from Lars Syll “Getting philosophical” is not about articulating rarified concepts divorced from statistical practice. It is to provide tools to avoid obfuscating the terms and issues being bandied about … Do I hear a protest? “There is nothing philosophical about our criticism of statistical significance tests (someone might say). The problem is that a small P-value is invariably, and erroneously, interpreted as giving a small probability to the null hypothesis.” Really? P-values are not...

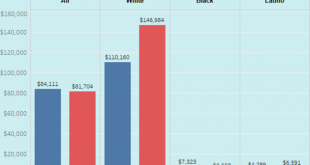

Read More »USA racial wealth divide

Source: Dreams Deferred, Institute for Policy Studies

Read More »A hundred years ago

from Lars Syll The treaty includes no provisions for the economic rehabilitation of Europe — nothing to make the defeated Central Empires into good neighbours, nothing to stabilize the new states of Europe … The Council of Four paid no attention to these issues … Reparation was their main excursion into the economic field, and they settled it as a problem of theology, of politics, of electoral chicane, from every point of view except that of the economic future of the states whose destiny...

Read More »The Green New Deal is happening in China

from Dean Baker One of the Trump administration’s talking points about global warming is that we’re reducing greenhouse gas emissions, while the countries that remain in the Paris accord are not. Well, the first part of this story is clearly not true, as data for 2018 show a large rise in emissions for the United States. The second part is also not very accurate, as most other countries are taking large steps to reduce emissions. At the top of the list is China. The country has undertaken...

Read More »Brexit: The endgame (update)

Prediction is a mugs game, but, watching the Brexit trainwreck, I can’t resist. Over the fold, my predictions from mid-December. So far, everything has gone as I predicted, but I didn’t anticipate how badly May would be defeated, or how strongly Parliament would reassert itself. I now think that the “No Deal” option will be off the table sooner rather than later. Either May will capitulate to Corbyn’s demand or Parliament will force the issue somehow. That makes...

Read More »The next recession: what it could look like

from Dean Baker With the New Year and the US recovery soon to be record-breaking in duration, many are asking when the next recession is likely to come and what will cause it. While none of us has a crystal ball that gives a clear view of the future, there are a few things we can say. First, and most importantly, the next recession will not look like the last recession. The last recession was caused by the collapse of a massive housing bubble that had been the driving force in the...

Read More »What do we do with a problem like #Adani

Inside Story has run an updated and expanded version of my last post on Adani’s pretense that it is ready to start its mining project at a moment’s notice. The main new point is a suggestion for how a federal Labor government could close off the Galilee Basin without a general moratorium on new coal mines. If federal Labor wins government in May (as seems highly likely), it will need to face up to the issue later this year. First of all, it will need to develop a coherent policy...

Read More »Socialist utopia 2050 …

… what could life in Australia be like after the failure of capitalism? That’s the title of my latest piece in The Guardian . It’s had quite a good run, but of course, plenty of pushback, mainly along the following lines General objections to any kind of utopian thinking, even the very modest version in my articlePolitical impossibilityWhat about Stalin/Venezuela ?What I haven’t seen, interestingly, is any suggestion that continuing expansion of financialised capitalism (aka...

Read More »Open thread Jan. 18, 2019

Fisher’s debt deflation theory of financial crises

from Asad Zaman This post is the third part of lecture 8 of Advanced Macro L08C: Fisher’s Debt-Deflation Theory of the Great Depression. In previous segments of this lecture L08A: Micro-Foundations for Keynesian Economics, and L08B: Keynesian Explanation for Great Depression: Seriously Incomplete, we examined the Keynesian explanation for the Great Depression, and found serious deficiencies in it. L08A explains that many different kinds of outcomes, with and without unemployment, are...

Read More » Heterodox

Heterodox