friday, the latest GDP numbers for the UK (first estimate for Q1 2023) from the Office for National Statistics (ONS) indicate that the UK economy is still a little shy of where it was back in late 2019, still down by 0.5% on Qs 3 and 4 of that year. The economy in Q1 was just 0.2% larger than in...

Read More »The UK economy – stalled and unhealthy

Day after day, day after day,We stuck, nor breath nor motion;As idle as a painted shipUpon a painted ocean. [The Rime of the Ancient Mariner, Samuel Taylor Coleridge] The UK economy remains stuck. Last Friday, the latest GDP numbers for the UK (first estimate for Q1 2023) from the Office for National Statistics (ONS) indicate that the UK economy is still a little shy of where it was back in late 2019, still down by 0.5% on Qs 3 and 4 of that year. The economy in Q1 was just 0.2% larger than...

Read More »The UK economy – stalled and unhealthy

Day after day, day after day,We stuck, nor breath nor motion;As idle as a painted shipUpon a painted ocean.[The Rime of the Ancient Mariner, Samuel Taylor Coleridge]The UK economy remains stuck. Last Friday, the latest GDP numbers for the UK (first estimate for Q1 2023) from the Office for National Statistics (ONS) indicate that the UK economy is still a little shy of where it was back in late 2019, still down by 0.5% on Qs 3 and 4 of that year. The economy in Q1 was just 0.2% larger than in...

Read More »Settling the public sector pay disputes now – modest cost, big benefits

Another week goes by. Hundreds of thousands of workers, mainly public sector, on strike last week, and again this week. Pay deals way below inflation. Zero movement from government. Continuing disruption and decay. Why can’t a settlement be reached? Just before Christmas, Prime Minister Sunak told us “I want to make sure that we reduce inflation and part of that is being responsible in setting public sector pay..” On 1st February, Mr Sunak’s Official Spokesman said “We want to have...

Read More » Heterodox

Heterodox