Read More »

China going wrong

Despite the opacity of Chinese politics, it is clear that things are going badly wrong there. In just the last week, we’ve seen The rejection of the officially backed candidates in Hong Kong’s local electionLeaks exposing the massive repression of the Uighur populationThe defection of an alleged Chinese spy, with allegations of interference in Australia’s domestic politicsClear evidence that the energy transformation towards renewables has been abandoned or downplayed in favor of...

Read More »WEA conference: Going Digital

from Malgorzata Dereniowska Going Digital: What is the Future of Business and Labour? Welcome to the second week of the Conference which discusses recent contributions to the understanding of the digital economy and its consequences for business trends and labour challenges. Read the latest comments on the DISCUSSION FORUM which is open until December 9th. All papers are available HERE. You can participate in the Discussion Forum by commenting on specific papers, or...

Read More »Graphics from 4 empirical muckrakers – 3. Thomas Piketty — Modern Inequality

from Blair Fix I don’t think I need to say much about Thomas Piketty. He’s probably the most famous economist in the world. Since publishing Capital in the Twenty-First Century, he’s become an academic rock star. Many heterodox economists think Piketty’s theories of inequality are naive. I would be one of those economists. But this does not detract from Piketty’s empirical work. He’s a prolific inequality muckraker. Together with other researchers, Piketty has created the World Inequality...

Read More »Economics — enslaved by the wrong theory

from Lars Syll The more I learned about economics, the more I discovered a landscape that is surpassingly strange. Like the land of Mordor, it is dominated by a single theoretical edifice that arose like a volcano early in the 20th century and still dominates the landscape. The edifice is based upon a conception of human nature that is profoundly false, defying the dictates of common sense, before we even get to the more refined dictates of psychology and evolutionary theory. Yet, efforts...

Read More »The origins of MMT

from Lars Syll Many mainstream economists seem to think the idea behind Modern Monetary Theory is new and originates from economic cranks. New? Cranks? How about reading one of the great founders of neoclassical economics – Knut Wicksell. This is what Wicksell wrote in 1898 on ‘pure credit systems’ in Interest and Prices (Geldzins und Güterpreise), 1936 (1898), p. 68f: It is possible to go even further. There is no real need for any money at all if a payment between two customers can be...

Read More »7 Wall Street theories

from Ken Zimmerman Wall Street is about investing. To get a large return on money invested. There is no shortage of theories on what makes the markets tick or what a market movement means. Some of which influence investor decisions. The two largest factions on Wall Street are split between supporters of the efficient market theory and those who believe the market can be beaten. Although this is a fundamental split, many other theories attempt to explain and influence the market, as well...

Read More »Open thread Nov. 22, 2019

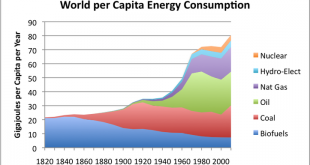

Graphics from 4 empirical muckrakers – 2. Vaclav Smil — The Energy Oracle

from Blair Fix Vaclav Smil is by far the most prolific energy muckraker out there. I’m not going to try to summarize his research. Just look at his list of publications here. But I will leave you with a beautiful chart of Smil’s data. Gail Tverberg has used Smil’s data to make a fantastic series of charts on world energy consumption. She uses Angus Maddison’s population data too. See the whole series here. Below is Tverberg’s chart for energy use per capita. Credit to Tverberg for such a...

Read More »Skidelsky on the uselessness of ‘New Keynesian’ economics

from Lars Syll Whereas the Great Depression of the 1930s produced Keynesian economics, and the stagflation of the 1970s produced Milton Friedman’s monetarism, the Great Recession has produced no similar intellectual shift. This is deeply depressing to young students of economics, who hoped for a suitably challenging response from the profession. Why has there been none? Krugman’s answer is typically ingenious: the old macroeconomics was, as the saying goes, “good enough for government...

Read More » Heterodox

Heterodox